App-enabled work is no longer just a gig: the global economic implications

February 2024 – Businesses looking for workers and central bankers trying to tame inflation should consider how app-based gig work has transformed labor markets around the world. Thanks to the proliferation of platform apps that help match consumers with their peers offering on-demand services—be it food delivery, dog walking or producing made-to-order artisanal honey— businesses are facing persistent pressure from a new and growing competitor for workers, driving up wages and adding slow-burn fuel to inflation.

Expanding consumer demand for app-intermediated services is helping sustain an alternative and flexible source of employment and income for millions of workers around the world, altering how traditional risk measures such as unemployment impact consumer-facing businesses. Visa’s depersonalized cardholder data suggests that one out of five consumers are already users of such platform apps, representing an addition of well over 300 million new consumers since 2019. In fact, our analysis suggests that global unemployment might have been a full percentage point higher without gig income to cushion workers from economic shocks over the last year. As consumers’ comfort levels and trust in apps continue to grow, gig work is also evolving. Just as digital technologies have disrupted transportation and hospitality industries, app-enabled peer-to-peer transactions are having a similarly transformative effect on the attention economy.

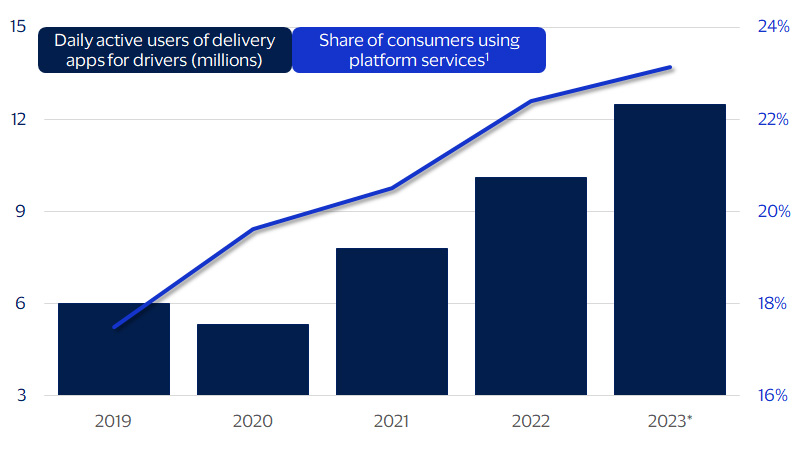

Platform economy growth accelerated post-COVID

(Daily active users of delivery apps for drivers and share of consumers using platform services¹)

* 2023 average through November.

App-based gig work is heating up competition for labor

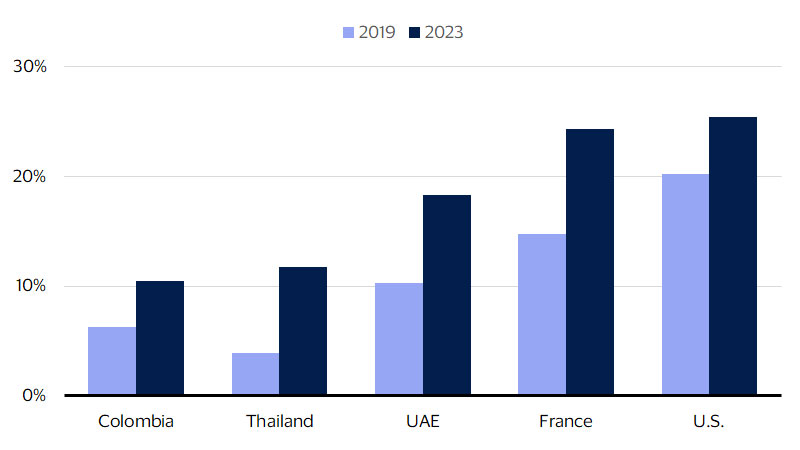

One change in the global economy that is different today versus even five years ago is the degree to which digital commerce has enabled and expanded new ways of working and earning income for consumers. Globally, demand for app-enabled commerce has expanded, with over 20 percent of Visa cardholders already using such platform apps today (up 5 percentage points since 2019), according to Visa Business and Economic Insights analysis. To meet this demand, a commensurate number of people supply that service on the other side of the transaction to earn income through such apps.

