Finding a way in Asia Pacific's new economic reality

January 2025 – Welcome to Asia’s new economic reality. A year of uncertainty and structural change looms in 2025: The new U.S. administration is likely to take a different approach to this highly trade-exposed region, and authorities in Mainland China are calibrating stimulus to accelerate growth and inflation in the region’s largest economy. Amidst the background of decent global growth, we are watching four key themes in Asia Pacific for the year ahead:

- Consumer-led recovery: Asia Pacific can look forward to a consumer recovery, in both real and nominal spending.

- Geopolitics: A new administration in the U.S. increases uncertainty in an already volatile region.

- Supply chain shifts: Asia Pacific will continue to integrate deeply into global supply chains.

- New financial flows: All these shifts in trade and investment patterns are leading to billions of dollars of new financial flows, as remittances, trade financing and foreign exchange flows follow the realignments.

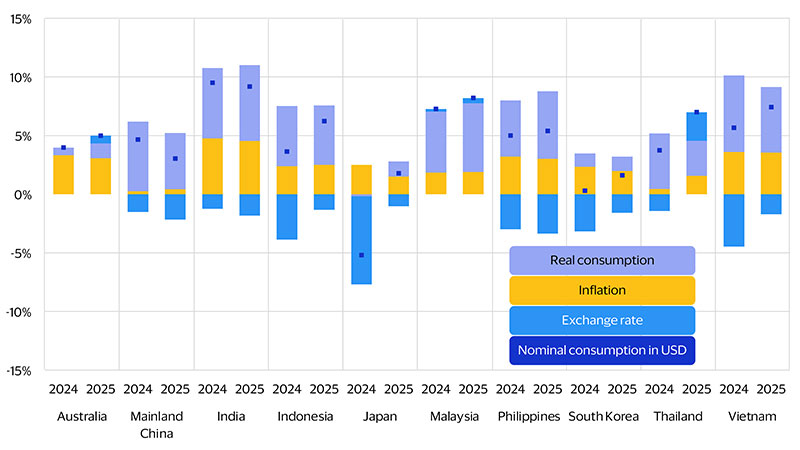

Consumer markets in Asia Pacific will be stronger in 2025

Places like Vietnam and India are expected to have robust local-currency spending

Geopolitics continue to take centre stage

Asia Pacific supply chains are reshaped by geopolitics

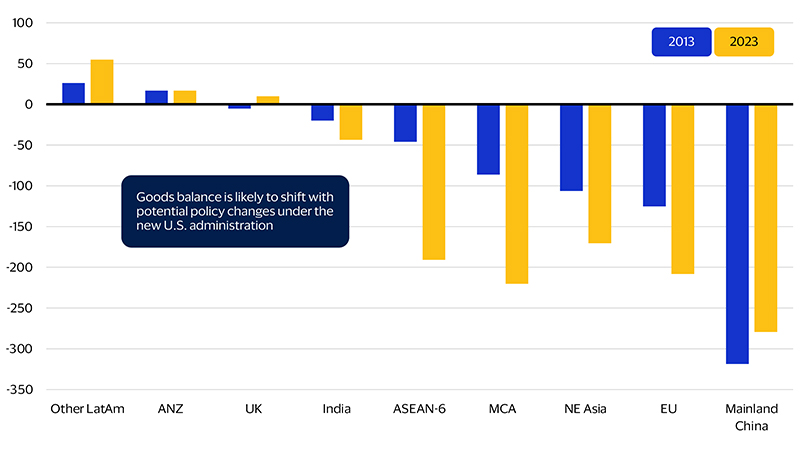

U.S. trade has undergone structural change over the last decade

U.S. goods trade balance (nominal billion U.S. dollar)

Financial flows are following shifts in supply chains

As the U.S. Federal Reserve embarked on its rate-hiking cycle in recent years, most Asia Pacific currencies have depreciated, particularly consequentially in the large economies of Japan, Mainland China and South Korea. Both emerging patterns of cost differentials and regulation are driving investment, such as in production facilities in Japan, and sourcing of components cross border, such as China’s surging exports to Southeast Asia. As the U.S. Fed continues to cut interest rates, any central bank holding rates constant or cutting slowly, such as in Malaysia or Thailand, should see currency appreciation. This will reduce export competitiveness even as it increases the spending power of local consumers.

So how will the region’s largest economies do in 2025? Asia Pacific will remain the world’s fastest-growing region, even as Mainland China’s economy slows against a mix of structural headwinds, such as a decline in the size of the workforce and weak confidence amid a property slump. Mainland China will be one of the few governments in the region embarking on fiscal stimulus rather than consolidation. This boost to spending could help to stave off deflation and manage a highly indebted property sector, making it countercyclical to much of the rest of the region. Urbanisation remains the biggest driver of growth for Asia Pacific’s emerging economies and, combined with sufficient improvements to the business environment, will propel India, Vietnam and the Philippines to become standout markets for growth. Significant numbers of new consumers are moving into the middle class, with implications for retail and travel, in particular. Demographic change is rapidly occurring, and economies like Thailand and Vietnam are going to face challenges with healthcare, pensions and employment due to ageing populations at lower levels of gross domestic product per capita than Mainland China did, and it in turn is facing them earlier than Japan or South Korea did. Technological change remains a bright spot, with much of the global cutting-edge innovation, from semiconductors to EVs, taking place in regional economies.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.