Meet the innovative winners of the Inclusive Fintech 50

Meet the winners of the Inclusive Fintech 50

An estimated five billion people around the world have access to mobile devices, yet more than a billion people lack safe and secure financial services, according to the World Bank.

There is a major opportunity for fintech solutions that combine the reach and user experience of digital channels with powerful software solutions to help connect the “un-banked” to well-designed, trusted financial products that empower them to lead more secure, fruitful lives.

While promising fintech firms in Silicon Valley and other global tech hubs can receive plenty of attention from potential partners and investors, many with equal potential fall outside the spotlight because they focus on non-traditional segments and underserved markets where investors and partners often have a hard time pinpointing opportunities.

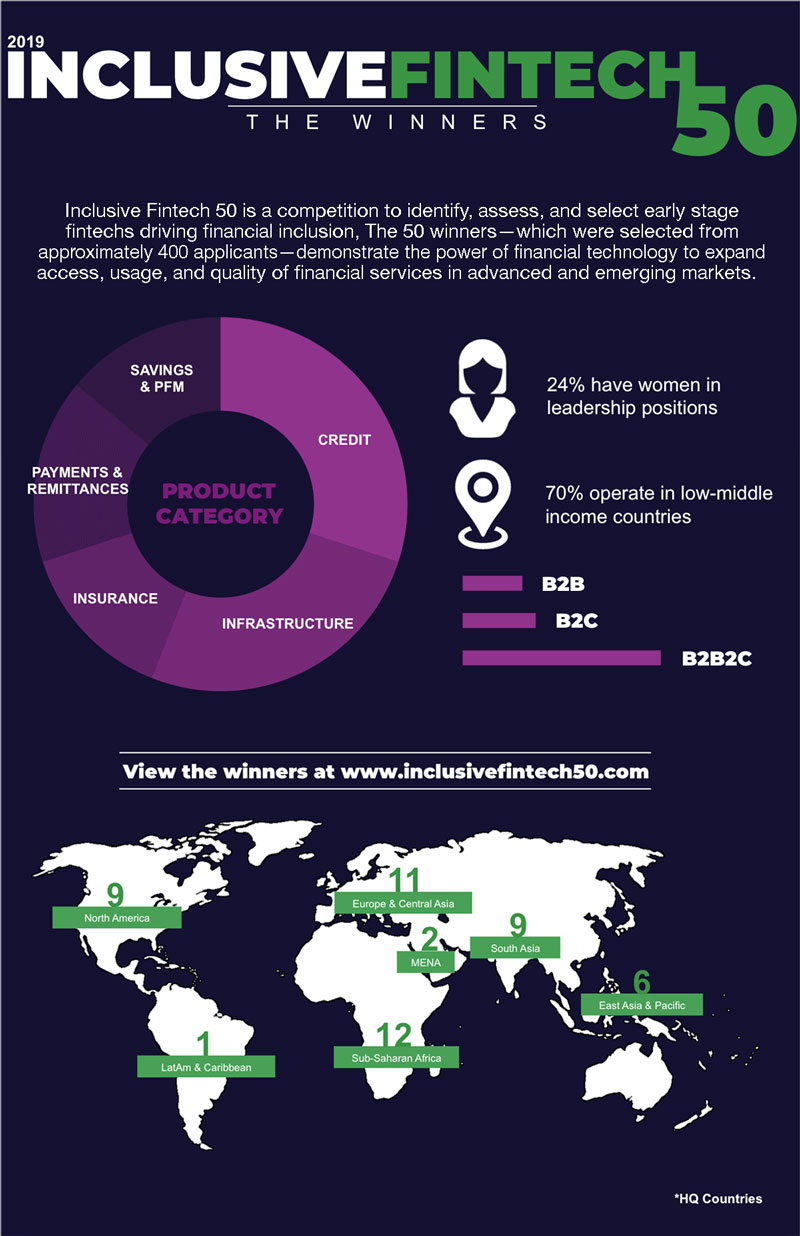

The Inclusive Fintech 50 competition was created to recognize promising early-stage startups that have not yet received due attention for bringing innovation to financially-underserved communities. We hope investors, large-scale financial service providers, and others will give close consideration to how they can help these 50 fintechs scale and reach more underserved people. The winners include some truly innovative solutions helping build credit histories, manage personal finances, access insurance, prove identity and make safe and quick payments.

Visa co-designed and funded the initiative with our friends at MetLife Foundation, IFC (the private sector arm of the World Bank), Accion (a global financial inclusion advisor and investor) and our implementing partner MIX. We put the call out for applications and a panel of more than 20 independent judges with expertise in fintech (e.g. CreditEase), investment (e.g. BlackRock), development finance (e.g. World Bank Group), philanthropy (e.g. Gates Foundation), government (e.g. UK’s Commonwealth Development Corporation) and digital financial inclusion (e.g. the founder of M-Pesa in Kenya) selected the final 50.

Out of 400 eligible applications, we are proud to announce the 50 winners, companies that are offering high potential, viable products and business models. Some highlights:

- Half of the winners operate exclusively in Sub-Saharan Africa or South Asia, regions containing the majority of unbanked individuals worldwide. Another quarter of winners operate in those regions plus others.

- One-quarter of the winners are women-led or founded.

- Half of the winners are headquartered outside traditional fintech hubs in East Asia, Europe and North America.

- The largest cohort of winners provide credit solutions (30 percent) to underserved segments including micro, small and medium enterprises (MSMEs).

- Approximately 25 percent of the winners offer infrastructure solutions like biometrics software that enables financial institutions to expand access to previously excluded groups.

- About 15 percent offer insurance, payments and remittances services, and savings and personal financial management tools.

Read the entire list in our press release and get full detailed profiles by going to www.inclusivefintech50.com/winners.

Congratulations to the winners of the Inclusive Fintech 50.