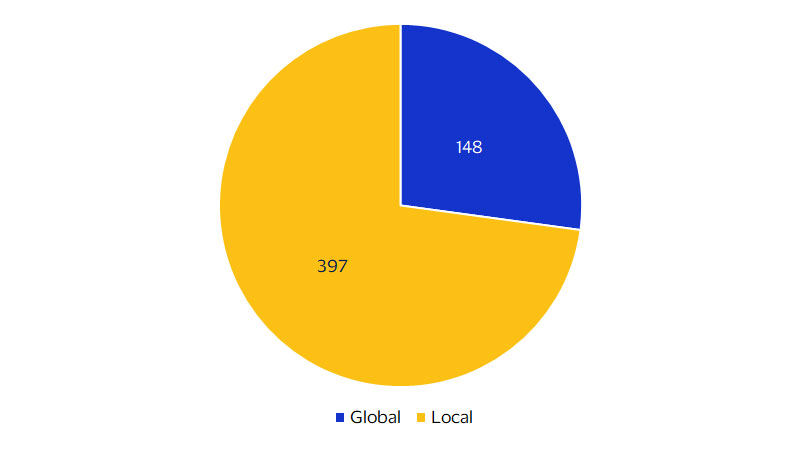

Analysis of a depersonalized and anonymized sample of global Visa cardholders making purchases through 48 global platform apps reveals that growth in consumer demand for such apps spans across all regions and levels of economic development. Even this picture likely understates the growth of the gig economy, considering that nearly three out of every four gig platform companies are actually regional or local rather than global, headquartered across 63 countries, according to a recent study by the World Bank.² In fact, the study estimates that 40 percent of traffic to online platforms already comes from developing markets whose demographics offer greater runway for future growth over the long term.

App-enabled commerce growth is global

(Share of consumers using platform services¹)

By contrast, gig platforms are mostly local²

(Online gig platforms by category)

Gig platforms have grown in importance beyond just offering a side hustle for participating workers. According to Visa survey-based research, two-thirds of app economy workers globally rely on their gig income as a primary source of earnings.³ More importantly, these gig work regulars (those who work more than 20 hours per week) account for an even larger share, comprising 80 percent of total gig hours worked and, correspondingly, income earned through such platform apps.

While estimates of the size of the gig economy vary, platform app workers invariably reflect a fast-growing segment that already accounts for at least 4 percent of the global workforce. According to data.ai, daily active users of delivery apps for drivers doubled globally since 2019, with Latin America experiencing the strongest increase. The gig workforce could be numbering as high as 435 million globally (or 12.5 percent of total), according to the World Bank. Estimates based on tax records indicate the number of workers making a living through this new economy have more than doubled since 2019 and could represent over 3 percent of U.S. employment.⁴

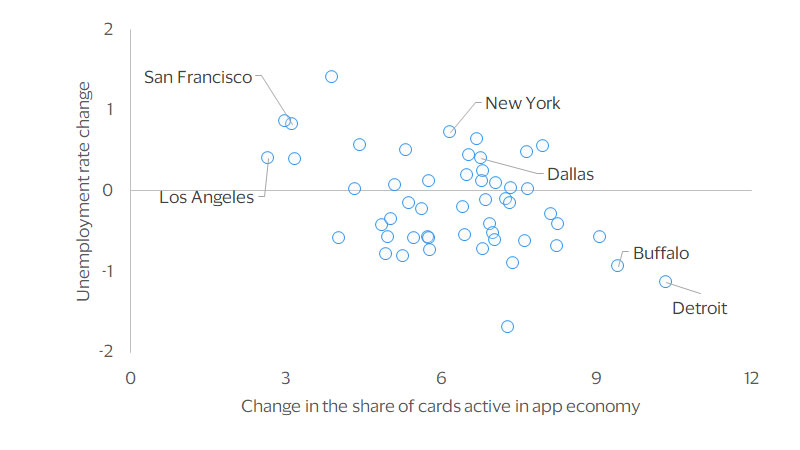

Platform apps help insulate workers in downturns

The gig economy is offering greater cushion to labor market shocks than commonly appreciated. Among markets with similar levels of post-pandemic spending recovery based on Visa’s Spending Momentum Index, workers in areas where gig-work platform use expanded experienced lower unemployment relative to pre-pandemic 2019. If the gig economy had not been there, this suggests the unemployment rate globally might have been a full percentage point higher in 2023.

