China shock 2.0: Tariffs set to lower growth in all regions

May 2025 – Economic growth across all four regions is set to slow in 2025, due in large part to expansive tariffs announced by the administration in April of this year. While we suspect employment growth remained strong in the first quarter across all regions, we expect hiring and consumer spending growth to moderate this and next quarter as a result of the tariffs raising input prices on businesses and retaliatory tariffs lowering demand for U.S. exports. The increase in prices along with the heightened policy uncertainty associated with the constantly changing tariff landscape has caused us to lower our forecast for real gross domestic product (GDP) growth for all four regions this year. While we expect that tariffs will be negotiated down by the end of Q3, the lasting uncertainty could be a major impediment to business investment through the end of this year.

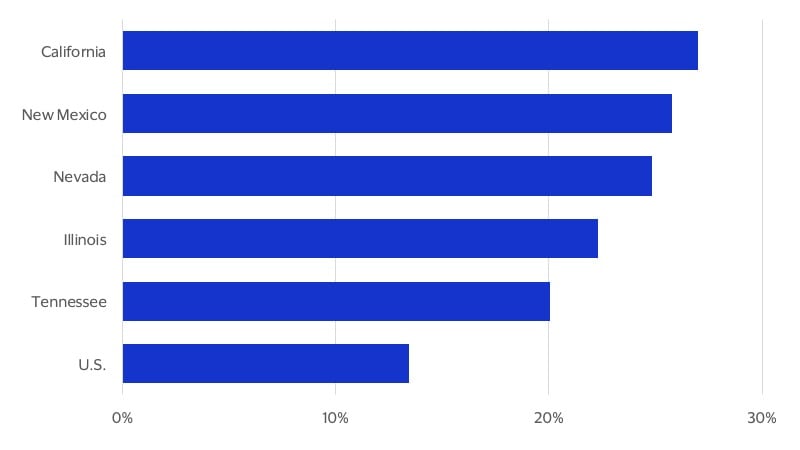

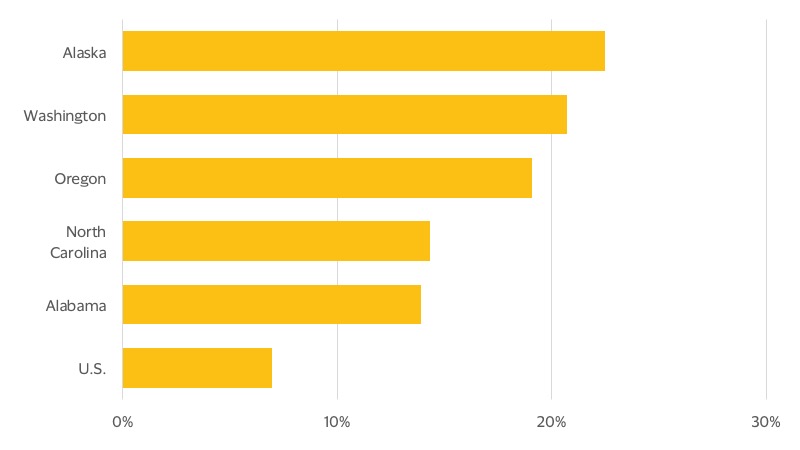

The most significant change in trade is the unprecedented rise in tariffs on Chinese goods. Even after taking into account exemptions, our current estimate for the effective tariff rate on Chinese goods is 30 percent. For its part, China has retaliated with a 10 percent tariff on goods imported from the U.S. Trade with China varies significantly across different states (see figures below), and thus we expect these differences will have disparate impacts on economic growth, job creation and consumer spending across each region. The West is likely to suffer the most, as the region trades with China far more than any other. The Midwest and South are also expected to suffer significantly from tariffs, as both rely heavily on China as a market to export goods to and for the imports needed in their manufacturing production. Largely thanks to a lower exposure to trade with China, our revised forecasts indicate that the Northeast will be the least impacted by the large increase in tariffs on China.

States that trade more with China will feel the most severe tariff impacts

Top 5 states for imports from China (share of total goods imports)

Top 5 states for exports to China (share of total goods exports)

The Northeast emerges as a source of stability in troubled waters

The Northeast’s GDP ended 2024 with slightly stronger growth than the nation in Q4. However, the region lagged the nation and all other regions except the Midwest for 2024 in GDP growth as high interest rates weighed heavily on interest rate-sensitive sectors that are prominent in the Northeast, such as finance, tech, construction and manufacturing. Our forecasts indicate that the first quarter of 2025 was far brighter, though, with economic growth expected to outpace the nation and all regions except the South thanks to strong hiring and consumer spending growth in New York, New Jersey and Vermont. The lack of exposure to Chinese imports when compared to other regions will be a significant advantage for the Northeast, as input costs for many imports into the region will not be impacted by the most severe tariffs. Additionally, we expect financial consulting firms and hedge funds in New York and Connecticut to benefit from policy uncertainty as high net worth individuals and large firms are likely to increase their demand for these services in the current volatile environment. We also expect the nation’s aging population will likely keep demand for health services growing, which will likely benefit New Jersey, New York, Pennsylvania, New Hampshire and Massachusetts the most.

While the Northeast is expected to be the top performing region in the country this year, a decline in international tourism is a significant headwind that poses downside risk to our otherwise positive outlook. The tourism industry is a significant driver of growth in the Northeast, but with tourists growing increasingly concerned about travel and immigration, international tourism to Boston and New York City is expected to decline 9.2 percent and 11.2 percent YoY respectively in 2025. This decline could be an important impediment to employment and consumer spending growth in the region. Despite the expected headwind from lower tourism, we expect the Northeast to be a source of stability relative to other regions and lead the nation in economic, employment and consumer spending growth in 2025.

