Economic outlook and forecasts 5 economic trends to watch in 2026 for LAC payments

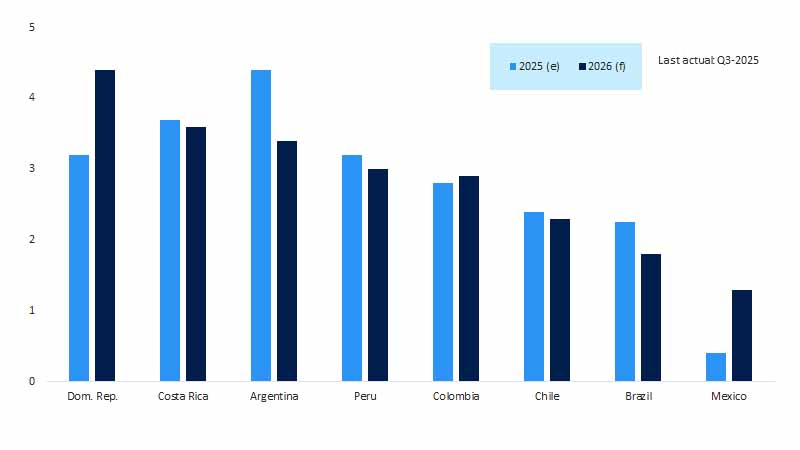

Economic growth expected across LAC

(Real Gross Domestic Product, YoY percent change)

In this environment, central banks across the region should be able to reach or maintain their interest rates near neutral, thereby reducing borrowing costs for households and businesses. This, in turn, should allow the second key trend to take hold: Households’ purchasing power should rise as income gains outpace inflation. Minimum‑wage increases enacted last year are expected to boost incomes. At the same time, lower producer prices support further disinflation.

Incomes and consumer spending should get a further boost as remittances from the U.S. are likely to grow modestly in 2026. This third trend will be guided by a softer yet stable U.S. labor market but constrained by new remittance taxes and stricter immigration rules. However, a stable or slightly stronger dollar may act as a tailwind.

The fourth key trend concerns cross‑border spending, which should get a strong lift from major cultural and sporting events, especially the 2026 FIFA World Cup, co-hosted by Mexico. Millions of visitors are expected to boost tourism, hospitality, transport and entertainment, while accelerating the adoption of contactless and card‑based payments. These events usually leave lasting improvements in payment readiness and provide a welcome economic boost.

Lastly, AI offers the region a real opportunity to increase productivity, improve public services and support formal employment. Many countries now have national AI strategies, yet challenges remain in infrastructure, skills and digital inclusion. With strong governance and broad access, AI can modernize services, strengthen competitiveness and enhance digital payments through better security and efficiency.

Economic growth will normalize

LAC is returning to steady, sustainable growth in 2026, but global and local uncertainties mean resilience and adaptability remain essential.

Latin America and the Caribbean should see real GDP growth of 2 percent in 2026, with most countries expected to grow at rates consistent with their long-term potential. At this more sustainable pace, inflation is contained, employment is stable and monetary policy is neither too tight nor too loose. In other words, the region is settling into a cruise speed, where it should remain, assuming no unexpected bumps throw it off course.

For many countries in the region, including Brazil, Chile, Uruguay and Costa Rica, less restrictive or even neutral monetary policy should result in stronger growth in 2026. With central banks lowering their interest rates, borrowing costs are declining, exchange rates are stabilizing and the environment for economic growth is improving. Past efforts at fiscal consolidation have helped stabilize public debt ratios, but these remain relatively high, so governments are unlikely to increase spending significantly. Remittances and inbound tourism are expected to remain important sources of support for many economies in the region.

The forecast assumes a slight deceleration relative to last year’s 2.2 percent real GDP growth rate, but the slowdown mainly reflects changes outside of the region. Demand for the region’s exports is expected to soften as global economic growth moderates on weaker growth in both the United States and China, which are key trading partners for the region.

This slowdown could have a secondary impact on the region, as weaker global demand dampens international commodity prices. The World Bank forecasts that overall commodity prices are expected to drop by nearly 7 percent this year, driven mainly by energy prices, reflecting persistent oil oversupply and weak oil demand growth. Relative to other commodity exporters, South America appears better positioned, as prices for its key exports—such as soybeans, beef, copper, gold and silver—are expected to rise modestly. Soybean prices are expected to firm up amid reduced U.S. acreage, tight inventories and strong demand, while beef prices should remain elevated, reflecting lingering supply constraints. Industrial metals, such as copper, are set to rise from AI‑driven data‑center demand, limited production growth and the energy transition—factors that also support silver, alongside tight supply and safe‑haven interest.

