A soft landing for everyone?

February 2024 – All regions of the U.S. likely experienced economic and job growth in the fourth quarter of 2023, continuing the positive trends started during the second and third quarters of last year, according to our analysis of the latest economic data. Resilient consumer demand and stronger than anticipated export growth were major catalysts for sustained job and gross domestic product (GDP) growth in Q4-2023. Given the strength of the incoming economic data, we are forecasting a soft landing for the U.S. economy in 2024 as a result of the Federal Reserve’s monetary policy tightening—helping to control inflation just enough without inducing a recession. However, we anticipate that high rates will limit business fixed investment through H1 of this year. Additionally, our analysis indicates that real disposable income growth is likely to significantly downshift on a year-over-year (YoY) basis during the same period, potentially triggering a pullback in consumer spending growth. Taken together, these factors suggest a downshift in economic growth in the first half of 2024, which could lead to some job losses.

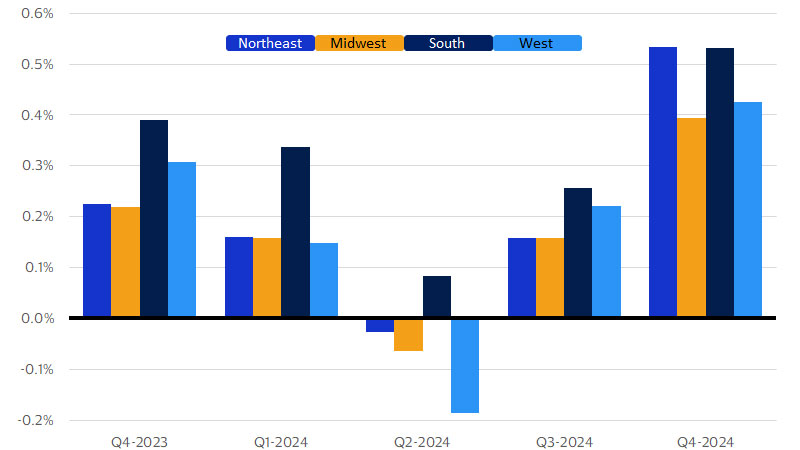

Regionally, we expect the slowdown to be uneven. We expect the largest job losses to occur in the West (see figure below) due to a stronger pullback in the residential sector and recent job losses in the transportation and warehousing sector continuing into 2024. Weakness in the latter sector is also likely to impact the Northeast’s job market, but those losses will be somewhat offset from job gains in the healthcare and education sectors. While slowing economic growth in the Midwest is likely to be more pronounced than that region’s job losses, we still expect that the manufacturing sector will experience some layoffs as a result of lower demand for cars and trucks. Conversely, the South will likely avoid job losses thanks to continued strong business investment and a relatively higher share of employment in the government sector. We expect the government sector to continue adding jobs and thus also help to limit GDP and consumer spending contractions in the South.

The West’s high exposure to the residential construction sector will be the main catalyst for higher job losses in the region

Total employment by region (quarter-over-quarter percent change)

Healthcare to sustain growth in the Northeast

The Northeast maintained steady GDP and employment growth in the second and third quarters of 2023 thanks in large part to strong hiring in the healthcare sector. Healthcare’s impressive job gains continued throughout the fourth quarter as well, indicating that the Northeast closed 2023 with solid job growth. This likely also contributed to the region’s robust consumer spending growth that trailed only the South. While growth in the healthcare sector was a boon, layoffs at major financial firms in New York earlier in 2023 along with a weaker tech sector in Massachusetts limited the Northeast’s economic growth and labor market expansion. When the books are closed on 2023, we expect to find that these headwinds caused the Northeast to end the year as the region with the lowest annual economic growth.

The first half of 2024, however, is shaping up to be better for the Northeast than all other regions except the South. Some major bright spots that are likely to drive growth in the first quarter include a planned investment in a new semiconductor factory near Syracuse, N.Y. and a healthcare sector set to continue its strong growth throughout the region. The education and healthcare sectors should continue to add jobs throughout 2024, to the great benefit of the Northeast’s labor market, which has a disproportionately high number of jobs in these sectors relative to the rest of the country. The New England census division (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont) is expected to fare better than the Mid-Atlantic census division (New York, New Jersey, Pennsylvania) as restrictive financial conditions are likely to weigh heavily on the manufacturing sector in Pennsylvania as well as the tech and financial services sectors in New York and New Jersey. However, the significant number of affluent consumers in the Northeast should bolster consumer spending through 2024 and keep economic growth on par with the nation.

Growth goes electric in the South

The South was the main source of strength in the U.S. economy for each of the first three quarters of 2023. Our analysis indicates that the region likely continued that strong performance in the final quarter of 2023 and led all other regions in GDP, employment and consumer spending growth in 2023. The region benefitted greatly from strong personal income growth in Texas, Florida, D.C. and South Carolina. Robust growth in jobs and incomes in Florida thanks to rising employment in the financial services sector, a broadening tech sector in North Carolina’s research triangle, a resilient residential sector in Texas and higher defense spending in Virginia all greatly contributed to the South’s economy outperforming all other regions in 2023.

