Resilience varies across LAC amid trade and immigration uncertainty

July 2025 – We have revised our GDP growth forecast for Latin America and the Caribbean (LAC) to 2.0 percent, up from 1.8 percent earlier this year, mainly due to an improved outlook for Brazil and Argentina. However, we acknowledge that the global policy environment remains volatile and fast-moving, characterized by intermittent protectionist actions and selective trade retaliation between the U.S. and the rest of the world. Six months into this backdrop, uncertainty remains elevated.

The effects on LAC have been uneven, reflecting varying degrees of exposure to complex U.S. trade and immigration dynamics. Mexico and Central America face the most direct exposure, while South America is more likely to experience milder, indirect effects. For the latter, we think the main transmission channels are the evolution of external demand, commodity prices, exchange rates, and consumer and producer confidence.

So far, the economic impact is more evident in the soft data—such as business and consumer confidence—than in hard indicators. Interestingly, some Q1 data from Mexico and Central America exceeded expectations, likely due to preemptive purchases and remittances ahead of U.S. policy implementation. Meanwhile, LAC’s labor markets remain relatively resilient, and low inflation is supporting real wage gains, which may help cushion the adverse effects on household consumption.

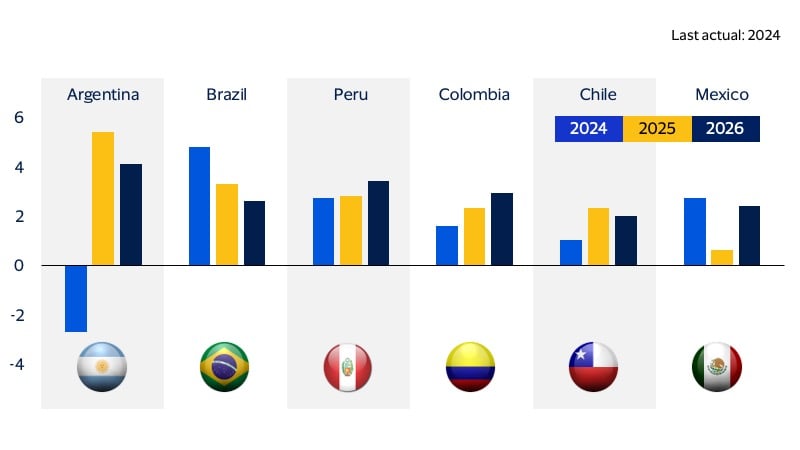

Household consumption

(Annual change,* percent)

Rebound in the Mexican economy may prove transitory

Lingering tariffs and protectionist threats, combined with the current state of employment and sentiment, suggest the conditions for a sustainable recovery are not yet in place.

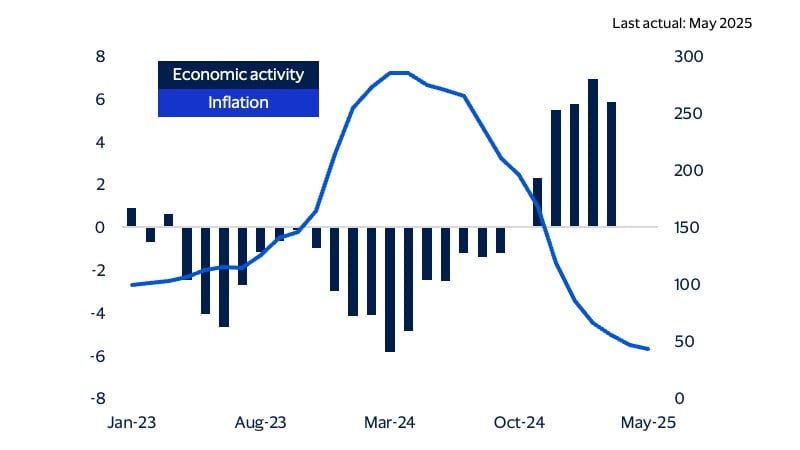

Among the region’s economies, Mexico remains the most exposed to the current complex global trade panorama and its surrounding uncertainty. Surprisingly, the across-the-board deceleration that lasted more than a year paused in the first quarter of 2025.

The service and industrial sectors led the uptick in Q1 GDP, with manufacturing showing a modest rebound. This recovery could be short-lived, though. The largest contributor to manufacturers, transport equipment, remains weak according to data through April. Manufacturing order indicators for May are not encouraging, while inventories appear to be building up.