Platform apps have a disproportionate impact on labor markets because they offer a flexible alternative to workers most vulnerable to job loss. These workers account for less than 20 percent of the workforce but shoulder most of the burden from layoffs during economic downturns.⁵ Flexibility and ease of onboarding to a platform app offer an increasingly viable alternative to a formal job market. This benefit is even greater in emerging markets, where the World Bank study found that platform apps have helped boost female participation precisely due to low barriers of entry and flexible work hours.

Gig app gains have helped blunt rise in joblessness since 2019

(Change in Q2-2023 relative to Q2-2019)

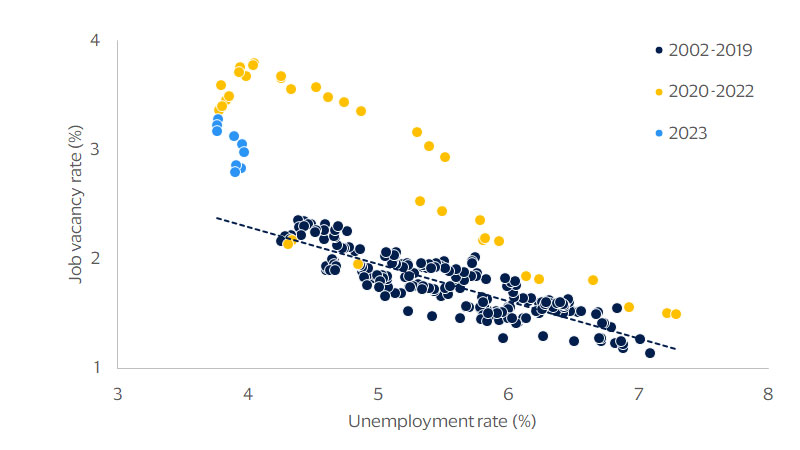

Gig alternatives could be complicating employer recruiting across advanced economies⁶

(Unemployment and job vacancy rates)

Flexibility for workers comes with greater challenges for employers, who are facing a more difficult new normal in labor markets. Across eight advanced economies around the world that publish such statistics, labor markets have become much less efficient at matching workers to available jobs post-COVID, which usually happens when there is a greater mismatch between skills needed by employers and available talent in the market. Difficulty in hiring has been most prevalent in food services and hospitality industries, where gig alternatives might be relatively more appealing to workers. Companies competing with platform apps for workers may need to adjust their staffing practices and start offering similar benefits to hire and retain workers, whether it be greater flexibility in scheduling or more timely wage payments.

The maturation of platform apps may carry two long-term implications for businesses. One, the availability of gig-work platforms could have permanently reduced the volatility in labor markets and may require adjusting risk models of how unemployment impacts consumer income and spending. Two, competition for low-wage workers will likely continue to apply upward pressure on wages and inflation in the services industries.

Nature and scope of gig work continue to expand as technology advances

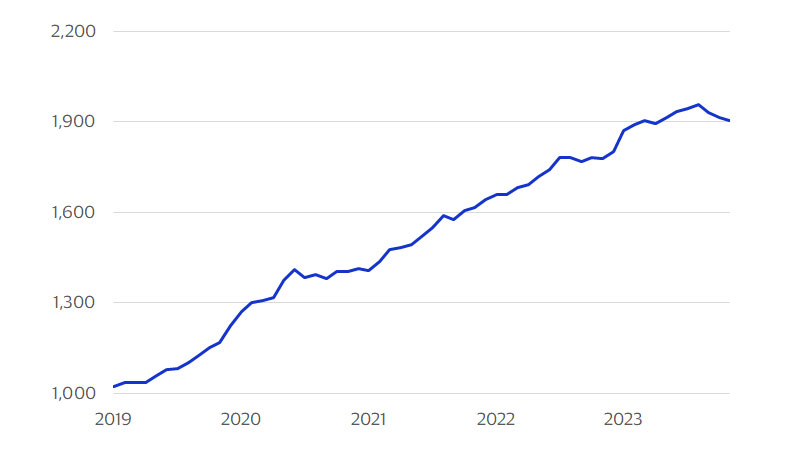

As digital technologies continue to develop, the range of jobs that face potential disruption from platform apps likewise continues to expand. One industry already in the midst of such a transformation is the attention economy, as the confluence of both surging demand for digital content and technologies enabling peer-to-peer interaction and payments in real time is globalizing opportunities for content creators of all types. On the demand side, consumers have become accustomed to interacting and sharing their lives virtually, and usage of media sharing platforms continues to surge. Daily active users of the top five media sharing apps nearly doubled in five years, from one billion people in 2019 to just under two billion in 2023.

