Understanding Canada’s rapidly expanding gig workforce

Gig worker growth trends present opportunities for businesses

The proportion of gig workers in Canada has more than doubled over the past decade,³ driven by technological advancements, increasing demand for on-demand services, and a cultural shift toward valuing work-life balance and autonomy. Gig work is not confined to digital platforms such as ridesharing or food delivery services. It spans across various industries such as healthcare, education, marketing, technology, and even creative fields like art, writing, and photography. The growth of digital platforms has made it easier for workers to find flexible opportunities across diverse fields. (See: App-enabled work is no longer just a gig: the global economic implications.) The gig economy’s advantages are not limited to workers—businesses are also benefiting. Companies are leveraging gig workers to fulfill specific tasks, reduce overhead costs, and adapt to fluctuating demand. The flexibility of the gig economy enables businesses to scale their workforce efficiently without the traditional long-term commitments.

Canada’s gig workers: A growing consumer segment

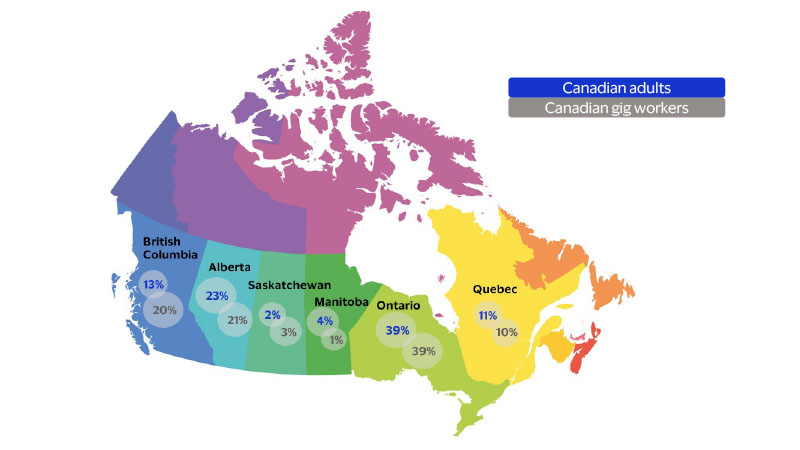

Geographical distribution of gig workers and differences between regions

The distribution of gig workers is not uniform across the country, with certain provinces demonstrating a higher concentration due to urbanization, technological infrastructure, and industry demands. In less urbanized regions, such as the Atlantic provinces, the gig work participation rate tends to be lower, according to the VBEI survey (see figure below). However, it is also growing, particularly in sectors like agriculture, tourism, and customer service.

British Columbia stands out as the province with the highest concentration of gig workers compared to its share of the total population. The province’s urban population, particularly in Vancouver, is conducive to gig economy platforms like Uber, DoorDash, and freelancing websites. The tech industry’s growth in British Columbia and proximity to the high-tech hub of Seattle also contribute to an increased demand for tech-related gig work.

Ontario and Quebec, with their large urban centers of Toronto and Montreal, have the highest concentrations of gig workers overall. However, the survey also suggests that the gig economy is growing rapidly in rural parts of these regions as well, where individuals seek additional income opportunities or flexible work arrangements that traditional jobs do not offer.

Gig work is prevalent in Canada’s urban centers

Shares of overall adult population and overall gig worker population in Canada, by province

Gig workers by age group

Demographic analysis of Canada’s gig workers reveals that gig work attracts members of all age groups. Certain cohorts, though, including Gen Z (23 percent) and baby boomers (18 percent) show higher participation rates (see figure below).

Relatively new entrants to the workforce, Gen Z (18–25) is increasingly drawn to gig work’s flexibility and potential for autonomy. Many are balancing gig work with education, seeking income while maintaining control over their schedules. They are also highly engaged with technology, which makes them more likely to turn to digital platforms to find work.

An often-overlooked demographic when discussing the gig economy, baby boomers (60–75) have also embraced gig work. Most are using gig platforms to supplement retirement income or to stay active in the workforce longer. Flexibility is particularly appealing to this age group, as it allows them to work without the physical demands or time constraints of traditional full-time employment.