Slightly slower growth prospects in 2026 reflect the lagged impact of economic and trade policy uncertainty. Global uncertainty remains high, driven by ongoing trade policy shifts and geopolitical tensions.

Uncertainty matters because, when it rises, it leads to a wait-and-see environment in which consumers postpone major purchases and businesses delay investments. For Latin America, uncertainty stemming from shifts in U.S. policies could have a silver lining, as it may encourage countries to diversify their trade partnerships and reduce reliance on a few major economies, opening new opportunities for growth—as seen in Brazil and Chile. The signing of the EU-Mercosur trade agreement is one such opportunity, and others may follow in terms of greater openness to trade within the region and with other major economies outside of the region.

Moreover, the shaping of a new global order may trigger a renewed interest in nearshoring that could turn investors’ heads toward the western hemisphere. In the medium-to-long term, this may benefit some of the largest economies in LAC, including commodity-intensive ones, especially in rare earth and industrial metal industries.

Potential shocks could set countries in the region on a different path. Elections in Costa Rica, Peru, the Dominican Republic, Colombia and Brazil could create short-term volatility as markets and consumers react to potential policy changes. In Mexico, the upcoming review of the U.S.-Mexico-Canada Free Trade Agreement (USMCA) adds another layer of unpredictability. Conversely, in countries where recent political developments are viewed as supportive of business and investment, a boost in confidence could support economic activity.

Venezuela regime change

Recent events in Venezuela underscore the shifting international environment and reinforce the need to account for global uncertainty in our scenario analysis. While the situation remains fluid, it is worth noting that at its peak in 2008, Venezuela’s economy was five times larger than it is today, representing more than 7 percent of LAC GDP. At that time, the country maintained active international trade, with merchandise exports nearly six times higher than current levels. Export markets—primarily the U.S., Netherlands, Brazil, and Spain—were also more diversified, in contrast to the now-dominant role of China.

On the migration front, a scenario in which outflows slow and voluntary returns begin among the nearly 8 million people who have left since the major exodus that began in 2014 could eventually contribute to higher potential growth domestically and help ease fiscal pressures in Colombia, Peru, Ecuador and Brazil.

Purchasing power returns as real incomes rise

Falling inflation and rising wages are restoring families’ buying power, fueling consumer spending and supporting economic stability across the region.

One of the most encouraging trends for Latin America and the Caribbean in 2026 is the recovery of purchasing power among households. We expect this to help sustain spending and, in turn, payment volumes.

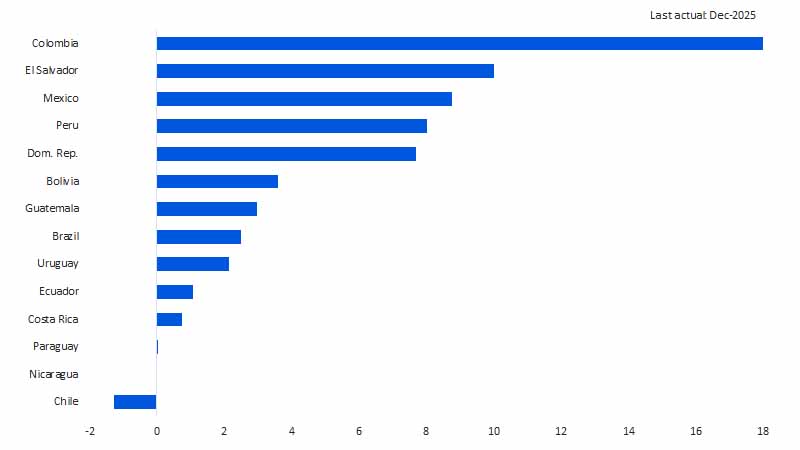

Recent increases in minimum wages across the region, though more modest than the double-digit hikes seen during the pandemic and its immediate aftermath, have generally outpaced inflation (see chart below). This means that workers, especially those in formal, low-wage jobs, are seeing real gains in their incomes. Minimum wage increases tend to have associated “lighthouse effects,” particularly when labor markets are tight, influencing pay levels in other sectors and helping to lift overall household purchasing power. For 2026, minimum wage revisions are mostly a single digit (percentage) above expected inflation, except in the case of Colombia, nearly 18 percent above.

Minimum wages imply real gains in household purchasing power

(Real minimum wages in 2026, YoY percent change)

Central banks remain cautious. They are closely watching to ensure that wage growth does not outstrip productivity and that lighthouse effect does not strengthen, which could reignite inflation. There is a risk that inflation could pick up again, erasing the gains in purchasing power. For now, though, most economies are operating at or near their potential, which should limit the risk of demand-driven inflation.

