Economic outlook and forecasts Slower job growth set to weigh on the West and Midwest

Several states are set to lose jobs by the end of 2025

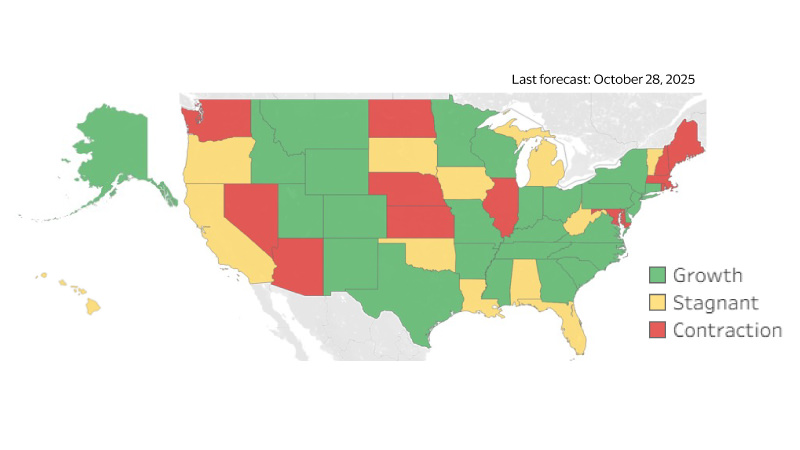

Projected employment change by state H1-2025 to H2-2025

The states that are likely to have roughly the same or fewer jobs compared to June tend to be states that are more susceptible to the negative impacts of trade restrictions, lower immigration, growing retirements, federal government layoffs, and slower in-bound travel from abroad. These states are overrepresented in the West and Midwest, which our forecasts indicate will lag the Northeast and South in terms of employment growth over the final two quarters of 2025. As a result of slower projected job creation, we expect consumer spending and real gross domestic product (GDP) growth in the West and Midwest to lag behind the Northeast and South in the second half of 2025.

Looking ahead to 2026, we expect that the impacts of restrictions on trade and immigration will continue to have an outsized impact on job growth in the West and Midwest. Since these policies are expected to continue, both regions will likely lag the South and Northeast in job, consumer spending and economic growth throughout next year as well.

Major projects are set to propel growth in the Northeast

The Northeast outpaced U.S. GDP growth for the second consecutive quarter on a year-over-year basis (YoY) in Q2. This is despite slower employment growth than the nation overall. While employment growth likely lagged the nation in Q3 as well, our forecasts indicate that the Northeast will outpace the national average in employment growth, consumer spending, and GDP growth in the final quarter of this year through the end of 2027. Much of the region’s anticipated job growth is fueled by significant investment projects. In Massachusetts, the $1 billion Kendall Square expansion in Cambridge is attracting global biotech firms and fostering hundreds of new jobs and likely stronger output from the biotech sectors.¹ Additionally, the state’s GDP and job growth is set to benefit from Harvard’s $1.2 billion Allston campus expansion that is slated to create an innovation hub for education, technology, and entrepreneurship.² Massachusetts will likely also continue to see rising consumer activity, supported by the Seaport District’s ongoing expansion.

The New York/New Jersey “Gateway Program,” a $30 billion rail infrastructure initiative, is under construction and expected to create 72,000 direct jobs while enhancing mobility across the region.³ New York City’s “Penn District” redevelopment project will add retail, dining, and entertainment venues, which is expected to drive increased disposable income and spending.⁴ Meanwhile, New Jersey is set to benefit from the $10 billion Port Authority “PATH Extension,” which will likely enhance regional commerce and support continued GDP growth.⁵

Outside major projects in the Northeast, we also anticipate a significant boost to consumer spending in the first half of 2026 due to the SALT deduction cap being raised. Of the top 5 states expected to benefit most from this change to the tax code, four are in the Northeast (New York, New Jersey, Massachusetts and Connecticut). While the impact is likely to be short-lived, the boost in spending will likely propel the region to outpace all others in consumer spending in the first half of 2026.

Despite the relatively bright outlook, labor shortages in construction, healthcare, and technology threaten to slow completion of key projects. The aging population of the region will likely exacerbate this shortage, especially with a more restrictive immigration policy expected to limit labor supply next year. The lack of labor force growth is expected to hit Maine, Pennsylvania, and New Hampshire especially hard, and will likely limit growth in these states.

The South surges forward in a volatile economy

Southern strength has been a defining feature in recent years, driven by domestic in-migration, a relatively lower cost of living, and strong job growth. While these dynamics are beginning to normalize, we still expect the region to outpace the rest of the country for the rest of 2025 and through 2026.

Economic growth has likely slowed in the South amid heightened uncertainty stemming from tariffs and trade tensions, though the impact has been less severe compared to other regions. Manufacturing has been hardest hit, with states such as Mississippi, Kentucky, and Arkansas continuing to experience job losses.

Retirees and millennials continue to drive population growth in the South, attracted by affordability, favorable climate, and lower tax burdens. States such as Texas and Florida exemplify this trend, having invested heavily in modern senior living communities in recent years. At the same time, robust job markets combined with relatively affordable housing have incentivized younger workers to relocate. As baby boomers draw down accumulated wealth and millennials increase spending from new employment opportunities, spending activity in Southern metros—already among the nation’s leaders—is poised to accelerate. We expect this demographic and economic divide between the South and other regions to widen further over the coming years.

While retirees will boost demand for leisure and hospitality, employers in these industries will face increasing challenges due to slowing immigration. Historically, immigrant labor has been essential to supporting these sectors. Weaker immigration flows will likely create upward pressure on wages and constrain business growth, particularly in states like Florida, where tourism and retirement services play a central role in the economy.