Further evidence of a short-lived recovery is the decline in capital goods imports such as machinery, which is typically destined for industrial production. These imports have dropped continuously since last spring, suggesting a sustained industrial acceleration is unlikely.

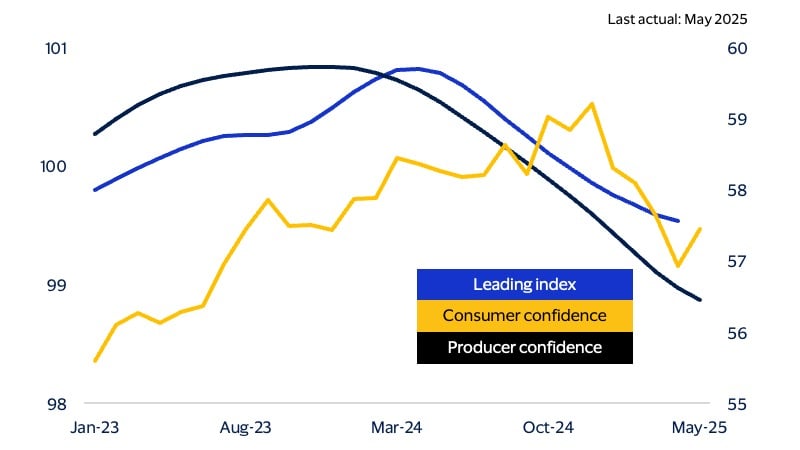

Along the same lines, overall leading indicators suggest the economy will continue to weaken over the coming months, driven by a deterioration in the investment climate, employment, and financial conditions.

Zooming in on consumption and its drivers, first quarter data show a notable uptick in private goods consumption. Retail sales indicate the rebound was primarily concentrated in food and beverages. Growth was strongest in supermarkets, albeit at modest rates, while department store sales—more sensitive to shifts in discretionary budgets—have remained flat since last summer.

Consumer indicators point to a possible further softening in spending. As of May, the job market had cooled, with annual growth in temporary contracts declining and creation of permanent positions moderating. Likewise, consumer sentiment and expectations for the next 12 months have fallen continuously since last fall. In the case of remittances, this substantial source of disposable income for low-income households is still growing in Mexican pesos. However, the volume of remittances as measured in U.S. dollars has declined, sketching a meaningful annual contraction in April. This suggests that currency shifts—as opposed to strong household financial conditions for relatives living overseas—may be behind the trend.

We anticipate a more robust economic recovery toward year-end, supported by a rebound in U.S. economic activity, the delayed impact of lower interest rates, and a likely reduction in uncertainty.

Forward-looking data point to a downturn

(Annual change, percent)

Brazil's economic cooldown may soon resume

Brazil’s growth gets a farm-fueled boost, yet domestic and consumer challenges remain.

Although Brazil’s direct exposure to current global trade tensions is relatively limited, rising uncertainty is dampening consumer and producer sentiment, while the economic slowdowns of its main trading partners (China, the U.S., and Europe) could curb trade and investment. However, Brazil’s main economic challenge is homegrown.

In H2-2024, the country’s economy weakened in the face of higher central bank interest rates, slower government spending, and lower international commodity prices that partially reflected expectations of weaker global economic growth. However, an extraordinary—albeit temporary—performance by the agricultural sector has boosted economic growth in 2025, prompting our upgrade to the real GDP growth forecast for the year.

Consumption, which makes up over 60 percent of GDP, resumed its moderation early in Q2. April’s retail sales showed an across-the-board slowdown, consistent with declining consumer confidence since last year. Nevertheless, data on consumption goods imports for May showed a rebound in nondurable and durable goods, indicating the activity inflection point may not be smooth.

We assume traditional drivers of consumption are congruent with moderation coming from higher financing costs, slower job creation, and weakened consumer sentiment. Regarding the former, there is strong consensus among local analysts that the central bank has already concluded its cycle of benchmark interest rate hikes. However, the lagged effects of tight monetary policy will continue to be felt throughout the rest of the year.