The reduction of benchmark interest rates in most countries has made borrowing cheaper and loosened credit conditions; this has helped to reduce consumers’ impulse to save and encourage spending as their income prospects and confidence improve. The current conditions are also helping to boost growth in digital payments as more people in the region choose more convenient and secure ways to spend on everyday purchases. This trend is likely to continue as consumers become more comfortable with digital financial services and as businesses invest in better payment infrastructure.

Modest remittance growth, modern payments

Remittances will grow more slowly in 2026, but digital innovation is making cross-border money transfers faster, cheaper and more accessible than ever.

Remittances have long been a lifeline for many families in Mexico, Central America and the Caribbean. In 2026, they are expected to continue growing, albeit at a more modest pace. The U.S. labor market, a key driver of remittance flows, is projected to remain steady but less dynamic, with job growth slowing as the population ages and immigration slows. This means that while the overall economy remains healthy, the pace of job creation will be slower, and wage gains will play a more important role in supporting household incomes. Additionally, Hispanic employment has continued showing a noticeable resilience.

The U.S. dollar is expected to be more stable and slightly stronger in 2026 as the Federal Reserve lowers interest rates and inflation eases. This could limit gains for local currencies in Latin America and the Caribbean or even lead to modest depreciation. For remittance recipients, this means that the value of money sent from abroad may not increase as much as in previous years, but it should remain relatively stable. Recent data validates this prospect of stability.

A new factor in 2026 is the introduction of a 1 percent federal excise tax in the U.S. on outbound remittances funded by cash, money orders, cashier’s checks or similar physical instruments. This tax, along with stricter U.S. immigration policies, is expected to slow the growth of remittance flows somewhat. Additionally, the number of new migrant senders is growing more slowly, further contributing to the moderation in remittance growth.

Despite these headwinds, the modernization of payment systems is making it easier and faster to send and receive money across borders. Digital and mobile channels, including instant payments, mobile wallets and real-time transfers, are becoming more common and accessible.

Regulatory support and innovation are helping to reduce costs and improve access, especially for people who were previously underserved by traditional transfer methods. This shift is making remittances more efficient and inclusive, ensuring that even as growth slows, the benefits of remittances are more widely shared.

Cross-border benefits flow from influx of soccer fans

Major sporting and cultural events, especially the FIFA World Cup 2026, will spark a surge in tourism, spending and digital payments, giving the region’s economy a timely boost.

In 2026, Latin America and the Caribbean will be at the center of the global stage for sports and entertainment, with major events like the soccer World Cup, multi-sport games and mega music festivals drawing visitors from around the world. These events are more than just entertainment, they are powerful drivers of economic activity, especially for the payments ecosystem.

Mexico, for example, will host 13 World Cup matches across three major cities: Mexico City, Guadalajara and Monterrey. These cities are not only equipped with modern infrastructure but also offer rich culinary, cultural and entertainment experiences. The influx of visitors is expected to benefit not only large tourism operators but also small and medium-sized enterprises (SMEs) and local governments.

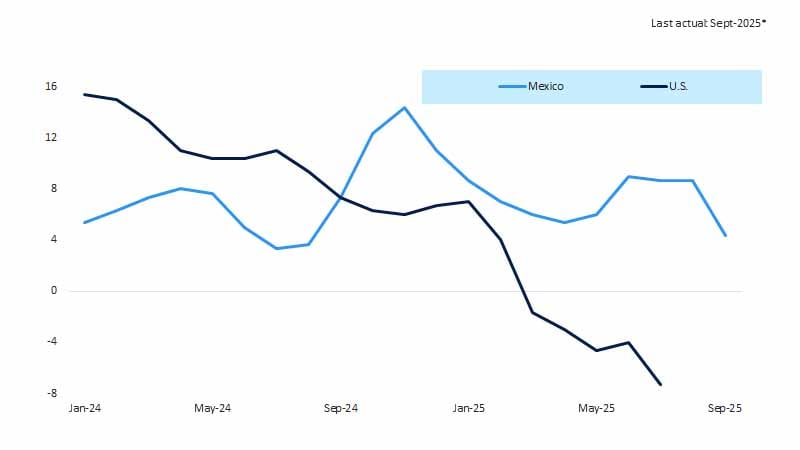

Recent data indicates a decline in inbound tourism to the U.S., while interest in Mexico remains visible (see chart below). This trend could present an opportunity for Mexico to position itself as an attractive destination during the FIFA World Cup even with only 13 matches scheduled—matching Canada but far fewer than the 78 matches to be played in the U.S. The event may serve as a catalyst for broader engagement with international visitors.

