Global Perspectives The rise of agentic AI: Empowering Canadian consumers for the next era of digital assistance

February 2026 – Agentic AI is poised to transform the way Canadians live, shop and manage their finances, yet most remain unaware of its potential. While nearly seven in 10¹ Canadians recognize generative AI tools like ChatGPT, only 27 percent are familiar with agentic AI: Intelligent systems that don’t just answer questions, but act on behalf of users to complete tasks, make purchases and manage complex decisions. This striking awareness gap is more than a statistic; it’s a call to action for businesses and policymakers.

The story here isn’t about the evolution of artificial intelligence in Canada; it’s about the readiness of Canadian consumers to embrace a new era of digital assistance. Our research reveals a paradox. Canadians are optimistic about the promise of AI, with 77 percent believing it will improve their lives, yet 92 percent express deep concerns about privacy control and ethical use. This tension between curiosity and caution defines the current landscape.

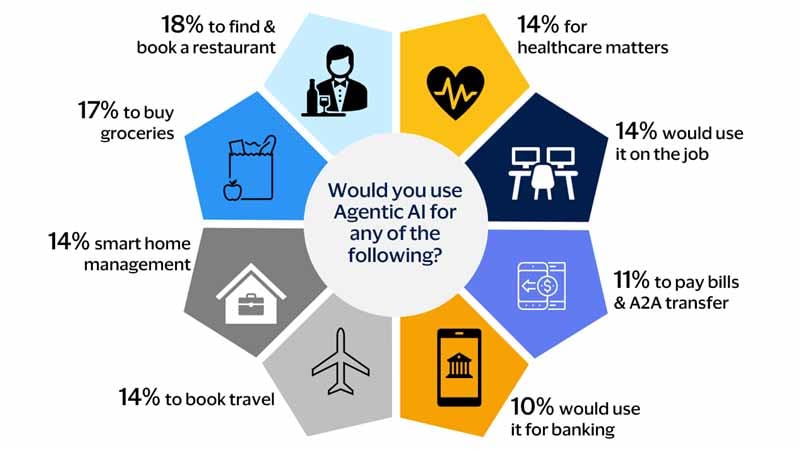

What’s driving this gap? For many, agentic AI remains an abstract concept, something futuristic and intangible. The reality is far more immediate. These technologies are already beginning to book dinner reservations, negotiate better prices and manage investments for early adopters. The challenge and opportunity for Canadian businesses is clear: Bridge the knowledge gap, build trust and demonstrate the tangible benefits of agentic AI in everyday life.

What Canadians actually want AI to do

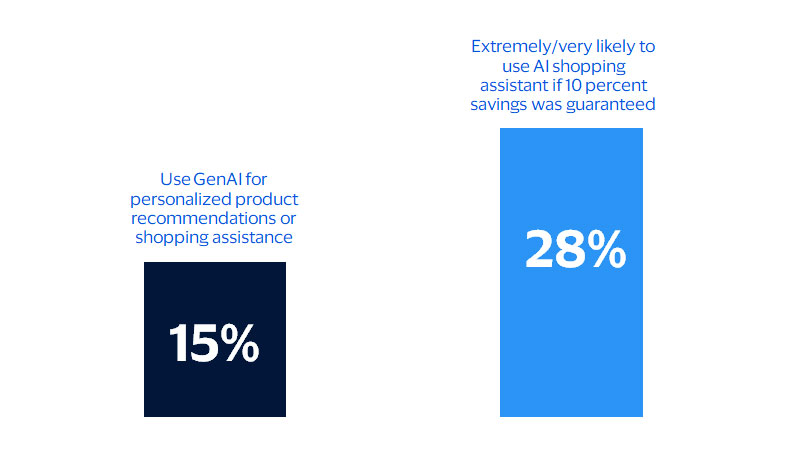

Likelihood of using generative AI for shopping relative to savings

Top agentic AI use cases

Why the awareness gap persists

Barriers to adoption

Despite the promise of agentic AI, significant hurdles persist. Only half of Canadians trust AI features offered by online retailers, and that trust evaporates when sensitive information is involved. Willingness to share financial data or biometric information drops sharply, creating a significant hurdle for the very applications that could prove most valuable.

