No, the SMI differs from Visa's total payment volumes in two important ways. First, the index is based on the count of consumers spending more or less during a given period. Payment volume, in contrast, aggregates spending across those consumers and can be influenced by how many consumers are spending and how much they are purchasing. Second, payment volume statistics are based on spending on all Visa-branded credentials, whereas the index relies on a sample of credentials and therefore does not reflect Visa financial or operational performance.

See how consumers are spending

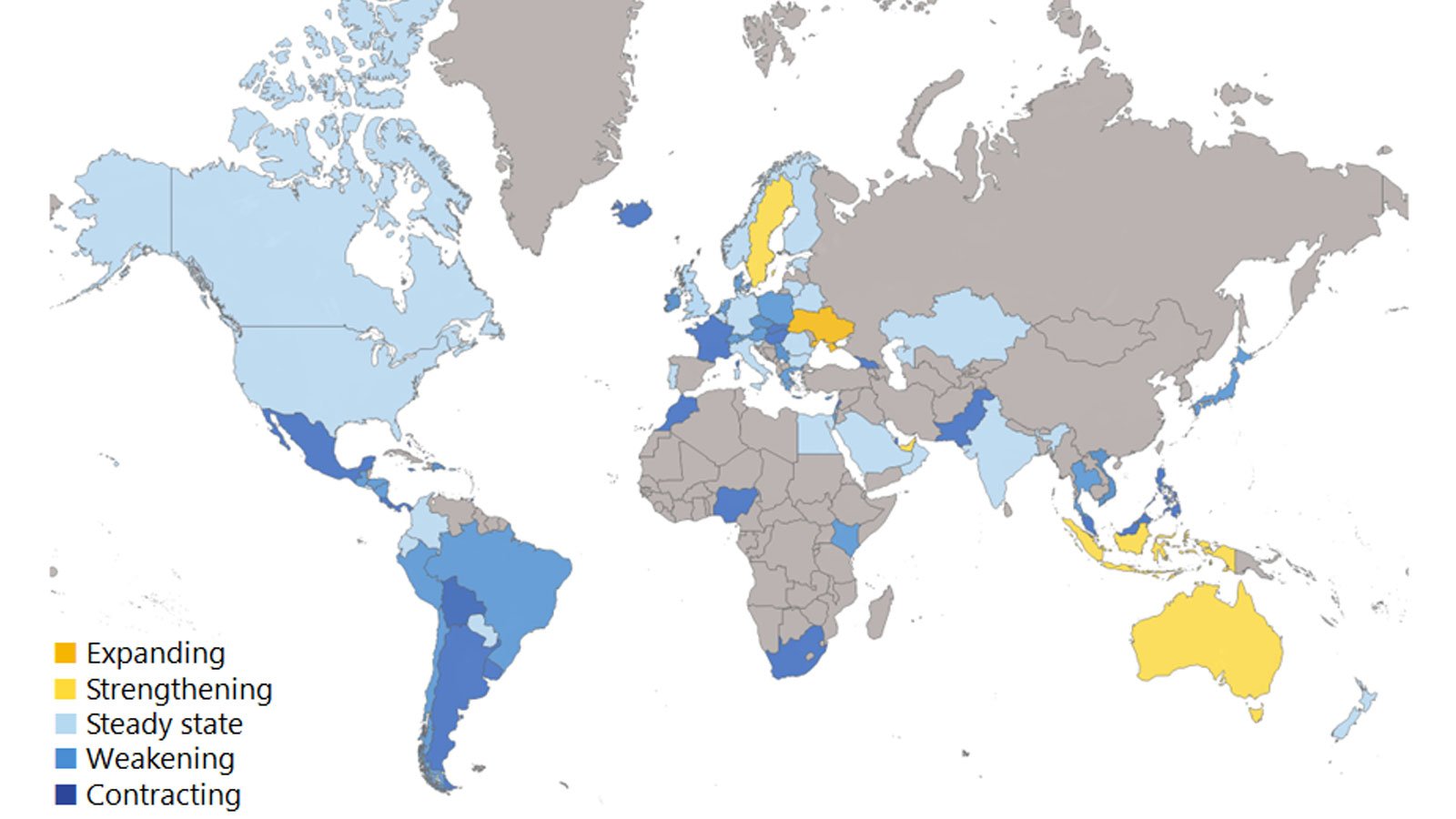

The Visa Spending Momentum Index gauges the health of consumer spending and overall participation by consumers in driving economic trends. Visa now offers the index in multiple countries and is continuing to expand into new markets, providing a more comprehensive view of global spending momentum.

Latest release

Data files for the Spending Momentum Index are available on a monthly basis.

Client solutions

The SMI is a big data indicator of consumer demand that improves and enhances business planning. SMI closely tracks broader consumer spending trends at various geographical levels (city, county, state and region). Additional attributes include two product splits (debit and credit) and four merchant spending segments.