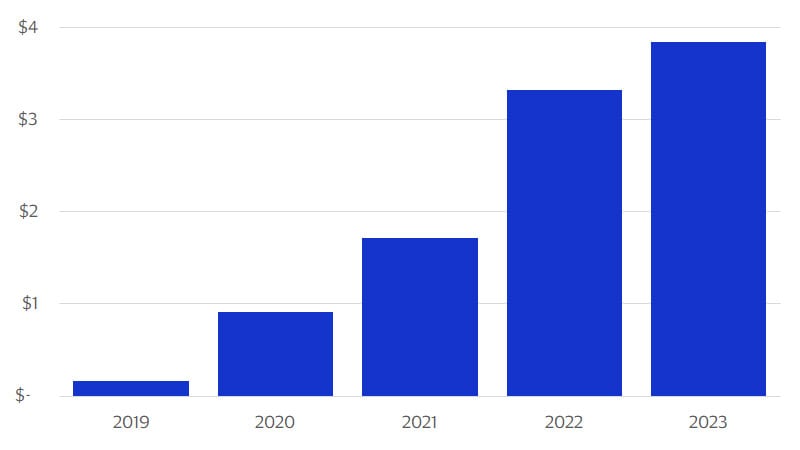

The pivot towards digital consumption is providing equal impetus to content creators—that is now more viable thanks to the global reach of media sharing platforms that allow new entrants to the attention economy to support their work both through traditional means, such as product endorsements from merchants, as well as direct payments from consumers. A recent study estimated that a major U.S.-based media platform already supports over 390,000 full-time equivalent content creator jobs in the U.S. and more than twice that globally—exceeding the employment footprint of even the largest privately held company.⁷ One example of this is TikTok, which has outgrown competitors to be the first mobile app to reach $1 billion in consumer spend in a quarter. According to data.ai, consumer spending on the platform is expected to reach $4 billion in 2023, primarily driven by sales of virtual coins that consumers can use to directly reward content creators.⁸

Growth of the gig economy reveals an increasing preference for on-demand, real-time transactions on both the consumer and worker sides. The pandemic proved that many more types of jobs can be performed remotely, suggesting that work for an ever-expanding set of industries from healthcare to education could potentially face a similar transition to a new normal over the coming decade.

Demand for user-generated digital content continues to grow

(Daily active users of five popular media apps†, millions)

Peer-to-peer payments are helping expand economic opportunities for content creators

(Global consumer spend on TikTok, USD billions)

† These apps include Clapper: Video, Live, Chat, Instagram, Snapchat, TikTok, and Xiaohongshu. These are based on the global rankings on data.ai.

Footnotes

- Share of active Visa-branded consumer cards across 30 top global markets that made purchases through 48 global apps that provide digital platforms helping match buyers with sellers of goods and services.

- World Bank (2023). Working without borders: Promise and peril of online gig work.

- Visa Inc (2020). Rethinking the gig workforce: How faster payment can help companies build and optimize their workforce.

- Garin, A., Jackson, E., Koustas, D., and Miller, A. (NBER 2023). The Evolution of Platform Gig Work, 2012-2021

- Gregory, V., Menzio, G., and Wiczer, D. (NBER 2021). The Alpha Beta Gamma of the Labor Market.

- Based on the average of eight major advanced economies around the world, including United States, Canada, Euro area, United Kingdom, Australia, Japan, Singapore, and South Korea. Job vacancy rate for some markets is imputed as job vacancies divided by the sum of job vacancies and employment.

- Oxford Economics (2023). The State of the Creator Economy.

- data.ai (2023). TikTok Becomes the First Non-Game Mobile App to Generate $10 Billion in Consumer Spending.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.