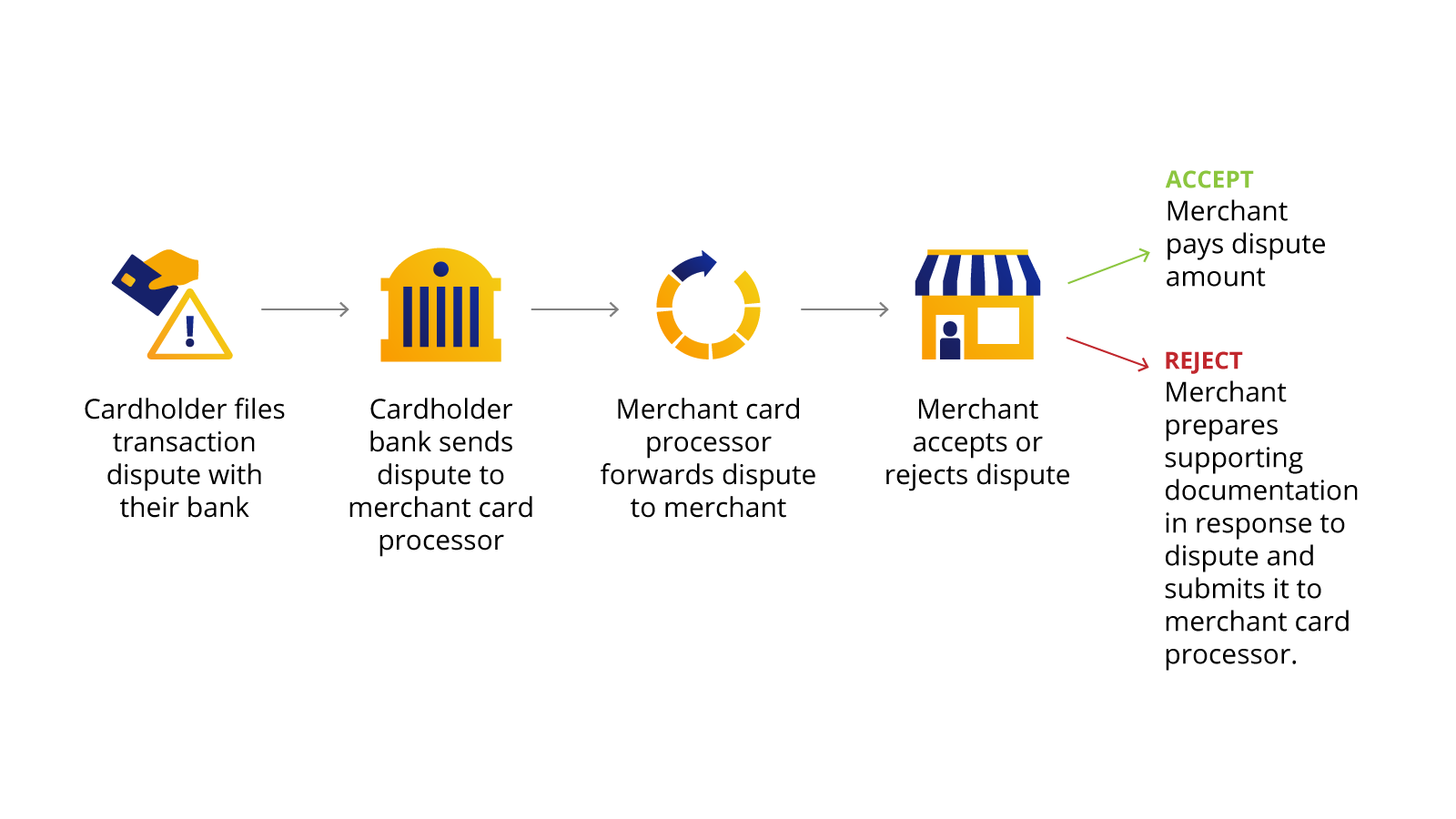

If your business processes Visa transactions, you know that for the most part, these payments tend to go smoothly. However, every once in a while, a Visa cardholder will dispute a transaction. Whatever the reason might be, when a cardholder questions a transaction on their bill, they typically file a dispute with their bank. This, in turn, begins the dispute resolution process.

Merchant disputes

Should your business receive a dispute, it is to your advantage to try to understand why this dispute occurred and determine what you can do to remedy the dispute given your rights under Visa rules. Sure, you are bound to have a few questions: Can I challenge this dispute…what should I do first…and how? The good news is we have all of the answers you need to successfully move forward right here.

The Visa Online Merchant Dispute Guide is your one-stop resource for handling cardholder disputes from start-to-finish. Targeted to the needs of card-present and card-absent merchants, this online guide is easy to navigate and simple to use.

Fraud, Category 10

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 10.1, EMV Liability Shift Counterfeit Fraud.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 10.2, EMV Liability Shift Non-Counterfeit Fraud.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 10.3, Other Fraud – Card-Present Environment.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under condition 10.4, Other Fraud – Card-Absent Environment.

-

Your card processor has notified you that the Visa Fraud Monitoring Program (VFMP) has identified a transaction that you processed. The dispute falls under Condition 10.5, Visa Fraud Monitoring Program.

Authorization, Category 11

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 11.1, Card Recovery Bulletin.

-

Your card processor has notified you that an issuer is disputing a transaction that you processed. The dispute falls under Condition 11.2, Declined Authorization.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 11.3, No Authorization.

Processing Errors, Category 12

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.1, Late Presentment.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.2, Incorrect Transaction Code.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.3, Incorrect Currency.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.4, Incorrect Account Number.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.5, Incorrect Amount.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.6.1, Duplicate Processing.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.6.2, Paid by Other Means.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.7, Invalid Data.

Customer Disputes, Category 13

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.1, Merchandise/Services Not Received.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.2, Cancelled Recurring Transaction.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.3, Not as Described or Defective Merchandise/Services.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.4, Counterfeit Merchandise.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.5, Misrepresentation.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.6, Credit Not Processed.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.7, Cancelled Merchandise/Services.

-

Your card processor has notified you that a cardholder is disputing a credit transaction that you processed. The dispute falls under Condition 13.8, Original Credit Transaction Not Accepted.

-

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.9, Non-Receipt of Cash or Load Transaction Value.

For more information, please see Dispute Management Guidelines for Visa Merchants

Acquirer’s approach or timelines may be different and you should adhere with your current Acquirer’s process. Not all disputes apply to every country/region, please check with your acquirer for further information.