Four key themes for small businesses in 2023

May 2023 – Entrepreneurship has been booming over the past few years, but will it continue if a recession occurs in 2023? Small businesses faced many challenges in 2022, including supply chain disruptions, low inventory, a tight labor market and inflation at levels not seen in over four decades, but most small businesses managed to weather them well. However, we forecast a mild recession in the second and third quarters of 2023, presenting the potential for a host of new small business challenges—and opportunities.

In light of our economic forecast, we have identified four key themes for small business in 2023. They include:

- Changes in capital markets: High borrowing costs and tighter lending standards are significant barriers to entrepreneurs looking to finance their businesses.

- High labor costs: The tight labor market has led to an increase in wages for small businesses, impacting both their own payroll and that of their suppliers, which also increases their input costs.

- Profit margin compression: Job losses and slower wage growth in the second half of 2023 could lead to lower consumer demand, putting downward pressure on revenues and compressing small businesses’ profit margins.

- Goods-to-services spending shift: Since the economy has reopened, consumers have been slowly rebalancing between their goods and services spending, which is changing where the biggest growth opportunities are for small businesses.

The rise of entrepreneurship post-COVID

Small business formation has been running at a historically high rate since the middle of 2020, with business applications highly likely to have staff and payroll capabilities still far above the 2019 average.¹ In the immediate aftermath of the 2020 recession, when many lost their jobs and many more transitioned to work from home, some decided to start a new business. This was motivated in some cases by a desire to avoid a job search in a labor market with few openings, or to keep working from home rather than return to the office. However, with unemployment rates below 4 percent since the beginning of 2022 and job openings remaining very high, a lack of employment opportunities has not been a major driver for some time. Additionally, the proliferation of new opportunities to work from home either part or full time makes it unlikely that returning to the office is still a deterring factor.

One of the main factors leading to high employer business applications has been the greater adoption of e-commerce by consumers. E-commerce created many more opportunities for entrepreneurs, with the share of retail sales (excluding gas and autos) emanating from e-commerce businesses rising from a 16 percent average in 2018 and 2019 to 22 percent between 2021 and March 2023.

This was also reflected in the business application data, since the main driver of new applications has been non-store retailers (official name for e-commerce). Another important factor was that in some cases, store retailers had closed their businesses during the pandemic and were simply replacing those businesses that had already existed before when applying for a new business application. The increase in business creations was also influenced by the high number of business applications in sectors impacted most negatively by the pandemic lockdowns, such as hotel, travel, automotive, and event services sectors, that have since rebounded over the past year. Another factor was the run-up in home buying and construction from the latter half of 2020 to early 2022, leading to a jump in homeownership for millennials as well as an increase in home purchases from investors during a time of very low interest rates. As a result, the demand for home and local services businesses rose across the country, according to Yelp’s 2022 Business Openings Report.² However, despite these factors working in favor of new small business formations, we expect that new challenges in the credit and labor markets will lead to a decline in new employer business applications in the second half of 2023.

