Economic outlook and forecasts Europe’s economic resilience could spark a resurgence

January 2026 – The latest forecasts for 2026 are hardly sparking much enthusiasm: Economic growth for 2026 (fourth quarter-on-fourth quarter) is expected to land at about 1.3 percent for the European Union, 1.1 percent for the Euro area and 1.2 percent for the United Kingdom.¹ None are especially exciting numbers, so it’s no wonder the economic sentiment remains muted, for the consumer and the business sector alike.

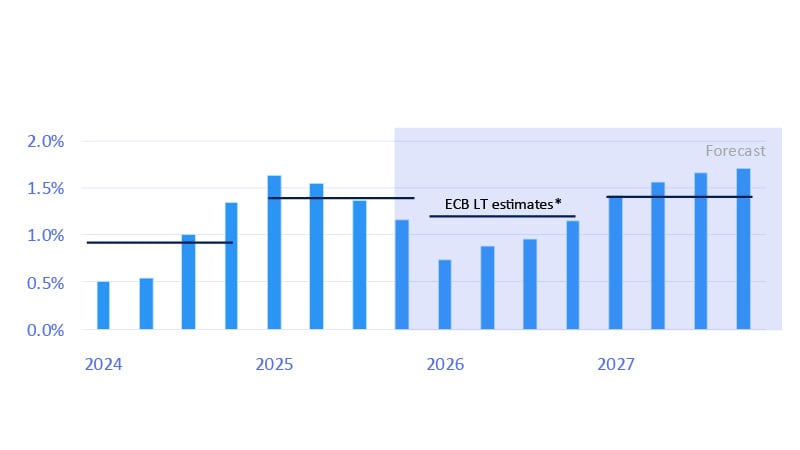

The truth is, as we look deep into the data, this pace of growth is tepid but not abysmal. Once we consider demographics, the growth in labour force, productivity and the level of capital investment in recent years, growth projections are just within a few decimals from the long-term growth estimates for the region (see figure below).

Eurozone growth still below long-term potential

(GDP, percent change, year ago) Last actual: Q3-2025

Furthermore, the previous five years challenged the European economies with a sequence of shocks nearly unprecedented in recent decades: a global pandemic that deeply transformed the structure of the economy; a major conflict on European soil; a surge in energy prices and a resulting inflation shock. These events were followed by a cost-of-living crisis, another disruptive and divisive conflict in the nearby Middle East region; and a trade war with the United States amid a global shift in supply and value chains. No wonder the European consumer, shellshocked by these events, sits on the sidelines.

And yet, it is not all doom-and-gloom. In a previous report,² we discussed some of the macroeconomic factors that suggest how European consumers may be in better shape than we may superficially believe: consider resilient labour markets, solid growth in wages and salaries, falling inflation and rising purchasing power, declining interest rates and improving credit quality.

In this Annual Economic Outlook, we will focus on the opportunities that, despite the broader context, may deliver some upside surprises in 2026: a rotation between essential and discretionary spending; the build-up in savings; further acceleration in e-commerce and a renewed emphasis on protecting the integrity of the payment ecosystem.

Highlights:

- A balancing act between caution and optimism

- Households prioritise needs over wants

- Savings rise is short-term headwind, medium-term tailwind

- An untapped opportunity in e-commerce

- Artificial intelligence is the game changer

- Countering the threat of fraud

- From a defensive crouch to a more confident stance?

A balancing act between caution and optimism

In 2026, European consumers are once again balancing caution with optimism. After years of economic uncertainty, spending has stabilized but not yet soared. Households remain guarded, adding to their savings as wages rise, while merchants stay vigilant against economic and fraud risks that persist in every phase of the economic cycle. At the same time, new avenues for growth are emerging: Digital payments and e-commerce still have room to expand in many European markets, and a wave of AI-driven change is beginning to shape consumer behaviour, driving more transactions online. Together, these forces create a narrative of resilience and unrealized potential in Europe’s economy.

