Regional spending and debt growth reveal economic opportunities

April 2024 – Following a strong end to 2023, our forecasts indicate that all regions of the U.S. likely continued to experience economic and job growth in Q1-2024. Income growth has consistently outpaced the inflation rate since last May, insulating consumer demand. Robust spending generated more revenue for businesses, which in turn allowed them to continue adding jobs and increasing investment despite persistently high interest rates. While we still anticipate high rates to limit investment and consumer spending growth in the first half of this year, hiring and demand in Q1 exceeded expectations and prompted upward revisions to our 2024 forecasts for each region.

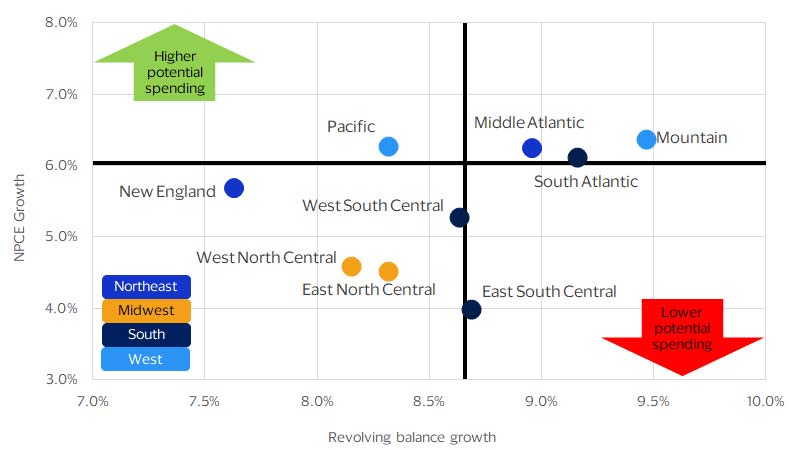

We can glean insights into areas with higher potential spending by looking at last year’s regional variations in consumer spending growth and how consumers financed that spending. Some areas, such as the Mountain, South Atlantic and Middle Atlantic census divisions, had high spending growth, but grew by revolving their debt at a high rate (see figure below). These areas could be at a higher risk for slower consumer spending growth, as many consumers may have overextended their credit lines to increase their spending last year. On the other hand, strong spending growth in the Pacific and New England census divisions was not funded as much by revolving debt, which indicates that consumers in these areas could have a higher share of their credit lines to tap for higher spending. Areas with lower spending and debt growth could be seen as more conservative with their spending (East and West North Central), while areas with high debt growth but low spending growth could be at the greatest risk for reduced spending as they likely needed to tap credit lines to keep up with bills (East South Central).

Areas with lower balance growth in 2023 have upside spending potential in 2024

All revolving balance growth v. nominal personal consumption expenditures growth (YoY percent change)

Rate cuts hold the keys to unlocking stronger growth in the Northeast

High interest rates disproportionately affected two of the Northeast’s major employment sectors, financial services and tech, setting its economic growth for 2023 behind all other regions and the national average. Consumer spending in the Northeast, however, outpaced all regions except the South. An estimated 66.3 million people visited the Big Apple last year, just 300,000 shy of New York City’s pre-pandemic peak, according to data from New York City Tourism + Conventions. We expect stronger economic and job growth in Q1-2024, thanks to tourism continuing to boost consumer spending, a robust healthcare sector that has continued to add jobs, and a financial services sector that has posted strong job and wage gains in the first two months of 2024.

Despite these improvements, the challenging interest rate environment will likely cause the Northeast’s economic growth to underperform all regions except the Midwest in H1-2024. High interest rates have impeded revenues and investment for firms in the regionally significant financial services and tech sectors. Rate cuts that we expect to start in June should alleviate some of the stress these firms are under and unlock stronger investment and hiring in New York, Connecticut and Massachusetts in the second half of 2024. While tech and financial services will suffer in the short-term, other sectors should pick up the slack. New York, Vermont and New Hampshire are expected to receive increased domestic investment in semiconductor manufacturing thanks to funding from the CHIPS Act. Vermont will benefit greatly from a Department of Defense contract with a major employer in the state set to begin this year, while arms manufacturers in New Hampshire are expected to be a major supplier for NATO partners who are committed to meeting spending targets.¹ Finally, New Jersey’s significant healthcare sector is poised to continue to add jobs and drive investment as the U.S. population ages. While the Northeast is likely off to a slow start, we expect positive year-over-year economic growth in the region in 2024.