Changes in capital markets

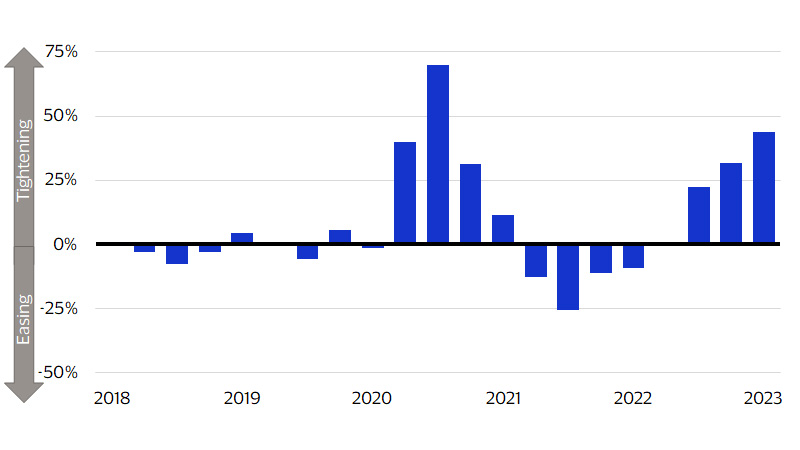

Recent changes in the credit market are significantly hindering small business formation. The most important change is the high cost of borrowing due to the rapid increase in interest rates by the Federal Reserve. To fight inflation, the Federal Reserve began to raise interest rates in 2022, and as a result, borrowing costs have increased. High borrowing costs will likely hamper entrepreneurs from getting the capital they need to start a small business, as interest rates across debt products have climbed rapidly over the past year. Another challenge for entrepreneurs is that lending standards have tightened significantly over the past year (Fig. 1). Recent volatility in the banking sector and the risk of a future slowdown in the economy have likely contributed to lenders taking a more cautious approach to giving out loans to prospective small business owners. This poses an additional barrier to entrepreneurs looking to finance a small business, since even if they can afford to borrow at elevated rates, they also need to meet higher standards from lenders.

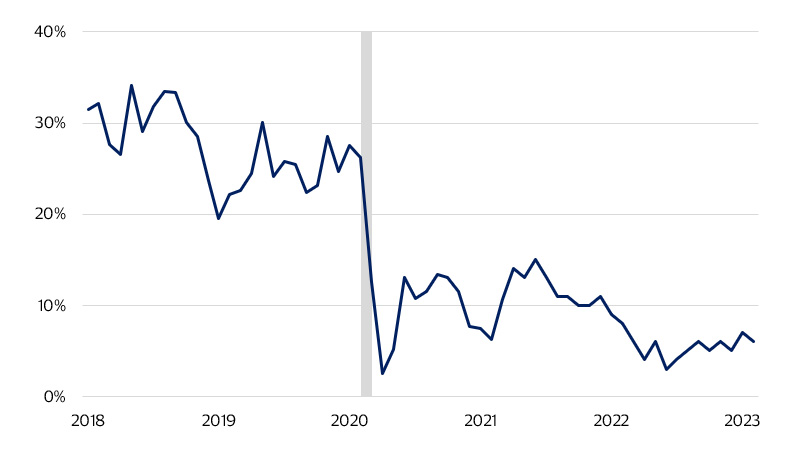

Existing small businesses are also facing significant pressure from higher capital and labor costs. These higher costs are greatly impacting small businesses’ ability to expand (Fig. 2). Reduced access to capital not only limits small business expansion opportunities but also their ability to meet current obligations to suppliers and employee payroll. Higher capital costs through most of 2023 will therefore contribute to higher costs for small businesses. We expect that small businesses in interest rate-sensitive sectors such as construction, real estate, finance, manufacturing and tech will be particularly hurt by high borrowing costs and tighter lending standards.

Tightening standards for small business loans (net percent)

Small business optimism: Firms saying now is a good time to expand business (percent)