Income and household characteristics of gig workers

While gig work offers flexibility, many workers still earn modest incomes. According to the VBEI survey, approximately 40 percent of gig workers report earning less than $50,000 annually, in stark contrast to traditional full-time employees who typically earn more with benefits. However, higher earning opportunities exist for those who participate in gig work full-time or in specialized fields, including consulting, technology, and healthcare. These workers tend to earn significantly more than those in entry-level or lower-skill gig jobs. Gig work in creative fields such as writing, design, or photography can also generate high incomes, depending on experience and portfolio.

Gig work income can also vary significantly across seasons, especially for workers in the tourism or retail sectors. This irregular income often requires them to budget carefully, save for lean periods, and sometimes supplement their earnings with multiple gigs or side hustles.

A higher percentage of gig workers (40 percent) live in two-person households compared to the total population (28 percent), which means they likely share financial responsibilities. This dual-income household structure helps mitigate the volatility of gig work income, allowing gig workers to benefit from the flexibility of their work while relying on other sources for financial stability.

Gig workers’ attitudes toward life and financial planning

Gig workers generally exhibit greater optimism about their present and future compared to traditional employees, according to the VBEI survey results. Many see gig work as a means to gain greater control over their lives, allowing them to pursue varied interests and career paths, and travel or even relocate without the constraints of traditional employment. This optimism is further amplified by the professional independence that gig work offers, which enables workers to design their own schedules and take on projects that align with their passions. Workers are not beholden to a single employer, and this autonomy fosters a more positive outlook on their professional futures, even amid financial uncertainty.

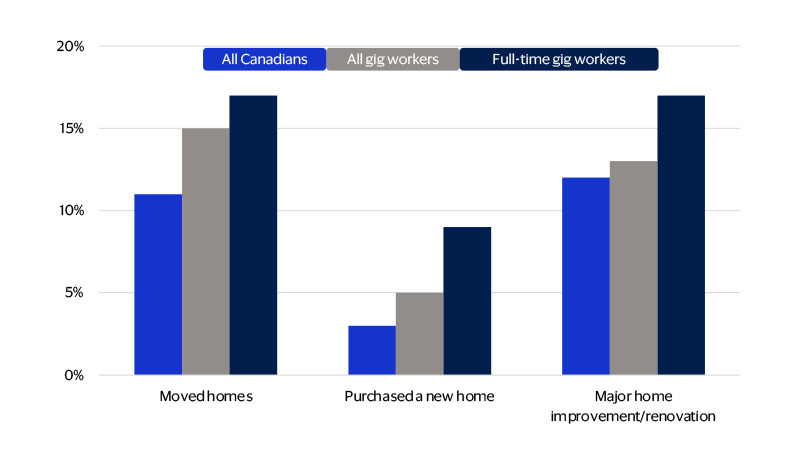

This independence carries over into gig workers’ financial decisions. Gig workers tend to adopt more strategic financial habits, especially when managing fluctuations in income. They are more likely to create personal budgets, save for unexpected expenses, and engage in long-term financial planning. This stands in contrast with traditional employees, who may have more predictable salaries and benefits but fewer incentives to engage in detailed financial management. Many also seek to diversify their income streams through financial investments. Real estate has become a key area of investment for full-time gig workers (see figure below), particularly in major urban centers where property values are rising. This aligns with a broader trend of gig workers seeking alternative ways to build wealth outside of traditional employment-based retirement plans.

Gig workers often exhibit a strong desire for personal growth, improving their skills through online courses, networking, and varied work opportunities. This drive for self-improvement enhances their adaptability and resilience in the ever-changing gig economy.

Full-time gig workers tend to be more mobile and engaged in real estate investment

Question: Which, if any, of the following have happened in the last 12 months?