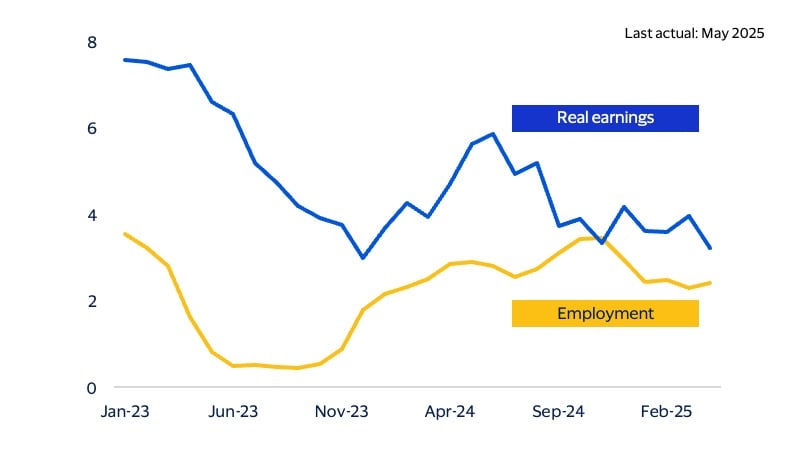

In contrast, a strong Brazilian real against the U.S. dollar, low unemployment, and stable real earnings have likely helped partially offset spending headwinds. An expected decline in policy interest rates may further support these factors next year.

Brazil’s labor market remains resilient

(Annual change, percent)

CarCam to be hit by slower remittances and tourism

Tighter U.S. trade and immigration policies are likely to impact Central America and the Caribbean indirectly through remittances and tourism.

As of April, Central America and the Caribbean continued to report economic growth, supported by low inflation and resilient labor markets that are helping sustain private consumption. Looking ahead, the subregion is particularly vulnerable to direct and indirect effects from new U.S. trade and immigration policies.

Remittances are a major source of income—representing 24 percent of GDP in El Salvador, 19 percent in Guatemala, and 9 percent in the Dominican Republic. Employment and income trends among Hispanic workers in the U.S. are a key driver of local consumption.

Recent data shows that remittance flows—mainly from the U.S.—remain strong, with a noticeable acceleration since early 2025. This rebound may be temporary, possibly driven by uncertainty around U.S. immigration policy. If that’s the case, the increase could be short-lived.

At the time of writing, the U.S. administration has proposed a 3.5 percent tax on remittances sent abroad by non-citizens. If approved by the Senate and signed into law, this could further reduce remittance flows—especially when combined with a weak U.S. dollar, which already reduces the value of transfers in local currencies. Such a measure could deliver a one-time shock to household income, particularly in El Salvador, Guatemala, and the Dominican Republic.

Remittances are not the only indirect channel through which global uncertainty could affect the subregion. In Panama, a recovery in shipping and global trade via the canal has continued through the first quarter, with close to 20 and 40 percent year-over-year growth in ship traffic and real revenues, respectively. These gains have plateaued, though, and a slowdown may be on the horizon: The World Trade Organization recently downgraded its 2025 global trade forecast from 2.7 percent growth to a 0.2 percent decline. That said, the canal’s performance may still benefit from a low annual comparison base due to drought-related disruptions in early 2024.

For the Dominican Republic and Costa Rica—the region’s top tourist destinations—tourism prospects are crucial. A weaker U.S. dollar could discourage American travelers, who make up a large share of visitors. On the other hand, an above-seasonal influx of travelers seeking alternatives to popular North American destinations could potentially serve as an offsetting factor.

Andean subregion to exhibit limited external vulnerability

Modest recovery in payrolls and low inflation are levering consumption resilience. Direct exposure to U.S. protectionist measures appears limited, while indirect effects may be the main reason to expect economic deceleration in 2025 and modest recovery in 2026.

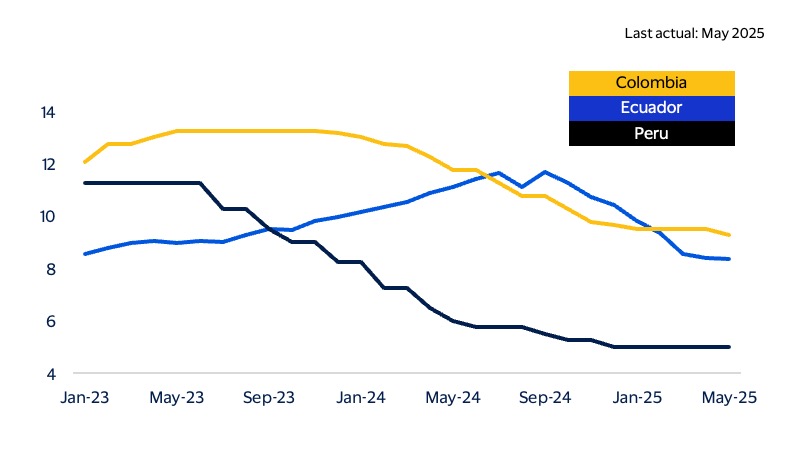

Andean economies appear relatively insulated from the current climate of high uncertainty and trade protectionism, due to their limited trade exposure to the U.S. However, indirect effects—likely moderate—should be considered one of the main factors behind our expectation of slower economic growth in 2025. Overall, we see resilient labor markets and low interest rates as key strengths this year, while weaker external demand and falling commodity prices may pose the main headwinds.