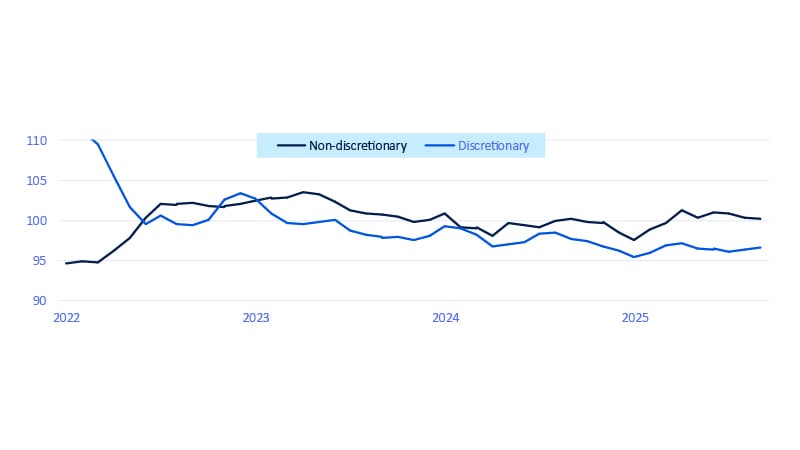

Visa’s proprietary spending gauge, the Spending Momentum Index (SMI), has stabilized,* halting the declines seen in 2024 and early 2025, yet still falling short of signalling a strong recovery. In recent months, the SMI painted a picture of moderate activity, but for most of the year, the index hovered around the neutral 100 mark, indicating no broad-based surge in spending. In the Euro Area, momentum flatlined. The U.K. saw a similar trajectory of modest growth, albeit with greater volatility. There were flickers of expansion, a strong month here and there, but nothing sustained. Essentially, European consumers are spending, but with restraint.

Households prioritise needs over wants

Non-discretionary spending has rebounded as discretionary spending lags

(Visa Spending Momentum Index: Eurozone (3mmav)) Last actual: November 2025

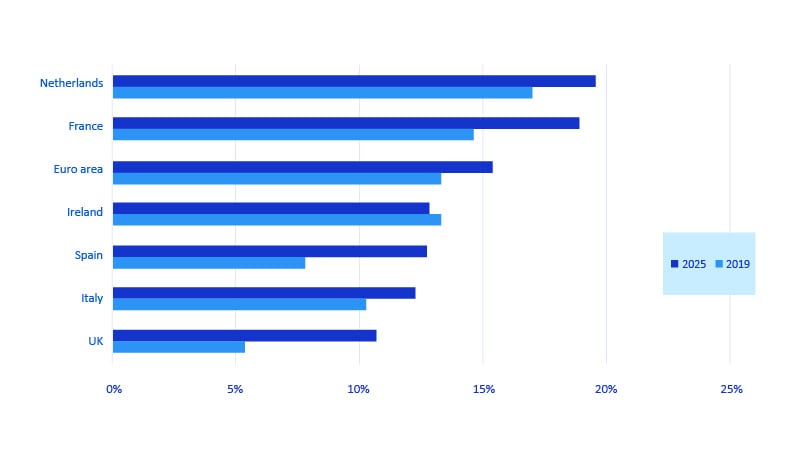

Savings rise is short-term headwind, medium-term tailwind

Savings across Europe have increased

Gross household savings rate (SA, percent) Last actual: 2025

This surge in savings is largely driven by uncertainty and prudence. After a few years of compounded economic headwinds, many Europeans feel safer keeping a financial buffer when possible. Notably, debt service ratios (the share of income spent on debt repayments) have remained relatively stable or even fallen in some cases, despite higher interest rates (France being the notable exception).⁶ That stability suggests households aren’t being forced to deleverage (pay down debt), rather they’re choosing to set aside extra cash as a cushion.

The flip side of this cautious behaviour is latent spending power. Europeans have amassed significant savings, which gives Europe a reservoir of potential demand. If confidence in the economy strengthens, those funds could flow back into consumption. In other words, European consumers in 2026 are financially better positioned than headlines might suggest: Employment is solid, wages are up and many families have healthier savings accounts. The challenge ahead is turning that financial capacity into actual spending. Overcoming the cautious mindset of recent years will be key. In this sense, the outlook hinges on sentiment as much as on income. If consumers feel more secure about the future, supported by easing inflation and positive economic news, they will have both the reason and the means to spend more. That shift could transform the current steady state into genuine expansion.

