Unlocking Gen Z’s mindset and consumer potential

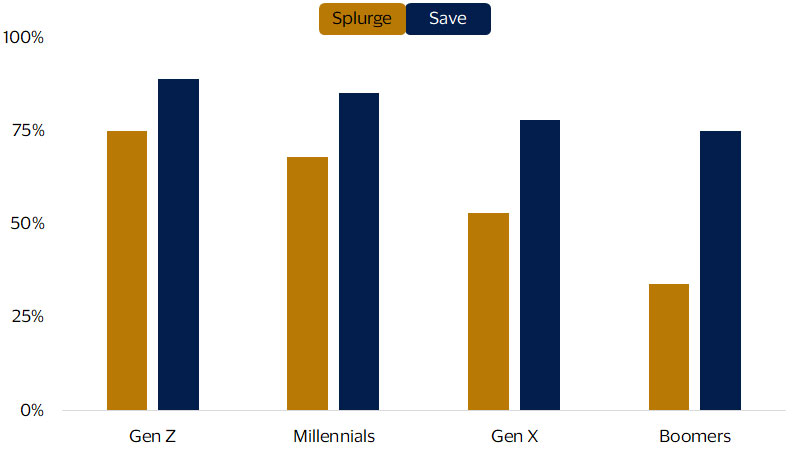

Gen Z’s “split-brain budgeting”

Split-brain budgeting

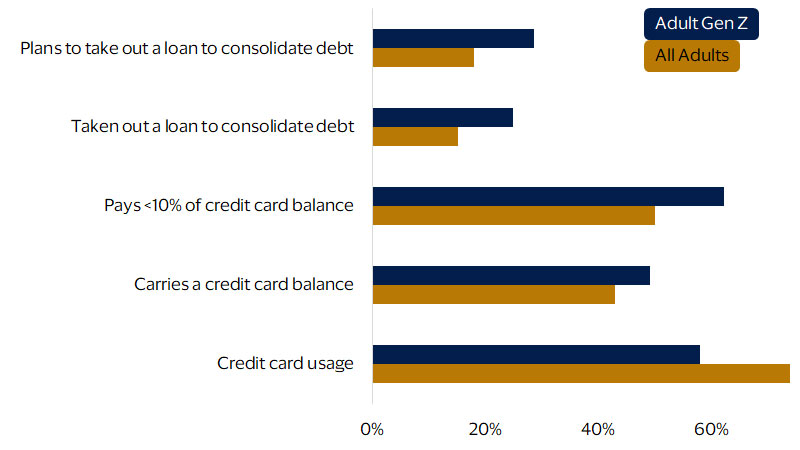

Unique approaches to credit and the rise of AI interactions

Gen Z financing preferences

Financial action taken or planned

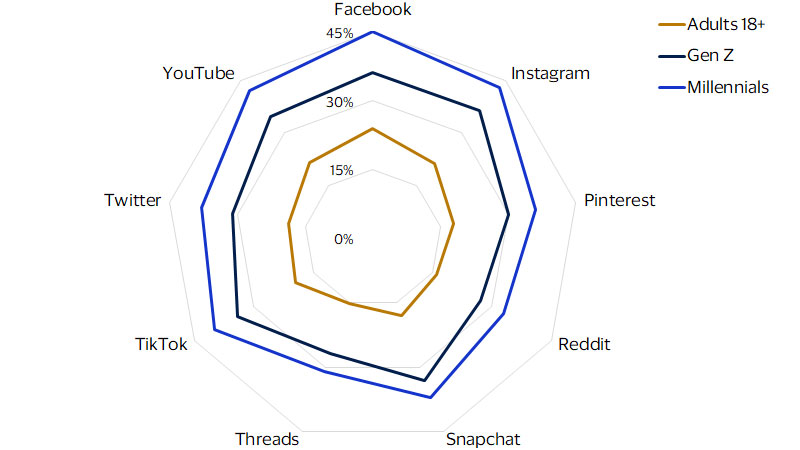

Social media platforms represent a key component of payment evolution

Social media payment engagement

How often do you make purchases from social network apps? Every day, several times per week or several times per month?

Why Gen Z is not millennial 2.0

Gen Z's present financial behavior reflects a generation still in the process of learning the ropes. Factors such as financial confusion, lower confidence in handling financial crises, and a preference for cash indicate a generation in the midst of a learning curve. Their inclination to shy away from traditional financial institution relationships necessitates a deeper understanding of their evolving financial needs.

Comparing Gen Z and millennials reveals nuanced differences in their perceptions of debt. While millennials view debt as normal and are more prudent in considering economic factors before making large purchases, both Gen Z and millennials are dealing with the uncertainties of the 21st century, and both express higher concern about saving for a rainy day and economic stability.

Understanding the multifaceted financial behavior of Gen Z unveils both challenges and opportunities for businesses. Crafting strategies that resonate with their split-brain budgeting, eco-conscious values, and preference for alternative financing methods is imperative. The integration of AI-driven interactions and the evolving landscape of social media transactions further necessitate adaptability.

Businesses should consider prioritizing tailored experiences that align with Gen Z's values and preferences. From sustainable brand practices to seamless digital interactions, organizations that proactively embrace and integrate these trends into their operations stand to gain a competitive edge.

Future-proofing strategies require a continuous monitoring of Gen Z's evolving financial behaviors. Staying attuned to their preferences, adapting payment systems to align with social platforms, and fostering financial education initiatives can position businesses as leaders in catering to this influential consumer group.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.