This may be a case of ‘they don’t know what they don’t know.’ For consumers, the inherent value of agentic AI remains unknown until experienced. This lack of exposure is a major barrier, alongside concerns about privacy control and the need for transparent safeguards. Until consumers have firsthand experience with agentic AI, their ability to appreciate its benefits is limited, which in turn slows demand and adoption.

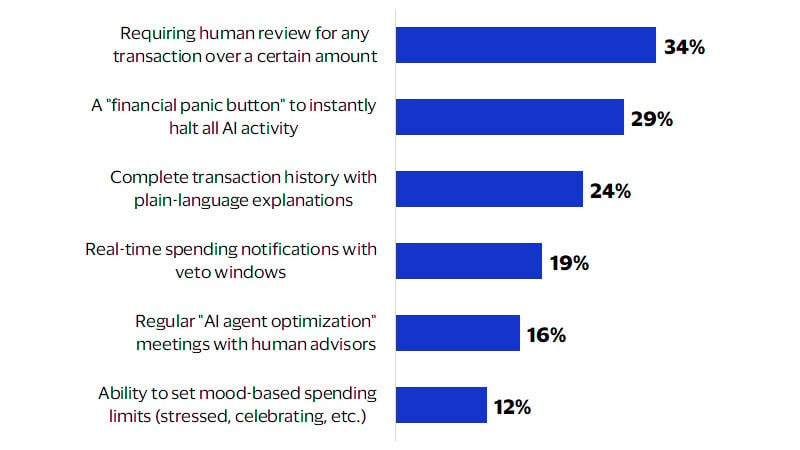

Canadians are demanding safeguards. More than a third want human oversight for high-value transactions. Nearly 30 percent insist on an emergency “panic button” to instantly regain control when an AI agent goes rogue or makes unwanted decisions (see chart below). Transparent data practices aren’t optional; they’re foundational. Real-time visibility into what an AI is doing and why will be essential to building consumer confidence.

Features that make consumers more open to using agentic AI

The readiness chasm

Agentic AI is more than an inevitable trend. It’s a chance to redefine customer relationships. By building trust and delivering personalized, proactive assistance, businesses can foster deeper loyalty, drive repeat business and enhance the lifetime value of each customer. Those who invest now in education, ethical frameworks and seamless integration will set the standard for the next era of commerce.

Agentic AI represents more than a technological upgrade. It's a fundamental reimagining of the consumer relationship. The companies that crack the trust equation, by making AI agents feel like helpful assistants rather than invasive automatons, will define the next era of commerce. For Canadian businesses, the window to shape this future is open, but it won't stay that way for long. The organizations piloting trusted agent protocols today, building AI literacy programs and establishing ethical frameworks immediately will set the standards that everyone else will follow. The question isn't whether AI agents will become part of everyday Canadian life; it's who will build them, how they'll work and whether we'll trust them enough to hand over the keys. The clock is ticking.

What comes next

Agentic AI acceptance is expected to accelerate rapidly in the years ahead. Consumers’ growing familiarity with generative AI and comfort level with automated digital services—especially among younger demographics—signal a potential acceleration toward mainstream adoption of agentic AI, once trust, safety and reliability are firmly in place. By the latter part of the decade, younger Canadians, in particular, are likely to reach a critical mass of adoption, with financial services, retail and travel emerging as early proving grounds.

The winning formula is evident: education to demystify the technology, ironclad governance to address privacy concerns and personalized experiences that deliver genuine value. Interactive demonstrations and relatable content will be crucial for moving agentic AI from abstract concept to trusted tool. Payment integration will prove critical. As these AI agents begin making purchases on our behalf, seamless and secure transaction capabilities will separate viable products from vaporware.

Footnotes

- Unless otherwise noted, the data in this report is derived from a nationally representative quantitative online survey commissioned by Visa Business and Economic Insights. The survey was conducted by YouGov in English and French from August 19–29, 2025, among 1,013 adults (18+) in Canada, with minimal weighting applied to align results to the Canadian general population.

- Ipsos Global Influentials, November 2025

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.