Our analysis indicates that while the South won’t be totally immune from a slower first half of 2024, the region’s labor market and economic growth will continue to outperform all other regions. High employment in the government sector is likely to be an asset in 2024, as we expect the sector’s robust job growth to endure despite the downshift in economic growth. The end of the auto workers strike will also be a major boon to employment and income growth in the first half of 2024, especially for Tennessee. Electric vehicle manufacturing is likely to be a major bright spot for the South this year, as Georgia and North Carolina are set to receive heavy investment from several auto makers to build new EV manufacturing plants in those states. Additionally, we expect the movement of high-income jobs in financial services and tech to continue to boost growth in Texas, North Carolina, Georgia and Florida. An aging population is expected to continue to support further in-migration to Florida and blunt some of the negative impact from a likely tourism slowdown in the first half of 2024. While lower fuel prices in the first half of the year will probably be a headwind for growth in energy-reliant states such as Oklahoma, Texas and Louisiana, the current outlook suggests that higher demand from Europe for natural gas will limit the downside risk. Whether it be retirees or high-income earning professionals, the positive in-migration to many states in the South is expected to continue and will likely preserve the region’s lead in economic, job and consumer spending growth in 2024.

The end of the strike won’t save the Midwest

The auto worker strike cast a long shadow over employment, economic and consumer spending growth in the third and fourth quarters of 2023 in the Midwest. Thankfully, we expect to see robust job gains for December, reflecting the strike’s end in November. However, long-term trends such as strong out-migration held the region back in 2023. Our estimates indicate that the Midwest’s employment and consumer spending growth was the weakest in the country and that its GDP growth lagged all regions except the Northeast in 2023. The inability of many Midwestern states to stem the tide of population decline has been a major impediment to more robust growth in the region, and signs point to that trend continuing in 2024.

While the outlook for the Midwest’s economy in 2024 is weak relative to the other three regions, there are a few important bright spots. Visa’s Spending Momentum Index (SMI) indicates that auto workers returning to work at the end of November had a significant impact on consumer spending in December. This suggests that the new deal worked out by the auto workers and the big three automakers could be an important tailwind for consumer spending in 2024. Strong growth in the healthcare and professional and business services sectors in Minnesota is providing a boost to the state and having positive spillover effects to the residential construction sector. A new semiconductor manufacturing plant in Ohio will likely be an important boon to employment and GDP growth in 2024 as well. That said, high labor and borrowing costs for automakers will be a hindrance to further employment growth and capital investment. Lower food prices are likely to heavily impact agriculture incomes in Nebraska, South Dakota, Iowa, Missouri and Kansas, further driving down economic growth and consumer spending in the Midwest. While the Midwest will likely only suffer very mild job losses in the first half of 2024, higher labor and borrowing costs will be a major headwind to economic growth.

Will housing woes weigh down the West?

The West finished 2023 strong, due in large part to a rebound in the tech sector and a housing market that proved to be more resilient to high interest rates than anticipated. The explosion in adoption of generative artificial intelligence (genAI) was a welcome boost to investment and employment in the tech sector and helped to support economic and employment growth that outpaced all regions except the South. The West’s economic resilience resulted in the region leading the country in consumer confidence for 2023, which likely led to stronger than expected consumer spending growth in the final months of 2023.

Despite the strong finish to 2023, some significant headwinds are expected to lead to a much slower start to 2024. While housing demand proved to be much more robust than expected in 2023, unaffordability in the first half of 2024 is likely to be a major headwind for the residential construction and real estate sectors in the West. Lower demand for housing is likely to lead to layoffs in the construction and real estate sectors in California, Idaho, Nevada, Arizona, Utah, Colorado and Washington. These housing markets are not expected to rebound until mortgage rates start to consistently decline, likely in the second half of 2024. As a result, the lumber industry in Oregon and building material mining sectors in Nevada, Colorado, Montana and Wyoming are likely to be heavily impacted by a lack of demand for building materials in the first half of 2024. Declining food prices will also be a headwind for California’s large agriculture sector and put further stress on the state government’s tenuous fiscal situation. While lower oil prices should help many residents in the region save money, it will likely be a significant blow to employment and income growth in Alaska. Additionally, the anticipated slowdown in tourism is likely to have a significantly negative impact on employment and consumer spending in Nevada, California and Hawaii. Despite these challenges, many states in the West have dynamic economies that are fully capable of bouncing back quickly from a slowdown. Thus, we expect that the West will have a significant rebound in the second half of 2024 once borrowing costs are lower and hiring ramps back up.

Forward-Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimers

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.