Tariff troubles: Which regional economies could be affected?

February 2025 – Our regional forecasts indicate that all U.S. regions outperformed our economic growth expectations for Q4-2024. The pace of job creation accelerated in the final two months of the year, leading us to upwardly revise our employment growth estimates for the South and West. As a result of stronger hiring and two additional rate cuts by the Federal Reserve in the final quarter of 2024, we also lifted our estimate for Q4-2024 consumer spending growth across all regions. However, with inflation remaining stubbornly above the Fed’s target of 2 percent year-over-year (YoY) growth, we no longer expect any rate cuts in the first half of 2025. These persistently high borrowing costs will likely lead to more modest growth in interest rate-sensitive sectors through the first half of the year.

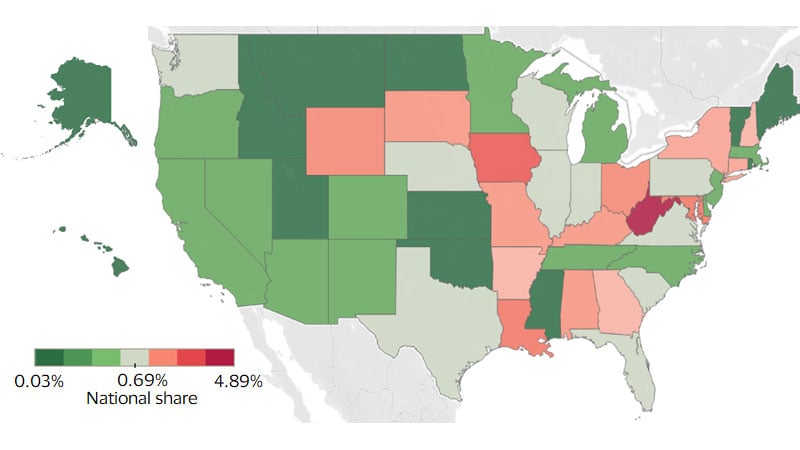

Outside of interest rates weighing on borrowing, the other major headwind for economic growth this year is tariffs. While the new administration has backed off from 25 percent tariffs across all products coming in from Mexico and Canada (at least temporarily), it has added 10 percent tariffs on top of existing tariffs to all imports from China. Additionally, the recently announced 25 percent tariffs on all imported steel and aluminum are expected to have very disparate impacts regionally (see map below). With high demand for both steel and aluminum in the manufacturing sector, we expect that the Midwest and South will be more negatively impacted by the new tariffs. Conversely, the West will likely be relatively less directly impacted. However, we expect the tariffs to lead to downstream cost increases, particularly for new autos, which we expect to hurt demand across all regions and translate into slower consumer spending growth.

Tariffs’ adverse effects likely will be felt more by states with a higher share of steel and aluminum imports

Steel and aluminum import value by state (share of total imports)

New headwinds emerge in the Northeast

We expect that the Northeast’s real gross domestic product (GDP) growth in Q4-2024 was very similar to its Q3-2024 YoY growth. Our forecasts indicate that manufacturing and construction layoffs in Massachusetts and government job cuts in Connecticut hurt consumer spending and business investment in the New England census division (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont), which caused slower growth in the area. However, this was likely offset by an acceleration in growth from the Middle Atlantic census division (New Jersey, New York, Pennsylvania). The reacceleration in growth in the Middle Atlantic states was likely due to increased investment and hiring in interest rate-sensitive sectors like tech and finance that are prominent in New York and New Jersey. These firms got some measure of relief on borrowing costs from a 100-basis point reduction in interest rates over the last four months of 2024, which likely helped boost hiring and investment in those sectors.

We do not expect further relief from high interest rates until the end of this year, which will be an impediment to many Northeast firms that operate in interest rate-sensitive sectors. Additionally, steel and aluminum tariffs are likely to have an outsized negative impact on investment and consumer spending growth in New York, Connecticut and New Hampshire relative to the nation overall. However, the move of many New York City-based financial firms now requiring employees to come back to the office five days per week will likely be a boon for retail establishments in the nation’s largest city. Additionally, the nation’s aging population will be an important driver of revenue, investment and hiring in New York, New Jersey, Massachusetts, Maine and Pennsylvania. An important caveat to the growth picture in the Northeast’s healthcare sector is that the labor shortage—particularly for nurses—could be exacerbated by the new administration’s policies around immigration. We anticipate a decline of new entrants to the region from abroad, which, combined with domestic outmigration and an aging population, would limit the potential labor pool and possibly constrain hiring in the healthcare sector.