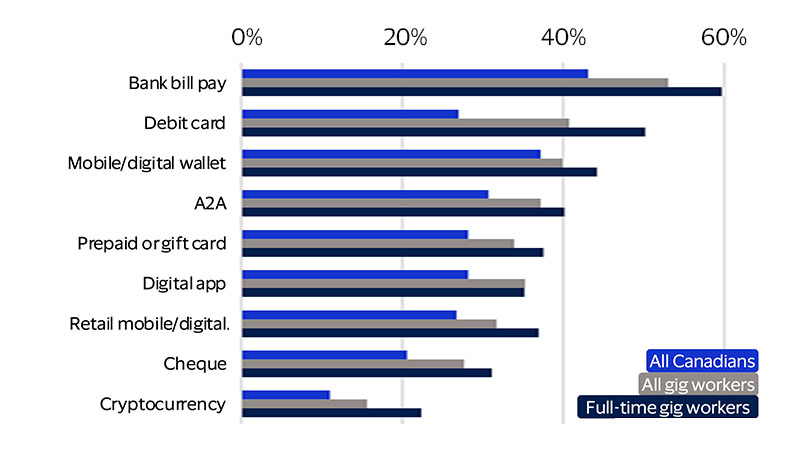

Gig worker spending patterns and payment preferences

Gig workers gravitate toward debit and bill pay when choosing a payment method

N/A

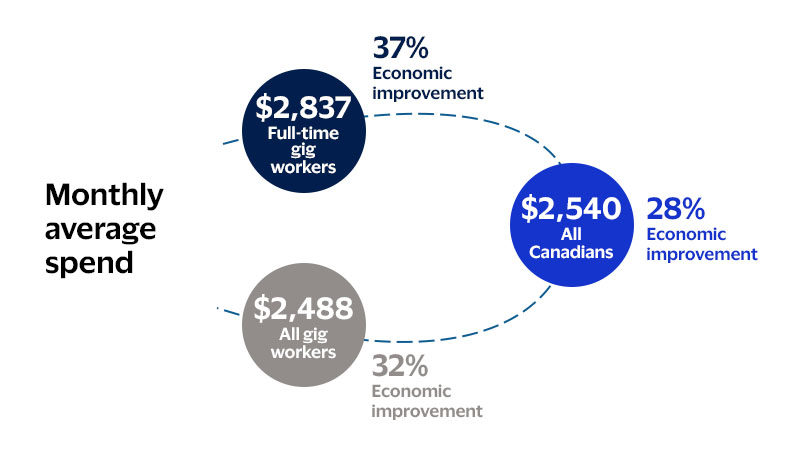

Full-time gig workers are major consumer spending drivers, with a monthly average spend of $2,837 in comparison to $2,540 for Canadians overall (see figure below). They also tend to allocate a larger portion of their income to discretionary spending, according to the VBEI survey, including personal care, fashion, electronics, and investments in their gig business. Gig workers are more deliberate about their spending, preferring purchases that reflect their lifestyle or help expand their business while supporting self-care needs. Many gig workers also spend a significant portion of their income on experiences that allow them to enjoy the benefits of their flexible schedules, such as travel, entertainment, and dining out.

As gig work expands beyond ride-sharing and delivery into professional services, healthcare, and education, the implications for Canada’s payments industry are significant. When gig workers earn more, they spend more (see figure below). Gig workers’ spending velocity, combined with their preference for digital transactions, is accelerating the move toward a more dynamic, real-time payment ecosystem.

Full-time gig workers punch above their weight nationally

Question: What factors would encourage you to spend more? (percent citing economic improvement as a factor)

Canadian merchants and financial institutions can leverage gig worker trends to grow their business

For financial institutions and merchants, gig workforce trends present both an opportunity and an imperative. The gig economy isn't just creating more transactions, it's creating different kinds of transactions, with different rhythms and requirements. Success in this evolving landscape will depend on understanding and adapting to these new patterns of earning, spending, and moving money.

The gig economy is poised for continued growth as Gen Z and baby boomers increasingly seek additional income sources, greater independence, and work flexibility. In addition to gig workers’ strong preferences for digital payment solutions, their tendency to manage multiple income streams also translates into greater engagement with financial services and higher adoption rates of digital banking tools. As digital platforms become more deeply integrated into daily life, merchants and financial institutions that adapt their services to meet these unique behavioral patterns will be better positioned to capture value from this rapidly expanding segment of the Canadian workforce.

Footnotes

- Hardy, V. (March 2024). Defining and measuring the gig economy using survey data. Statistics Canada.

- Behind the Gig: Securian Canada Insights. (October 2024). Securian Canada.

- What we heard: Developing greater labour protections for gig workers. (March 2023). Employment and Social Development Canada.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.