Mexico remains an attractive North American tourist destination

(International tourist arrivals, SA, YoY percent growth)

Tourists are expected from a diverse list of countries. The Visa Presale Draw for the World Cup revealed interest from fans in over 200 countries, with the highest demand coming from the host nations, followed by Germany, England, Brazil, Argentina, Colombia, Spain and Italy. Many visitors will take advantage of Mexico’s wide range of destinations, from soccer host cities to popular tourist spots, thanks to a strong tourism offering and relaxed visa requirements for many countries.

Analysis by Visa Business and Economic Insights and Visa Consulting and Analytics shows that Mexico has seen consistent double-digit growth in spending by foreign visitors, with strong adoption of digital payments and credit cards. Sports tourism, in particular, attracts a broad segment of visitors and drives up spending on hotels, transportation and local businesses.

Major international sports events typically generate a burst of short-term economic activity, with host cities seeing sharp increases in tourism, hotel stays, transportation use and consumer spending. There is also a temporary boost in job creation and global visibility.

Over the longer term, some cities benefit from improved infrastructure, stronger branding and sustained tourism interest. However, there can be displacement effects, as regular tourists may avoid the area during major events. Still, the overall impact is positive, especially for countries like Mexico that are looking to boost growth after a period of economic stagnation and trade uncertainty.

For the payments system, these events present unique challenges and opportunities. Payment networks must scale up to handle surges in cross-border transactions, ensure near-perfect uptime and absorb sharp increases in demand. Visitors overwhelmingly adopt digital, contactless and card-based payments when the infrastructure is in place, leaving lasting gains in digital readiness across host cities.

Merchants benefit from flexible payment solutions and fast onboarding, while the data generated during these events provides valuable insights into international spending patterns. This helps financial institutions better forecast demand, design targeted services and strengthen the resilience of the broader payment system well beyond the event itself.

The great AI promise and LAC

Artificial intelligence holds huge promise to transform Latin America’s productivity and services, but realizing its benefits will require overcoming deep structural challenges.

Artificial intelligence (AI) offers Latin America and the Caribbean a real chance to break out of its cycle of low productivity, expand the formal sector, improve public services and drive new engines of growth. It is true that the region faces deep structural challenges in infrastructure, computing power, data quality and talent. However, most of the region’s largest economies now have a national AI policy at various stages of implementation.

The AI promise for LAC may be ambitious, but its potential is undeniable. AI can become a key driver for improving productivity, modernizing public services and creating new forms of work. It can help governments and businesses make better decisions using data, reducing costs and expanding access to education, health and financial services. AI also allows countries to leapfrog technological stages, modernize key sectors quickly and strengthen economic growth with more efficient, accessible and innovative tools.

The diagnosis and opportunity areas for LAC are clear: Connectivity issues, limited electricity infrastructure and a deep digital skills gap exclude large segments of the population. Many businesses lack quality data and access to advanced technology, and high informality reduces exposure to and benefits from AI. There is also a risk that technology could increase inequalities if only a few countries, cities or companies are able to adopt it. Thus, to harness AI’s potential, Latin America and the Caribbean must invest in connectivity, training, appropriate regulation and strategies to ensure that its benefits reach everyone.

Countries like Argentina, Brazil, Chile, Colombia, Costa Rica, the Dominican Republic, Panama, Peru and Uruguay have launched or are developing multi-year national AI policies. These projects share common motivations, such as preparing for a world where technology advances faster than current rules, infrastructure and capabilities. The goal is to use AI to improve public services, drive innovation and maintain economic competitiveness, while ensuring safe, ethical and transparent use. The challenges and objectives of these national strategies converge on the need to strengthen regional stability and development, addressing shared challenges like economic vulnerability, limited institutional capacity and the pressure to improve productivity and social inclusion. Despite different approaches, all agree that the current landscape requires coordination, strategic vision and mechanisms to seize opportunities without losing sight of structural risks.

In the payments sector, AI is helping to modernize rapidly by making transactions more secure, seamless and simple for both consumers and businesses. AI tools can detect fraud more accurately, authorize payments even during service outages and reduce errors in recurring processes, improving the user experience.

Tokenization and other smart solutions make digital payments more reliable, while personal finance apps help people better understand and manage their spending. Overall, AI is strengthening the efficiency, security and quality of digital payments, benefiting the entire ecosystem.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook,” “forecast,” “projected,” “could,” “expects,” “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.