The record high build-up in non-public debt places additional stress on an already challenging process. Nevertheless, the process seems to be well underway, with retail sales still expanding at a double-digit pace and Chinese tourists traveling overseas in record numbers.

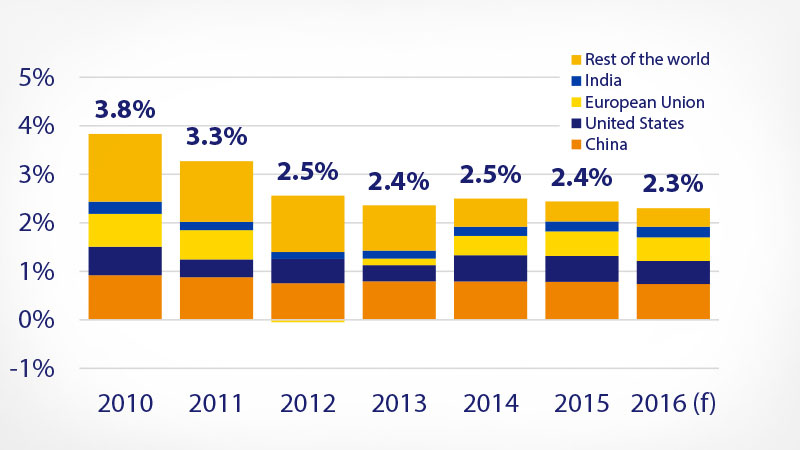

Emerging markets: Low commodity prices should continue to weigh on much of the emerging world, impacting export earnings, investment flows and ultimately income growth. Although falling oil prices are ordinarily believed to be a net positive for the global economy, the scale of the decline is posing significant challenges to major energy exporters such as Brazil, Russia, Saudi Arabia and Venezuela, which combined are expected to shave 21 basis points off global growth; prior to 2014, these economies typically contributed 25 basis points to growth.

Risks to the global economic outlook

A substantial share of China’s businesses and factories are struggling with overcapacity and high levels of debt. If they were to default, the resulting financial crisis could cut the expected growth rate in 2017 by at least half and cause spillover effects to neighboring countries and the broader emerging world. Some risks already exist, but the full impact has yet to be measured. Continued strength in the dollar could exacerbate capital outflows from the emerging economies, already weakened by reduced inflow of export revenues and foreign investments. In Europe, the migration crisis is causing a breakdown in the common border area, with corresponding disruption in cross-border supply chains and commerce.

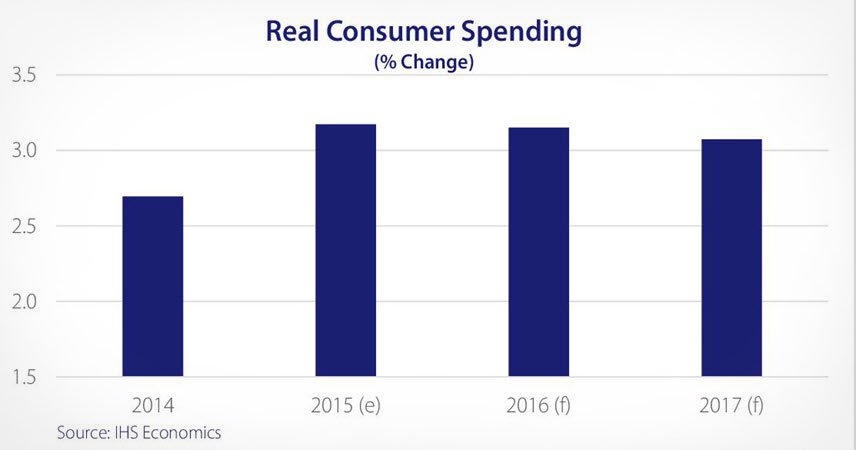

Risks are also emerging in the U.S. Declining stock prices could weigh on spending through negative wealth, especially among the affluent, who represent about 40 percent of spending in the U.S. The strong dollar will continue to weigh on exports and corporate earnings. In addition, if oil prices do not stabilize, we can expect further declines in energy investment and more bond defaults, which will have a deeper impact in the U.S. oil belt. Despite these risks, the outlook remains guardedly optimistic that the weakened global economy will be on a higher growth path soon. In the meantime, the U.S. is well positioned to withstand the turmoil and continue in its role as one of the primary leaders of worldwide growth.