Colombia and Peru continue to show strong economic growth, driven by household consumption supported by solid labor markets and recovering real earnings. Looking ahead, we expect consumer spending to moderate from solid prints in Q1, due to sluggish progress on inflation, which may limit further gains in purchasing power.

High-frequency data suggest Ecuador may be emerging from its 2024 recession. The recovery in employment during the first quarter, along with rising real earnings, points to a gradual rebound in consumer spending. Low inflation appears to be one of the main drivers of this recovery. A rebound in consumer goods imports provides early evidence of a recovery.

The Andean region is not immune to global trade protectionism. While these economies are not major targets of U.S. tariffs, they remain vulnerable through channels like slowing global demand and softer commodity prices. The subregion is especially exposed to shifts in global prices for mineral fuels, precious metals, and grains.

According to World Bank forecasts, prices for energy, grains, and industrial metals are expected to fall by 17 percent, 11 percent, and 9 percent respectively in 2025 (in nominal U.S. dollars), with smaller declines projected for 2026. This outlook adds to the case for moderate economic deceleration in 2025 driven by weaker export performance.

In the coming quarters, monetary policy may help offset some of the expected slowdown. The lagged effects of interest rate cuts implemented in late 2023 are likely already supporting activity. In addition, there is strong consensus around further rate cuts, with a reduction of about 50 basis points expected in Peru and 100 basis points in Colombia.

Finally, an expected 33 percent increase in precious metal prices in 2025 could provide an additional boost to the region’s economic outlook.

Tamer inflation in the Andean region creates room for further drops in interest rates

(Central bank policy interest rates. Lending rate for Ecuador, percent)

Southern Cone economies may be bright spots

A year of economic recovery in Argentina is expected to contrast with modest slowdowns in Chile and Uruguay, driven by lower commodity prices and tight monetary policy.

The economies of the Southern Cone, particularly Argentina, Chile, and Uruguay, stand out as some of the most promising stories in Latin America this year. Their relatively low exposure to trade protectionism and resilient domestic demand support this positive outlook. However, indirect headwinds such as falling international prices for industrial minerals, grains, and protein, along with a weak U.S. dollar, could weigh on regional growth.

Argentina is experiencing a strong economic rebound, with GDP expected to post solid growth in 2025. Several factors are driving this recovery, including a rebound in consumption, increased capital investment, a revitalized agricultural sector, and a favorable comparison base from last year. Additionally, leading indicators point to increasing momentum.

The rebound in Argentine household spending is supported by a moderate jobs recovery and a sharp improvement in purchasing power, thanks to falling inflation. This is also occurring in the context of rising consumer confidence. Argentina’s outlook will depend on the continuation of structural reforms, effective inflation management, and the outcome of the October 2025 midterm elections.

The resilience of Chile’s economy stems from a recovery in retail sales of both durable and nondurable goods, increased government spending, and strong exports of goods and services. While job creation appears to have plateaued, real earnings continue to rise, even as inflation trends gradually upward—mainly due to the temporary impact of lifting electricity price freezes. On this front, the central bank has acknowledged the need for caution. However, it still expects inflation to return to the target range of 2–4 percent. There is also strong consensus around further cuts to the policy interest rate before the end of the year, which could support consumer spending. Politically, the country is facing rising polarization ahead of the November 2025 presidential election.

Uruguay continues to show macroeconomic strength, with growth momentum putting upward pressure on consumer prices. Although inflation remains within the 3–6 percent target range, the central bank is maintaining a restrictive monetary stance. These inflationary pressures and high short-term inflation expectations are likely to justify maintaining the policy rate on hold for most of the year. As a result of elevated inflation, we expect consumer spending to moderate—mainly due to the delayed effects of tight monetary policy rather than any significant weakening in the labor market, which has remained resilient so far.

Argentina showing remarkable recovery

(Annual change, percent)

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.