SMI use cases

Here's how businesses can use the SMI to gain powerful insights into global consumer spending trends.

SMI resources

SMI provides a valuable economic signal in machine learning models to anticipate key business and economic trends.

SMI as a guide to navigate business through economic cycles

In this video, senior global economist Dulguun Batbold showcases one way that the SMI is used to help businesses anticipate key trends, such as economic cycles.

Driving business growth with confidence during a recession

Consumer spend insights can help mitigate risk during economic downturns and identify opportunities earlier in a recovery.

FAQ

-

-

The Visa Spending Momentum Index (SMI) is an economic indicator that provides a timely read on consumer spending. It is based on depersonalized spending data from Visa-branded credit and debit credentials and represents all consumer spending regardless of form factor. Readings above 100 signal strengthening momentum; below 100, momentum weakens. The SMI offers eligible clients a customizable view of consumer spending trends across online and offline purchases.

-

-

-

-

In addition to the national figure that is publicly released, Visa's SMI can be segmented further for business intelligence. Depending on the data customization provided, the SMI can help to inform acquisition, usage, and retention initiatives. It can also be an early indicator of local and national changes in worker incomes and jobs, allowing for timely and comprehensive risk management. Additional industry benchmarking can help give clients a deeper understanding of payment and economic trends.

Sub-indexes are available on a subscription basis to eligible Visa clients in four key areas:

- Location. The scores associated with the Visa SMI index generally start at the city level. Data at the city level can be further aggregated using population weights to create indices for higher levels of geographic aggregation (for example, state, province, region and nation, etc.).

- Credential segment, i.e., debit and credit credentials.

- Major spending segments, including fuel, restaurant, discretionary and non-discretionary spending items. Discretionary spending includes purchases that are more sensitive to changes in household income and employment, such as travel and entertainment, durable goods, clothing, personal services, home repairs, and others. Non-discretionary, or everyday spending, is less sensitive to these labor market changes and includes health care, groceries, utilities, and education. Restaurant spending includes spending at full-service and quick-service restaurants. Gasoline spending includes all spending at fuel/service stations.

- Custom SMI according to the client's own portfolio.

-

-

For eligible Visa clients, access to more detailed views based on geography, merchant segment and product of the data is available through subscriptions delivered via the Visa Analytics Platform. More custom engagements can be arranged by contacting Visa Consulting and Analytics (VCA), Visa's global client-facing team of several hundred payments consultants, data scientists and economists across six continents. VCA can help to identify an actionable SMI solution that best meets your needs and desired business outcomes. Contact: vca@visa.com.

-

-

Anticipated SMI release schedule for 2026*

-

-

Beyond the markets included in the monthly releases of Visa’s SMI data appendix, Visa provides access to a broader set of countries as subscription or custom solution to eligible clients. To arrange access, please contact Visa Consulting and Analytics at vca@visa.com and check for the latest subscription options.

-

-

The SMI is designed with customer data protection in mind. All SMI data is depersonalized so that it cannot be linked back to an individual. The data is also aggregated based on the count of credentials that have increased or decreased their spending according to various transactional-level attributes, then summarized into an SMI diffusion index. To ensure both privacy and statistical robustness, the number of credentials used in any SMI data sample must meet a minimum threshold. This threshold exceeds the minimum requirements of most survey methodologies. Read more about data privacy.

-

-

Visa's Spending Momentum Index measures the share of Visa-branded credit and debit cards that have increased their monthly spending compared to the same month in the previous year. Using proprietary filtering techniques, Visa samples the credentials to minimize the influence of commercial-related changes for every pair of observations over time. Together with adjustments made to sales volumes, these steps amplify the underlying signal on the momentum in consumer spending.

Each card that remains after filtering is assigned one of three scores: 200 for cards where spending has increased more than the long-term average growth rate in spending, 100 for cards with stable spending and 0 for cards with spending growth that falls below the long-term average. The long-term average growth rate is the five-year rolling average annual growth rate. The scores are then aggregated at a city-level. The data at the city level is then aggregated using population-weighted averages to create indices for higher levels of geographic aggregation (for example, city, state, province, regional and national, etc.). An SMI reading above the 100 threshold indicates broad based net acceleration in economic momentum, while values below indicate a contraction on an annual basis.

Visa Business and Economic Insights

Get actionable intelligence from Visa’s team of economists based on the latest trends in consumer spending and payments.

Disclaimer:

*The Visa U.S. SMI is based on a sample of aggregated, depersonalized VisaNet and third-party data; it is not reflective of Visa operational and/or financial performance. SMI is provided “as is” without warranties of any kind, express or implied, including, without limitation, as to the accuracy of the data or the implied warranties of merchantability, fitness for a particular purpose, and/or non-infringement. Visa is not responsible for your use of the information contained herein, including errors of any kind, or any assumptions or conclusions you might draw from its use. Each SMI report is as of the publication date, and Visa has no obligation to update data contained therein.

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.