De minimis: not a trifle anymore for global e-commerce

May 2025 – Many Americans shopping online in recent weeks have been confronted by an unfamiliar choice at checkout: When the cost of shipping exceeds the value of the goods in their cart, is it worth proceeding? For markets around the world, low-value international (aka “de minimis”) shipping has become a focal point of trade policy. The European Union and the United States, among others, have taken another look at these policies after a recent surge in low-value imports, with the U.S. most recently removing de minimis exemptions on shipments from China.¹ Beyond their trade impact, these policy shifts are altering how goods are sourced and distributed, setting in motion changes that could reshape the future of e-commerce as sellers and consumers adjust to higher barriers and costs to online cross-border purchases, according to Visa Business and Economic Insights (VBEI) analysis.

Although low-value international parcels amounted to only a small fraction of total online sales in each market by year-end 2024, analysis of VisaNet data reveals that these shipments have emerged as the fastest-growing segment of e-commerce globally. Several players are leading a shift in the global e-commerce landscape, in which social media, low distribution costs and shorter delivery times have combined to unleash a new force in e-commerce, offering extremely competitive prices and fast shipping to customers around the world.² Prior to the de minimis trade policy shifts, these sites sold and imported items of sufficiently low value to be exempt from standard customs processing and duties, helping them maintain lower prices while minimizing the paperwork and delays typically associated with imported goods.

With the removal of the de minimis threshold, many companies may need to rethink their logistics and marketing strategies as consumer demand and preferences evolve. More price-sensitive consumers may hold back on purchases, for example, while others will look at ways to minimize shipping and administrative costs, such as consolidating orders to reduce shipments, comparative price shopping, or choosing local sourcing. The trade policy shift raises questions about whether the low-value model of e-commerce will survive, now that its cost advantage has been removed.

Highlights:

- De minimis shipments lead e-commerce growth

- Governments take a closer look at de minimis exceptions

- Consumers and sellers adjust to higher costs and inconveniences following de minimis reforms

De minimis shipments lead e-commerce growth

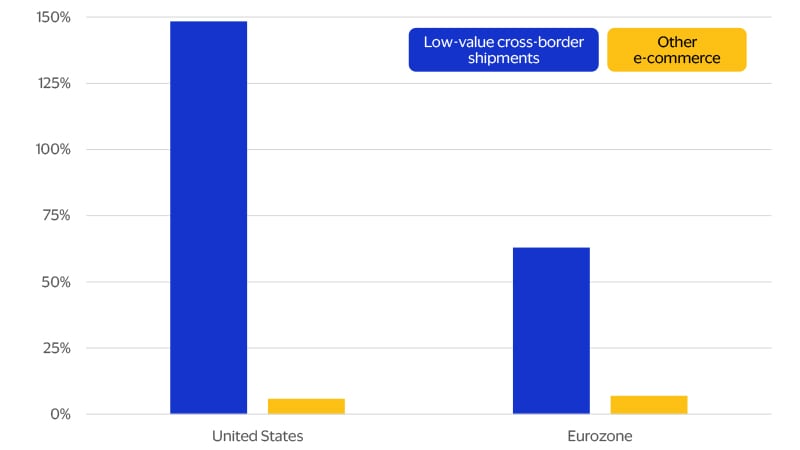

Low-value cross-border purchases have been in a league of their own

Compound annual growth in transactions, 2021-2024

Governments take a closer look at de minimis exemptions

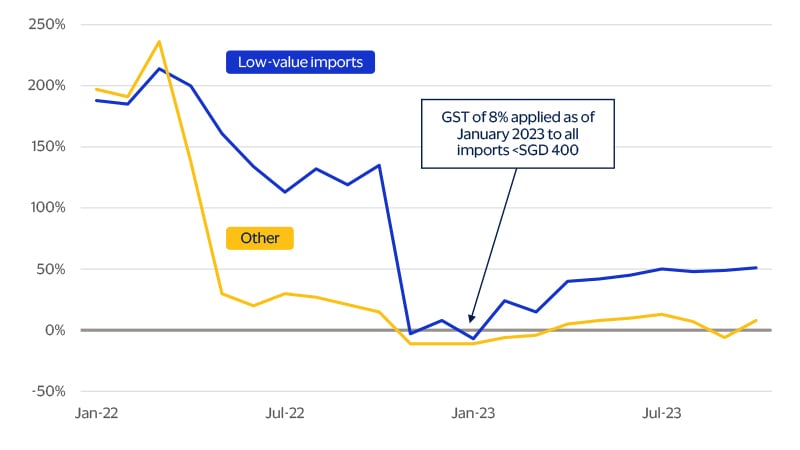

Singaporean low-value imports continue to grow faster after GST is applied

Online purchases in SGD across top 50 merchants, year-on-year percent change

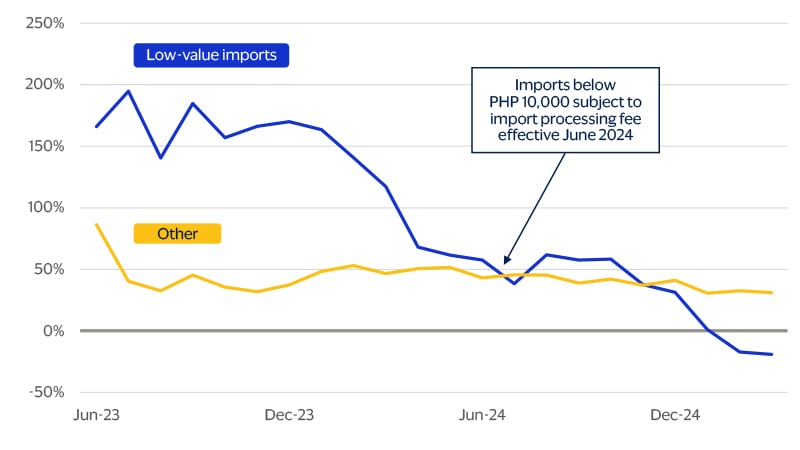

Philippine low-value imports are shrinking in response to new customs processing fees

Online purchases in PHP across top 50 merchants, year-on-year percent change

A comparison of sales trends before and after these changes showed that the reforms significantly slowed the growth of low-value imports relative to other e-commerce sales. (see figures above).