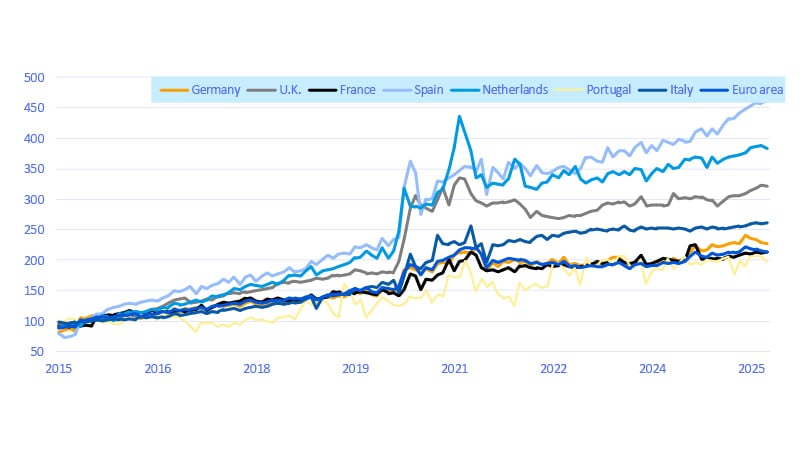

An untapped opportunity in e-commerce

One structural trend continues unabated: the shift toward digital payments and e-commerce. The pandemic years accelerated this shift, but Europe still hasn’t fully tapped the potential of online commerce. This is good news for future growth. In 2026, the expansion of digital payments stands out as a prime opportunity for the region.

The U.K. embraced e-commerce earlier and more fully than its continental peers (see figure below). By 2019, the U.K.’s online retail market had surged well above its 2015 baseline, and it remains far more elevated today than in many other European countries.⁷ British consumers’ early adoption of online shopping, from grocery delivery to digital subscriptions, means the U.K. is a more mature e-commerce market. By contrast, many countries in the Euro Area lag, and this digital gap presents a clear opportunity for catch up.

Opportunity for digital payment growth in some markets

Internet retail trade (Index, 2015=100) Last actual: October 2025

Artificial intelligence is the game changer

No outlook would be complete without addressing the tech wave of the moment: artificial intelligence (AI). What might have seemed like a niche or futuristic topic a few years ago is now front and centre in consumer and business trends. In 2026, AI’s influence on the economy and on consumers will be increasingly visible in Europe.

European consumers are rapidly embracing AI. Where previous technologies took years to reach mass adoption, AI has surged into everyday use at an exponential rate.* The growth in AI usage over the past three years has been faster than the adoption rate of the internet over its first 14 years of existence.⁹ AI is no longer an abstract concept for most people; it’s already reshaping consumer behaviour and ingrained in daily life.

The rise of AI also makes the digital shift even more critical for businesses. As consumers increasingly use AI to compare products and shop smarter, having a strong online presence becomes essential to compete for those AI-assisted purchases. Put simply, if consumers are asking digital assistants for recommendations, only businesses with a robust online profile will be in the running.

Recent surveys¹⁰ show that generative AI usage in Europe is only slightly behind the U.S. About 30 percent of British consumers report using AI tools like chatbots or image generators, while over 20 percent in France say the same. Driving this rapid uptake is the younger generation, the digital natives. More than half of consumers aged 18–35 have engaged with generative AI in some form, whether for fun, education or work. These younger consumers are now bringing their comfort with AI into shopping and financial decisions. In 2026, AI will underpin much of the customer experience: younger shoppers will rely on AI to guide purchase decisions and increasingly expect smart, personalized, tech-enabled services as the norm.

For businesses and the payments industry, this means AI is becoming a key factor in how consumers discover and choose products. Recommendation algorithms, virtual assistants and personalized marketing driven by AI can all influence consumer spending patterns. At the same time, AI offers powerful tools to combat fraud and streamline operations, reinforcing the critical importance of security in today’s digital age.

Countering the threat of fraud

Fraud risks remain a constant undercurrent. Whether economic times are good or bad, fraud attempts don’t disappear—they change and adapt. History shows that fraud is pervasive and occurs whether the economy is expanding or contracting. During good times, when consumer spending is high, businesses can become complacent about risk amid the transaction boom. Consumers and firms, spending freely, may pay less attention to security. Innovation runs high in these periods, but there’s often less familiarity with new tech solutions, creating openings for sophisticated scams. In downturns, a different vulnerability emerges. Financially stressed consumers can be more emotionally vulnerable and susceptible to fraud schemes, while companies under cost pressure might cut back on security investments. High staff turnover, or even disgruntled employees, can further weaken corporate defences.

Europe in 2026 sits somewhere between these extremes. The economy is improving but not roaring, which means neither the careless optimism of a boom nor the desperation of a bust fully applies. Yet elements of both scenarios linger. The lesson going into 2026 is clear: Continued vigilance is crucial. Europe’s hard-won resilience could falter if fraud undermines consumer and business trust just as spending is poised to expand. In other words, even as optimism rises, security and trust must remain top of mind to support the recovery.