High labor costs

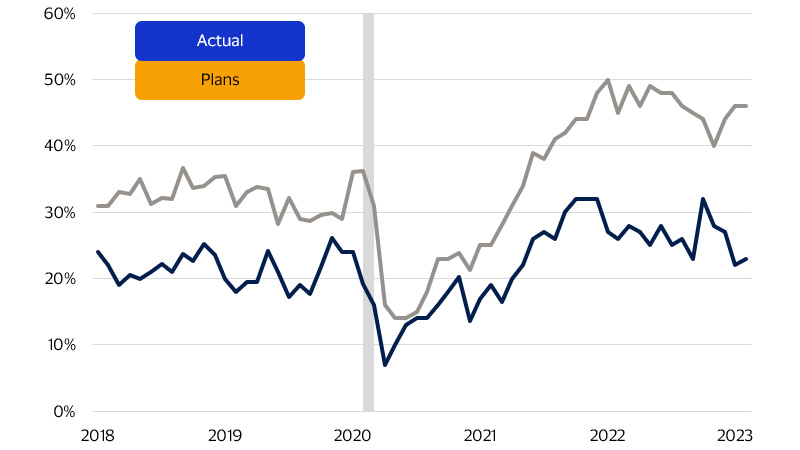

The tight labor market has led to a significant increase in wages, especially for lower and lower middle wage workers (Fig. 3). While we expect wage growth to moderate due to job losses from a mild recession in the second and third quarters of this year, the high cost of labor will keep many would-be entrepreneurs from starting their own small business. Labor costs have also become a major hindrance to existing small businesses. Most small businesses reported increasing worker compensation in 2022 and plan to continue doing so in the future (Fig. 4). This not only impacts small businesses directly when they have to pay more to their own employees, but also indirectly due to rising wages at the supplier level impacting their input cost. The high cost of labor is especially burdensome given that the increased costs of capital make it harder to access additional funds to pay workers more.

However, given our recession forecast, this will likely put some slack in the labor market and relief from the rising labor costs. The silver lining of the recent spate of announced layoffs and additional job losses likely at large tech and finance firms is that higher quality labor will be more available to small businesses. The influx of new highly skilled workers into the prospective job market could go a long way to helping existing small businesses fill roles they have struggled to fill previously. New small businesses would also have an easier time getting up and running. An increase in the amount of quality labor would be a major help to small business owners: they rate the lack of quality labor available as a pressing problem on par with their concerns about inflation.³

Wage growth tracker by wage level

(NSA, weighted, YoY percent change)

Actual and planned raise in employee compensation

(Net percent of firms)

Profit margin compression

High borrowing costs are already a major hindrance to small businesses, especially those that rely heavily on debt to finance day-to-day operations. We expect that this increased cost burden will persist through 2023 and thus compress profit margins. High labor costs are also likely to weigh on profitability as wages tend to be sticky. Thus, even if the recession brings down the rate of increase in labor costs, small businesses aren’t likely to get relief from the high wages. While we expect the short and mild recession to help small businesses by reducing the growth in labor costs, the job losses and slower wage growth in the second half of 2023 would lead to lower consumer demand. Additionally, we anticipate interest rates to remain high throughout 2023, which will cause consumers to be less inclined to borrow in order to maintain their current level of consumption. Small businesses are already experiencing a lack of consumer demand with the net percent of firms reporting higher real sales over the last three months being negative for every month since November of 2022.⁴ If consumer demand continues to decline, it will put downward pressure on revenues and further compress profit margins.

The decline in demand will not be equally burdensome to all small businesses as we expect that demand will almost certainly impact small businesses selling discretionary goods and/or services to be more strongly impacted. We also expect that the trend of consumers switching back from goods spending to services spending will benefit service oriented small businesses. This will mean more margin compression for goods oriented small businesses than service oriented small businesses. While all small businesses will be dealing with high services inflation, the drop in consumer demand for small businesses selling goods will likely be higher, with less revenue to offset the high cost of services.