Despite new challenges, outlook for the South remains positive

Our forecasts indicate that the South ended the year strong and led the nation in economic, employment and consumer spending growth in 2024. Despite certain areas of North Carolina, Florida, South Carolina and Tennessee being battered by hurricanes Helene and Milton, strong growth throughout the rest of the South offset the disruption to job creation and economic growth. Employment data from the first two months of Q4 indicate a hiring surge in the District of Columbia, Louisiana, Mississippi and Oklahoma that likely boosted economic growth in those states and made up for more modest growth in states impacted by the hurricanes.

Our outlook for this year indicates that the South will continue to lead all other regions in real GDP, employment and consumer spending growth. The new administration’s energy policy is likely to benefit major energy-producing states like Louisiana, Texas and Oklahoma. We also expect that years of strong domestic in-migration to Texas, North Carolina, South Carolina, Georgia, Florida and Tennessee that saw young professionals move to large metro areas and retirees to suburbs and exurbs will help support strong consumer spending growth and a robust tax base to support infrastructure improvements. Additionally, federal grants from the CHIPS Act to support new infrastructure investment in the Port of Savannah and Brunswick in Georgia will also likely bolster construction hiring in the near term and provide long-term support to the region’s burgeoning logistics sector.

While the growth landscape for the South remains very positive, some challenges have emerged that pose downside risk to our current outlook for the region in 2025. Borrowing costs are expected to remain high well into 2025, which could hinder investment and hiring in the manufacturing, real estate and residential construction sectors. Steel and aluminum tariffs are also likely to disproportionately raise costs on producers and consumers in Louisiana, Alabama, Georgia, Mississippi, Kentucky, West Virginia and Maryland. Finally, the new administration’s immigration policy is likely to constrain hiring and economic growth in Texas, Florida, the District of Columbia and Virginia. Despite these headwinds, we still expect economic growth in the South to remain firmly above all other regions this year.

The Midwest continues to take a hit from low growth and uncertainty

The Midwest economy is set for another year of relatively sluggish growth in 2025. Persistent high interest rates, trade uncertainties, and workforce challenges will likely weigh on the region, with manufacturing-heavy states feeling the greatest impact. Illinois, Michigan, Indiana, and Ohio—key manufacturing hubs—face rising borrowing costs that dampen capital investment and hiring. Additionally, elevated auto loan rates will weaken demand, particularly hurting Michigan and Ohio, where the auto industry is a pillar of positive economic activity. Steel and aluminum tariffs are set to raise input costs on the auto industry, putting further pressure on profit margins among Midwest-based automakers. With automakers and consumers cost constrained, there is a real risk of slower hiring along with more layoffs, which would lead to slow retail and service-sector growth in the region.

While our forecasts do indicate that the Midwest will continue to trail all other regions in economic growth and job creation, there are some upside risks to our outlook. The healthcare sector is set to see steady expansion as the population ages, which will support job creation in healthcare-driven economies like Minnesota and Ohio. Additionally, investments in EV production and renewable energy in Minnesota and Missouri offer long-term potential. Finally, logistics and e-commerce are likely to strengthen Illinois and Missouri. Overall, the Midwest faces a year of slow and uneven growth. The region’s trajectory will largely depend on federal policy decisions and their impact on inflation, trade, and investment.

High borrowing costs set to weigh on economic growth in the West this year

Economic and job growth in the West outpaced the nation in Q3-2024, and our forecasts indicate that this trend continued into the final quarter of 2024. While we expect that most states in the West saw strong growth in Q4-2024, our hiring, economic and consumer spending growth estimates were negatively impacted by job losses in Nevada and the Boeing mechanics’ strike in Washington.

In the year ahead, we expect economic and job growth to slow as high borrowing costs continue to weigh on growth in the tech, construction, and real estate sectors. While we do not expect more large-scale layoffs at tech firms this year, we do think the rebound in tech hiring will be delayed until further interest rate cuts. The impact of slower tech hiring will primarily limit growth in California, Washington, Colorado, Utah and Oregon. Other victims of the high-rate environment have been the construction and real estate sectors, which are major drivers of economic and spending growth in the region. Housing starts in the West declined for the third consecutive year on a YoY basis in 2024. While existing home sales did increase on a YoY basis last year for the first time since 2021, total existing home sales in the region were down 40 percent compared to 2021. With rates set to stay elevated until the end of this year, we expect the West’s housing market to remain relatively muted in 2025, which will likely limit both economic and consumer spending growth in the year ahead.

While the West has little direct exposure to the newly enacted tariffs on steel and aluminum relative to other regions, the new administration’s stricter stance on immigration is likely to have a significant impact. This is particularly true for California, which is also dealing with the aftermath of several major fires that decimated parts of Los Angeles in January. A slow recovery effort following the fire and lower levels of international migration would be an impediment to growth in California, which given its size, would significantly impact growth in the West.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.