Growth slows and regional economic divides deepen

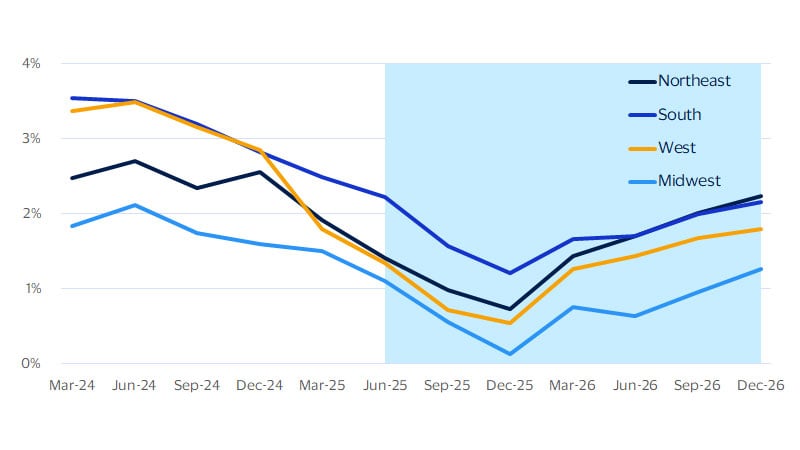

August 2025 – Economic growth slowed across all four U.S. regions in the first quarter of 2025. However, the effects of expansive and volatile tariffs, heightened uncertainty, and a gradually weakening labor market are not being felt evenly, and clear distinctions between regions are emerging. After several quarters competing with the South for the fastest‑growing economy, the West exhibited the sharpest slowdown among all regions. Growth in the South also eased, but more modestly, and the region is expected to widen its lead over the other three regions through year‑end, even as its growth slows. The Northeast likewise slowed and is projected to remain a distant second to the South in economic performance for the rest of the year. The Midwest continues to lag all other regions and is expected to see further deceleration in the months ahead. Labor market dynamics, consumer spending patterns, and sector-specific trends are increasingly shaping these regional divides.

The South’s outperformance is fueled by favorable domestic in‑migration and a relatively low cost of living, which are driving strong job growth. The Northeast benefits from wage gains, in‑migration of high‑income earners, and wealth effects from rising home prices, though hiring is slowing in certain states. The Midwest faces persistent manufacturing and agricultural headwinds, along with weaker purchasing power, despite pockets of strength in healthcare and semiconductor investment. In the West, tech job losses, weakening tourism, and tariff pressures in the region’s largest states are only partially offset by continued robust growth in growth states like Arizona and Utah. These diverging forces set the stage for an uneven second half of 2025, with growth increasingly concentrated in the South, while slower job growth, tariffs, and demographic headwinds weigh heavier on the other three regions.

Real gross domestic product (GDP) by region

SA, YoY percent change

Resilient but recalibrated: Northeast’s growth outlook aligns with nation

The Northeast’s GDP kicked off 2025 with economic, consumer spending and employment growth roughly on par with the U.S. overall on a YoY basis and surpassing all other regions except the South. Our forecasts indicate that this trend continued into the second quarter of 2025 due to robust job creation in the financial activities and healthcare sectors, which both have a disproportionate presence in the Northeast region. Looking ahead to the second half of 2025, the Northeast is poised to maintain its position as the region with the most robust employment and economic growth outside the South. This is in large part thanks to a stronger consumer spending outlook compared to other regions. Estimates from Bank of America Institute’s internal customer data indicate the Northeast is seeing greater gains from wage growth and positive net-migration of high-income consumers than any other region.¹

Additionally, the Northeast leads all other regions in home price appreciation, which is expected to help drive further spending via the wealth effect.² We also expect the significant decline in days worked from home in New York City to drive more retail spending and thus support more economic growth and job creation in the retail and service industry.³

While the outlook for the Northeast is expected to be relatively bright for the rest of 2025, we no longer expect the region to lead all others in economic growth this year. This is due both to a more positive outlook for growth prospects in the South, as well as a downgraded outlook for the Northeast. We expect that on a quarter-over-quarter (QoQ) basis, employment contracted in Q2 in both Connecticut and Maine, and that the pace of job creation slowed considerably in New York, New Jersey, and New Hampshire. This relatively more muted job creation rate has exposed the negative impact of declining tourism (particularly from Canada) and job losses among non-profits that relied on federal government funding following Department of Government Efficiency (DOGE) cuts. As a result of our expectation that both issues persist through 2025, we now expect economic growth in the Northeast to match that of the nation rather than lead the nation.

The Southern economy remains more robust than expected

As our forecasts predicted, the South once again outpaced all other regions in economic and employment growth in Q1-2025. Despite wide-ranging tariffs on imports that have caused a significant increase in economic uncertainty, our forecasts indicate that the South continued to lead the nation in economic, consumer spending and employment growth.

While tariffs imposed on imports are likely to hinder hiring and income in the South’s manufacturing sector through the second half of 2025, the lack of retaliatory tariffs on U.S. exports has contributed to our more optimistic outlook on growth in the South. Additionally, job creation in the retail and leisure and hospitality sectors has been far more robust than we had previously anticipated, outpacing all other regions. Similarly, job creation in the tech sector in the East South-Central census division (Alabama, Kentucky, Mississippi and Tennessee) outpaced all other census divisions except the Mountain census division in the West.