Goods-to-services spending shift

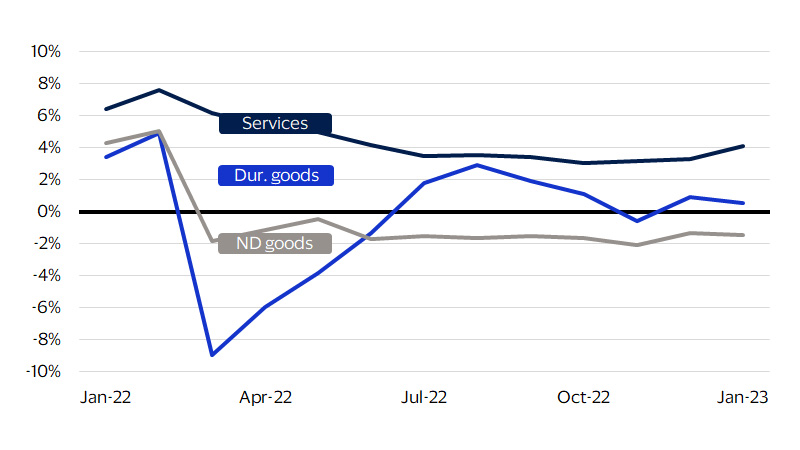

During the pandemic, many services were no longer available, leading consumers to spend more on goods.⁵ However, since the economy has reopened, consumers have slowly increased their services spending as a share of their total spending. As consumer spending rebalances between goods and services, small business revenues could be impacted. While our forecasts indicate softer consumer spending overall due to a mild recession in the middle of this year, we expect that growth in services spending will continue to outpace that of goods spending. One sign of the increasing demand for services has been the strong employment gains in service industries. This has been especially true for leisure and hospitality, education, health services, and professional and business services.⁶ Additionally, in every month since last year, service spending growth has outpaced both durable and non-durable goods spending growth (Fig. 5). While this change will likely be a boon to service sector small businesses, the switch from goods to services spending also comes with some challenges.

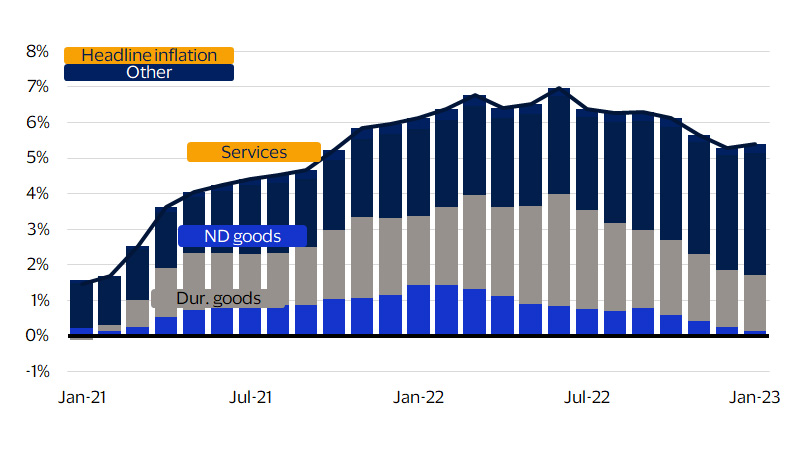

The move from goods to services spending has not only meant more revenue for service sector firms, but also elevated prices for services. Service inflation now dominates the contribution to overall inflation and has continued to grow, despite both durable and non-durable goods inflation continuing to ease (Fig. 6). Given expected higher demand for services, service sector small businesses will likely have greater pricing power than goods producing small businesses. Therefore, costs for services that goods firms rely on will remain high. This will almost certainly lead to more margin compression for small businesses in the goods sector through high costs. Ultimately, we expect demand to subside through the third quarter of this year, which will eventually ease demand-driven inflation pressures on service prices. However, we expect demand for services to remain stronger than demand for goods for the foreseeable future. In the short term, this will mean that high service inflation will be more persistent than high goods inflation, but in the long term will mean more robust growth opportunities for service-oriented small businesses than goods-oriented small businesses.

Real PCE by major spending category

(YoY, percent change)

Contributions to the PCE deflator (percent)

Footnotes

- ¹ U.S. Department of Commerce Retail Sales Report

- ² “2022 Business Openings Report”, Jan 2023, Yelp

- ³ National Federation of Independent Businesses

- ⁴ Small Business Optimism Index Survey March 2023, National Federation of Independent Business

- ⁵ U.S. Department of Commerce

- ⁶ U.S. Department of Labor

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Art of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statement we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the Securities and Exchange Commission (SEC). Expect as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.