The greatest downside risk is concentrated in Washington, D.C., Maryland, and Virginia, given their reliance on federal employment. Significant workforce reductions and funding cuts have already dampened growth and spending in the region, and we expect continued weakness through 2026 until structural adjustments are complete.

Despite these sectoral challenges, we continue to forecast the South as one of the strongest regions in the country. While GDP growth will decelerate modestly due to economic uncertainty, the South is expected to outperform the national average. Expansion will remain concentrated in high-growth states such as Texas and Florida, though federal retrenchment will pose localized risks.

The Midwest continues to lag all other regions

The Midwest economy continued to lag the nation and all other regions in Q2-2025 on a year-over-year basis. While there are bright spots in healthcare and semiconductor investments, manufacturing and agriculture—which feature heavily in the region—are facing persistent headwinds from high interest rates and trade disruptions. The region’s growth is expected to continue slowing through the end of this year and into 2026. In fact, the Midwest is the only U.S. region forecast to see slower economic growth next year, which will further widen the growth gap between the Midwest and other regions.

Minnesota is a regional standout, propelled by the strongest healthcare employment growth in the Midwest over the past year. Despite downward revisions to healthcare employment, major expansions in medical services and semiconductors are underway. For example, a $5 billion redevelopment and expansion project recently broke ground at a major medical campus in Rochester.⁶ Additionally, CHIPS Act funding is enabling several key manufacturers to expand semiconductor production in the state.⁷ These investments will support above-average wage growth, which in turn will fuel above-average consumer spending growth.

Indiana is also poised to outperform, thanks to strong logistics and ongoing EV and other battery investments that are supported by a low-tax, low-cost-of-living environment. Nonetheless, its manufacturing sector remains vulnerable to trade disruptions and high interest rates, and lower average wages will limit spending growth.

Iowa and Michigan are among the region’s slowest-growing states. Iowa’s economy is weighed down by weak crop prices, elevated production costs, and a struggling manufacturing base tied to agriculture. Michigan’s auto sector faces rising costs from tariffs on metals and imported parts, leading to cautious hiring and subdued consumer spending. Wisconsin and Ohio show modest growth, but both remain exposed to trade volatility and demographic stagnation.

The Midwest will continue to underperform the nation in economic growth due to its higher exposure to agriculture and manufacturing, both of which are facing significant headwinds. Demographic stagnation will also remain a persistent obstacle, and with slower foreign immigration across the country, the Midwest will face even greater challenges in growing and sustaining its labor force.

The West’s economy shifts from growth leader to follower

The West’s economy continues to downshift from its former perch as a growth leader. The region grew slightly faster than the U.S. in Q2-2025, but growth is expected to decelerate, and the West is poised to underperform the nation over the next two years.

California remains under pressure. Tech employment is still shrinking, with hiring subdued as firms navigate high borrowing costs, AI-driven restructuring, and ongoing trade and immigration uncertainty. Payrolls in California’s entertainment industry have yet to recover from the 2023 writers’ and actors’ strikes, as the sector contends with high interest rates and competition from lower-cost states. State officials have raised the cap on film and television incentives from $350 million to $750 million, offering long-term upside.⁸ While capital-intensive growth from technology and AI will keep economic growth near the U.S. average, payrolls will lag as firms generate more with fewer workers and high costs continue to drive out-migration.

Other tech states are also feeling the strain. Higher financing costs are leading Washington’s tech firms to cut payrolls, while trade tensions challenge the state’s global cloud service leaders. Manufacturing faces headwinds from tariffs, and aerospace is constrained by workforce shortages and rising input costs.

Oregon, despite being a semiconductor hub, has struggled to capitalize on surging chip demand due to land constraints. As semiconductor investment shifts to other states, Oregon loses one of its highest-paying industries, weighing on consumer sectors and tax revenues.

Idaho, Arizona and Utah are regional standouts. Idaho’s tech and advanced manufacturing industries continue to benefit from major investments, such as a $15 billion semiconductor facility under construction and another $30 billion project planned.⁹ Arizona is experiencing its own semiconductor boom, with hundreds of billions in investment from the CHIPS Act and other private investment from major producers.¹⁰ Utah’s tech sector has also outperformed thanks to lower costs.

Tourism-dependent states like Nevada and Hawaii are underperforming as visitation softens. Agriculture and energy states—Montana, Wyoming, Alaska, and New Mexico—face weak commodity prices and trade tensions, with slow or negative population growth limiting prospects.

The region’s long-term strengths remain its capacity for innovation and a dynamic workforce, but structural challenges will limit broader growth.

Footnotes

- Visa Business and Economic Insights and Boston Realty Advisors, Kendall Square’s Billion Dollar Redevelopment Underway, May 18, 2025

- Visa Business and Economic Insights and Boston Business Journal, Harvard unveils massive Allston expansion with conference center, hotel, and life sciences hub, October 17, 2025

- Visa Business and Economic Insights and Amtrak

- Visa Business and Economic Insights and Vornado Realty

- Visa Business and Economic Insights and New Jersey Port Authority

- Visa Business and Economic Insights and Rochester KROC, Major Demolition Work Begins This Month For $5B Mayo Expansion, February 5, 2025

- Visa Business and Economic Insights and Minnesota Governor’s Office, Governor Walz Announces Historic Investment in Minnesota Semiconductor Manufacturing, May 13, 2024

- Visa Business and Economic Insights and California Governor’s Office, Governor Newsom announces tax credit awards for new job-creating films shooting in California and generating $1.4 billion for the state’s economy, October 21, 2025

- Visa Business and Economic Insights and MSN.com, Micron announces plans for a second memory-manufacturing plant in Boise, June 12, 2025

- Visa Business and Economic Insights and Reuters, Trump and TSMC announce $100 billion plan to build five new US factories, March 4, 2025

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.