Low-value imports in both markets significantly outpaced other sales prior to the policy changes; after they took effect, the gap narrowed in Singapore and turned negative in the Philippines, indicating that the changes dampened consumer demand for low-value imports.

The Philippines saw a greater impact in part due to the higher rates applied to lower-value purchases: the fee to import something valued at PHP 1,000 (US $18) could be between 40-50 percent of its value. Additionally, the administrative burden and costs fell more on and were more visible to consumers in the Philippines.

Consumers and sellers adjust to higher costs and inconveniences following de minimis reforms

While the impacts on the aggregate level were different in the Philippines than Singapore, the data also confirms a fundamental truth about tariffs and similar trade policy shifts: the consumer pays the cost of these changes. Some consumers are able to bear the increased cost and inconveniences that these policies bring, while others are not.

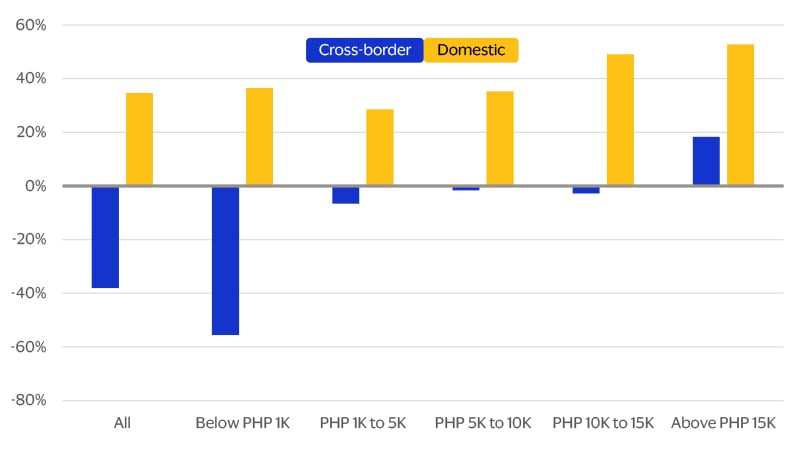

This was more evident in the Philippines, where cost-sensitive consumers opted to stop purchasing items rather than pay higher shipping fees. Most of the loss in de minimis purchases occurred among the lowest value imports, which fell 56 percent year-on-year in the first quarter of 2025, two quarters after the initial policy shift, with no offsetting increase in domestic purchases at a similar price point (see figure below). An 18 percent rise in transactions over PHP 10,000 did not offset this drop, because e-commerce transactions skew towards the lower end in terms of cost per transaction in most markets. On net, the total volume of cross-border transactions fell by 38 percent. A similar shift occurred in Singapore as well, where the lowest-value import transactions grew much slower than other imports.

Consumers shifted to larger ticket purchases in the Philippines

Year-on-year change in the volume of cross-border vs. domestic online purchases at the top 50 merchants, segmented by transaction size

Although the increase in large purchases did not offset the fall in the volume of purchases, it did help cushion the fall in revenues, with the aggregate cross-border transaction value up 3 percent year-on-year. This rise in the larger average value transactions could be driven by buyers who have bundled several orders into one larger order to reduce customs processing costs.

Offering online shoppers timely deliveries at low cost and with innovative marketing cutting distribution margins allowed new companies to emerge and thrive in e-commerce markets around the world. Loss of the de minimis exemptions coupled with high tariffs could seem like unsurmountable barriers to the continued growth of these companies. Then again, as we have seen in both the Philippines and Singapore, companies that have adapted to these challenges—including by moving offshore logistics around the sale to onshore—have continued to grow. By focusing on maintaining their core value proposition to online buyers, they have managed to expand into new areas and segments and continued to build and grow their franchises.

Footnotes

- Exec. Order No. 14259, 90 Fed. Reg. 15509 (April 8, 2025), Exec. Order No. 14526, 90 FR 14899 (April 2, 2025), Exec. Order No. 14200, 90 FR 9277 (February 5, 2025), Exec. Order No. 14195, 90 FR 9121 (February 1, 2025).

- Karen Sutter and Michael Sutherland, “China’s E-Commerce Exports and U.S. De Minimis Policies,” Congressional Research Service, IFI 12891, February 3, 2025. European Commission, “A comprehensive EU toolbox for safe and sustainable e-commerce,” Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions COM (202) 37 final, 5 February 2025.

- Christopher Casey, “Imports and the Section 321 (De Minimis) Exemption: Origins, Evolution, and Use,” Congressional Research Service, Report no. 48380, January 31, 2025.

- U.S. Customs and Border Protection recorded 1.36 billion packages shipped under Section 321 BOL in FY 2024, which works out to 3.8 million packages per day, De Minimis Statistics, April 25, 2025. European Commission, “A comprehensive EU toolbox for save and sustainable e-commerce,” Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions COM (202) 37 final, 5 February 2025.

- Inland Revenue Authority of Singapore, “5 questions you may have when shopping online,” accessed April 26, 2025.

- Bureau of Customs, Department of Finance, Republic of the Philippines, Customs Dues, Fees and Charges, Customs Administrative Order 02-2024

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.