U.S. Economic Insights for November 2015

Solid consumer fundamentals are propelling the U.S. economy forward into 2016 and 2017, despite volatile equity markets and slower growth abroad.

Key trends

Increase in Jobs

Six years after the Great Recession, the U.S. economy remains well-positioned for growth to continue—which could make for one of the longest expansionary periods in U.S. history. Employers added an average of 271,000 jobs per month over the last 12 months, putting 2015 on track to be one of the strongest years since 1999.

Unemployment Rate Drop

Robust job gains have helped lower the unemployment rate to 5.0% —the lowest since April 2008. As workers rejoin the labor market, the unemployment rate should hover around 5.2% in both 2016 and 2017—within range of full employment.

Spending

The tighter labor market should finally put upward pressure on wages, with the employment cost index—the most comprehensive measure of wage growth—expected to accelerate from 2.1% in 2015 to 2.4% in 2016 and 3.0% in 2017.

Consumer spending and economic growth

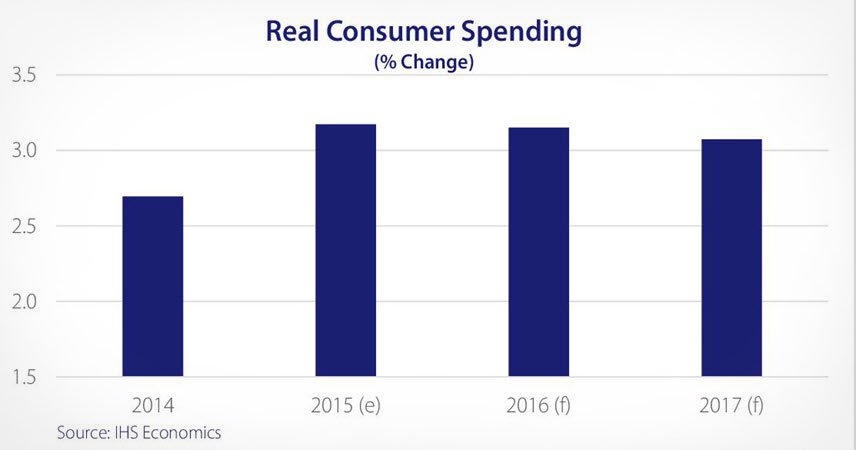

Strong economic tailwinds should support real consumer spending growth of 3.2% in 2016 and 3.1% in 2017. Consumers should continue to benefit from cheap gas, with prices forecast to remain below $3 per gallon through 2017, fueling discretionary spending.

The strong dollar—which lowers the cost of imported goods—should also support spending. Furthermore, consumer spending should benefit from household formation, which has increased rapidly since the end of 2014 to its fastest pace in ten years.

Solid consumer fundamentals are propelling the U.S. economy forward into 2016 and 2017, despite volatile equity markets and slower growth abroad.

Home sales and mortgage rates

While home prices are nearly back to their pre-recession peaks, low mortgage rates have helped push the household debt to disposable income ratio to near 35-year lows. These factors have improved homeowners’ ability—and willingness—to spend.

The tight housing supply should spur construction and new home sales, which are expected to reach 600,000 in 2016, the most since 2007. These factors should prepare real GDP for liftoff with growth forecast to accelerate from 2.5% in 2015 to 2.8% in 2016 and 2017.

Inflation and interest rate projections

Low oil prices and the strong dollar are keeping inflation subdued. However, with strong October job growth, the Fed is now expected to begin slowly raising interest rates in late 2015, with the federal funds target reaching 1.5% by the end of 2016 and 2.5% a year later.

Tighter monetary policy could send equity markets into a temporary tailspin—and may pressure luxury spending—but consumers should be able to weather the turbulence.

Economic trends in China, Europe and Japan

Although the U.S. economy has clear skies ahead, prospects are gloomier overseas. China’s downshift is effecting equity markets around the globe, but the direct linkages to the U.S. economy are small with U.S. exports to China only 1% of GDP.

Europe and Japan are more at risk given higher exposure to emerging markets and weaker domestic demand. Even so, another global recession is unlikely in the near term. The U.S. economy has the momentum needed to remain on course for the next couple of years.

The changing environment for payments

We will continue to provide updates to consumers’ views of their financial institutions, with a particular focus on security issues, financial institution reputation, and the evolution and value of rewards programs. We are paying particular attention to the changing demographics of financial institutions; customer bases. In these contexts, we seek to provide assistance with approaches to customer interaction that align financial institutions with current consumer mood.

Expansion of business and economic insights

Our group is growing. Moving forward, we look forward to providing you not only with a broader and deeper understanding of the macroeconomic factors effecting the payments industry, but also more in-depth analysis on the multitude of factors that affect credit issuing, consumer spending and the breadth of your business.