Looking ahead, we no longer expect a major decline in demand for exports, which sets up Alabama, North Carolina, Louisiana, Delaware and Kentucky for relatively stronger growth than previously expected through the rest of the year. Our forecasts also indicate that consumer spending will remain robust in Texas and Florida, driven mainly by strong job creation. Resilient consumer demand in these two powerhouse states is set to contribute significantly to economic growth and job creation through the rest of 2025.

While the South’s outlook for this year is bright, significant challenges lie ahead. Large cuts in the federal workforce are having a large negative impact on employment and consumer spending growth in Maryland and Washington, D.C., and to a lesser extent in Virginia. As a result of these layoffs and expected subsequent layoffs at private firms whose work relies heavily on government contracts, we expect both Washington, D.C. and Maryland to shed jobs through the second half of 2025. While we still expect the South to outpace all other regions, the federal layoffs present downside risks to our outlook.

Economic headwinds persist for Midwest despite isolated gains

The Midwest economy continued to trail the nation and all other regions in growth in Q1-2025 on a YoY basis. Core industries such as manufacturing and agriculture remain under pressure from high interest rates and trade disruptions, while inflation and more cautious consumer spending further weigh on activity. We expect the region to keep underperforming, with growth slowing through year-end. Manufacturing activity is softening, with sector employment flat or declining since April. In major manufacturing states such as Ohio, Illinois and Michigan, manufacturing employment remains below pre-pandemic levels. Trade disruptions have also hit exports: According to the U.S. International Trade Administration, manufacturing export values are down 10 percent in Michigan, 6 percent in Ohio, and 2 percent in Wisconsin—all top 10 manufacturing states.⁴

Agriculture faces similar headwinds. Tariffs on machinery and fertilizers have raised costs, while retaliatory tariffs from China have reduced exports of soybeans, pork and dairy. These challenges are especially severe in Iowa, Nebraska and Wisconsin, where agriculture is a cornerstone of the economy. Constant shifts in tariff policies add uncertainty, further undermining producer confidence and investment. Consumer spending is under strain as well. Midwest inflation, as measured by the consumer price index, reached 3 percent year-over-year in June, slightly above the national average. Tariffs have contributed to price pressures, but rising housing costs are also a factor. The region’s relative affordability has fueled demand and home price growth, yet inflation hits harder here due to historically slow income gains—eroding real purchasing power.

There are, however, pockets of strength. Healthcare employment continues to grow, and advanced chip manufacturing is emerging as a high-potential sector. Notably, a $3.8 billion semiconductor packaging facility is slated to open in 2028 near Purdue University in Indiana, with plans to employ 1,000 direct hires. Still, these bright spots are outweighed by broader challenges. High borrowing costs, persistent trade disruptions, and demographic stagnation are likely to hold the Midwest below the national average in economic, employment and consumer spending growth this year.

The West faces the sharpest slowdown in regional economic growth

In our previous regional outlook, we projected that the West’s economy would lag the nation in 2025 after outpacing national growth in 2024. Recent data confirm that forecast: The region grew 1.8 percent YoY in the first quarter of this year, down 1.1 percentage points from 2.9 percent growth in Q4-2024—the sharpest slowdown among all four regions. High costs, cooling consumer demand and rising trade tensions are expected to weigh on growth through year-end.

California, the region’s largest economy—and recently named the world’s fourth largest—remains a global innovation leader, but it faces slower job growth and higher costs.

The state’s tech sector continues to shed jobs as high borrowing and housing costs push workers and investment elsewhere. In the first half of 2025, California tech employment was down 2.3 percent (about 44,000 jobs) from the same period last year. In fact, the number of tech employees in the state has only grown about 5,000 above pre-pandemic levels, compared to Texas, where the number of tech employees has increased 270,000 from pre-pandemic levels. While other regional tech hubs like Washington and Utah are expanding, investment is increasingly taking place in rapidly growing hubs in the South. Tourism, another key growth driver, is weakening. Visit California projects annual visitation to decline in 2025—the first drop since the pandemic—driven largely by fewer international visitors.⁵ Nevada, heavily dependent on leisure and hospitality, is also feeling the slowdown, with Las Vegas visitation down year-over-year for six straight months since January, according to the Las Vegas Convention and Visitors Authority.⁶

Tariffs remain a major risk. The West is especially vulnerable due to its reliance on international trade and imported inputs from Asia. New tariffs on electronics, auto parts, and solar components are increasing manufacturing costs and eroding export competitiveness.

Still, domestic investment offers bright spots. Arizona is experiencing a surge in semiconductor manufacturing, with plans for three fabrication plants, two advanced packaging facilities, and a research and development center in Phoenix—totaling $165 billion investment.

High-growth states like Arizona, Utah and Idaho will maintain an advantage from ongoing investment and higher net domestic migration. However, tariffs and tighter immigration policies will likely restrain overall regional momentum. As a result, we expect the West’s economy to continue lagging the national average in 2025.

Footnotes

- Visa Business and Economic Insights and Bank of America Institute

- Visa Business and Economic Insights and Federal Housing Finance Agency

- Visa Business and Economic Insights and Survey of Working Arrangements and Attitudes

- Visa Business and Economic Insights and U.S. International Trade Administration

- Visa Business and Economic Insights and Visit California

- Visa Business and Economic Insights and Las Vegas Convention and Visitors Authority

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.