From a defensive crouch to a more confident stance?

Europe’s economic outlook for 2026 is guarded but with some unsung bright spots—and the consumer is central in this story. They are still employed, earning more and sitting on a pile of savings, yet remain hesitant, scarred by recent uncertainty. This caution is evident in the tepid spending momentum and high precautionary savings that have kept growth steady but not spectacular.

However, the narrative is far from pessimistic. The very factors causing caution could become catalysts for growth if conditions turn favourable. The extra savings accumulated by households could fuel a consumption rebound if confidence builds, especially if labour markets stay resilient and inflation remains under control. Europe’s opportunities for expansion are within reach. Digital payments and e-commerce form a frontier, where pushing further can boost economic activity. Because some major markets are behind the curve, widely available technologies can be adopted more broadly without requiring brand-new innovations, potentially boosting growth in 2026 as adoption accelerates. AI can act as an accelerant, propelling growth beyond the ordinary by opening new efficiencies and channels for businesses and consumers alike.

2026 holds real promise for Europe. While it may not be a year of exuberant excess, it could mark a shift from resilience to resurgence—a time when consumers move from a defensive crouch to a more confident stance. After years of playing it safe, households may cautiously begin to spend from a position of strength. If uncertainty continues to fade, Europe could turn the page from caution to opportunity, with consumers leading the way.

Footnotes

- European Commission latest business and consumer surveys

- Visa Business and Economic Insights Europe Economic Outlook, November 2025, A slow recovery hides a split in consumer behaviour.

- European Commission latest business and consumer surveys

- European Central Bank Economic Bulletin Issue 7, 2025

- European Central Bank projections

- European Central Bank, Euro area economic and financial developments by institutional sector: Second quarter of 2025

- Forrester: Global online retail sales to grow 8.9% annually, reaching $6.8 trillion in 2028

- EY: Why payments data is the key to unlocking new customer value

- Visa Press Release, December 2025: Visa survey finds AI and crypto poised to transform U.S. holiday spending

- OECD, Who uses digital technology, why they use it, and how it shapes well-being

Spending Categories

Discretionary (airlines, lodging, auto rental, appliance retail, computer retail, fashion retail, florist, general department store, home goods retail, leisure goods retail, luxury goods retail, repurposed goods retail, sporting goods retail, attractions & amusements, duty free, entertainment, gambling, marina services, sport & recreation, transportation, travel agencies, construction services, electric goods repair, home repair services, personal services, professional services, spa/beauty services, telecommunication, charity, direct marketing, membership clubs).

Non-discretionary (medical/health services, pharmacy, food retail, supermarkets, postal/courier, utilities, education, tolls/fees, wholesale).

The discretionary and non-discretionary categories exclude restaurant and gas spending; both restaurant and gas are included in the total SMI.

Methodology

The Visa Spending Momentum Index (SMI) measures the breadth of year-over-year change in household spending within an economy, including the share of households with increased spending compared with those where spending was stable or declined. The index is generated using proprietary techniques that extract economic signals from business-related noise inherent in VisaNet transaction data, such as portfolio flips, routing changes, or evolving acceptance across geographies or merchant segments. Regional and national aggregates are population-weighted averages.

The resulting sample data is then aggregated using a diffusion index framework in which index values are scored from 0 to 200. Values above 100 indicate broad-based net acceleration in economic momentum. Values below 100 indicate contraction on an annual basis.

Disclaimer

You may not distribute, modify, copy, publish, transmit, display, sell, license, use, reuse or create derivative works of any of the contents of or material displayed for any public or commercial purpose without the written consent of Visa or any third party Visa deems necessary. Visa Spending Momentum Index (SMI) is based on a sample of aggregated, depersonalized VisaNet and third-party data; it is not reflective of Visa operational and/or financial performance. SMI is provided “as is” without warranties of any kind, express or implied, including, without limitation, as to the accuracy of the data or the implied warranties of merchantability, fitness for a particular purpose, and/or non-infringement. Visa is not responsible for your use of the information contained herein, including errors of any kind, or any assumptions or conclusions you might draw from its use, and Visa has no obligation to update data contained therein. Each SMI report is as of the publication date, and Visa has no obligation to update data contained therein.

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.