Trade disruptions set to slow the South

The South ended last year leading the nation in economic, employment and consumer spending growth in 2024, as our forecasts predicted. We expect that this trend carried into Q1-2025, leading the South to once again outpace all other regions in economic and employment growth. However, the wide-ranging tariffs announced in April and subsequent retaliatory tariffs imposed on U.S. exports by China are likely to have an outsized impact on economic growth in the South. We expect that this slowdown will also hinder consumer spending growth and job creation in the South in 2025.

Our forecasts indicate that the South will lose its lead in real GDP, employment and consumer spending growth in 2025 to the Northeast, largely as a consequence of higher tariffs both on imported goods from China as well as retaliatory tariffs imposed on U.S. goods by China. High tariffs on imports from China are set to have a disproportionate impact on input costs to manufacturers in Tennessee, South Carolina, Oklahoma and Arkansas. Due to retaliatory tariffs imposed by China, we expect a drastic decline in demand for exports from Alabama, North Carolina, Louisiana, Delaware, West Virginia and Kentucky. Additionally, large cuts in the federal workforce are likely to negatively impact employment and consumer spending growth in Maryland, Washington D.C. and Virginia.

Despite large headwinds from trade disruptions, we still expect the South’s growth to remain stronger than all regions except the Northeast. Strong domestic in-migration to Texas, Georgia and Florida is likely to continue and will help support strong consumer spending growth this year. Additionally, the new administration has signaled that an increase in defense spending is a priority, which would be highly additive to growth for South Carolina, Oklahoma, Georgia, North Carolina, Texas, Tennessee and Virginia.

While the growth landscape for the South remains positive, changes in trade policy and cuts to federal employment have led us to lower our outlook for the region’s growth in 2025.

The Midwest struggles to regain momentum amid auto slowdown and tariff pressures

The Midwest economy ended 2024 on a weak note, with real GDP growing just 1.8 percent YoY, underperforming the national average and all other regions. Our forecasts indicate that this has carried into early 2025. While Missouri and Minnesota have shown resilience—benefiting from logistics, clean energy, and favorable business conditions—most states remain constrained by weakening manufacturing, trade disruptions, and population outflows.

The auto industry, a key economic driver, remains a major drag. Production slowed sharply in Q1 as elevated auto loan rates curbed demand, which particularly impacted production in Michigan and Ohio. While some consumers pulled forward auto purchases to get in-front of tariffs raising costs, affordability concerns remain. Meanwhile, new steel and aluminum tariffs have raised input costs, squeezing margins and prompting layoffs and hiring freezes across the sector. High interest rates continue to weigh on the region, limiting business investment and curbing household spending—especially in manufacturing-heavy states like Indiana, Illinois, and Ohio. Trade policy uncertainty adds further pressure, particularly in export-dependent areas.

Structural challenges also linger. Outmigration and an aging workforce are shrinking the labor pool and weakening demand. Unlike coastal regions, the Midwest has fewer innovation hubs to offset industrial decline. Still, some bright spots remain. The healthcare sector is poised for steady growth, especially in Minnesota, Illinois, and Ohio. Clean energy and EV investments in Missouri and Indiana offer long-term promise, while logistics and e-commerce continue to support growth in Illinois and Missouri. Additionally, higher defense spending would likely be a major benefit to employment and consumer spending growth in Missouri and Kansas.

The Midwest entered Q2-2025 on a path of slow, uneven growth. As a result of tariff disruptions and continued out-migration, we expect the Midwest to continue to lag the nation in economic, job and consumer spending growth this year.

The West will outpace the nation no more, for now

The West’s economy demonstrated robust growth in Q4-2024, growing 2.9 percent YoY and outpacing the national average for the sixth consecutive quarter. However, our forecasts indicate a reversal in this trend for Q1-2025. Plunging consumer confidence and a weaker national outlook are hitting states in the region in different ways. For example, Nevada's cyclical economy is suffering from cautious consumer spending and declining tourism. California, the nation’s top state for tourism last year, expects international visitation to fall 9.2 percent in 2025, according to Visit California. While growth states such as Utah, Arizona, and Idaho are expected to continue outperforming the nation, significant headwinds will hinder the West's momentum in the coming quarters.

California, the region’s largest economy, continues to face challenges in its tech sector due to high interest rates and the relocation of tech investments to lower-cost states. Although some investment stays within the West, an increasing portion is shifting to the South. Tariffs on Chinese goods and retaliatory tariffs on U.S. goods are likely to have a negative impact on growth in the West, particularly for Alaska, California, Oregon, New Mexico, Nevada and Washington. Tariffs also threaten coastal states, as West Coast ports handle most Chinese imports. California, Washington, Oregon, Idaho, and Arizona also face reduced demand in their agricultural export markets due to rising trade tensions and competition. Restrictive immigration policies are another growth headwind, particularly for California, which relies on international migration for population growth. While states like Utah, Arizona, and Idaho will see slower population growth, they still retain an edge over the rest of the U.S. due to higher net domestic migration.

While the West’s recent performance has been strong, we expect these challenges to weigh on growth. High borrowing costs, reduced trade, tech investment shifts to lower-cost areas and restrictive immigration policies pose significant risks to the region’s growth prospects. As a result, the West is projected to lag the overall U.S. in economic, employment and consumer spending growth this year.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.