The South: Building for tomorrow

The South led all other regions in economic, consumption and employment growth in 2023 thanks to strong wage growth, strong net in-migration and favorable business conditions in many of its largest states. Our analysis indicates that the region maintained the lead in these areas during Q1-2024 as well. The South has benefited greatly from the federal government’s recent focus on building up domestic manufacturing capacity, with the region’s manufacturing construction rising 50.1 percent on a year-over-year (YoY) basis in the first two months of Q1-2024. The budding electronic vehicle (EV) market is a key driver in this manufacturing investment surge, with North Carolina, South Carolina, Tennessee and Georgia all being major destinations for new EV plants.

The South’s manufacturing boom is a major factor informing our expectation that the region will again lead the nation in economic growth in 2024. While the ramp-up in EV production is an important factor in the manufacturing boom, it is only one part of the story. Texas has drawn over $50 billion in investment for semiconductor plants, while North Carolina has recently seen new investment in its already nation-leading pharmaceutical manufacturing sector. Outside of manufacturing, major investments and job growth in the healthcare and financial services sectors have also benefited the South, particularly in Florida, Texas and Georgia. Texas’s share of employment engaged in financial services is now double the national average as the state’s economy continues to diversify. We expect robust growth in the South’s manufacturing, healthcare and financial services sectors—along with an expected boost in state and local government spending this year—to mitigate recent weakness in the transportation and warehousing sector, which has had an outsized impact on Georgia, Tennessee and North Carolina. Additionally, record oil output will likely help to offset the impact of lower fuel prices on energy-producing states like Texas, Oklahoma and Louisiana. Robust investment and labor force growth are expected to continue for much of the South, which we see as a major catalyst for the region to outpace all others in economic growth in 2024 and 2025.

Unfavorable demographic trends holding back the Midwest

The auto sector continues to be a bright spot for the Midwest. Significant wage gains were secured following the end of the auto worker’s strike, providing a basis for consumer demand. Vehicle sales have also been resilient, despite higher interest rates on car loans. While EV demand has recently stalled, EV investment in the region is marching forward. For example, construction on a new multibillion-dollar battery facility outside Columbus, Ohio is expected to be completed by the end of this year. These and other investments will create thousands of manufacturing jobs in the region and throughout upstream and downstream industries.

Unfortunately, demographic factors in Ohio and Illinois are constraining growth. Both states are experiencing population declines, but for different reasons. In Ohio, healthy net migration is being offset by an aging population and the highest death rate in the region. In contrast, Illinois’s population decline is primarily due to prime-age workers leaving the state. As the two largest economic engines of the Midwest, labor force woes in these states will hinder regional GDP growth at a time when high interest rates and persistent inflation are already presenting headwinds.

While Illinois and Ohio find their footing, other states like Indiana are emerging as important contributors. Population growth in the Hoosier State has outpaced the rest of the Midwest, thanks to a strong labor market and low cost of living. Still, robust growth in the region will hinge on key states addressing the issues driving residents away. Additionally, strong supply dynamics and increased foreign competition will drive row crop prices lower in 2024, hurting agricultural incomes in Nebraska, South Dakota, Iowa, Missouri and Kansas. The one-two punch of lackluster growth in key states and pressured agricultural incomes will pose barriers to economic growth in the region.

Western growth states outperforming coastal juggernauts

The outlook for the West is a tale of two trends. While overall growth is expected to slow in 2024, the economic headwinds facing the region will affect some states more adversely than others. Tech layoffs have been more pronounced in California, Oregon and Washington, and while the worst is over for the tech sector as it adjusts to higher interest rates, new tech hubs in lower-cost states are increasingly siphoning away firms, workers and investment. Soaring housing costs are driving this coastal outmigration due to a combination of high interest rates, the mortgage “lock-in” effect and existing housing shortages, particularly in California.

Utah and Nevada have been the biggest beneficiaries of the coastal exodus, as they offer a lower cost of living, plenty of amenities and a diverse base of economic activity. Accordingly, these states will drive regional growth in the near term, while the biggest slowdowns will be in high-cost states where housing constraints will limit payroll growth. Despite these disparate trends and an overall frozen housing market, home prices are either rising or anchored in many markets throughout the region. Mortgage rates fell below 7 percent at the start of the year and unleashed some pent-up demand from buyers. In Utah and Nevada, it is not housing shortages driving price growth, but rather strong demand. Nonetheless, housing markets are not expected to rebound until mortgage rates come down further.

While lower housing demand has negatively impacted the lumber industry in Oregon and demand for building material mining operations in Nevada, Colorado, Montana and Wyoming, these headwinds will eventually desist when inflation eases and interest rates come down. New home construction should provide a source of demand for building material suppliers as homebuyers, frustrated with the lack of inventory, are increasingly turning to builders for housing options.

Footnote

¹ U.S. Department of Defense

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.