What is Ethereum's Staking Model?

Understanding the role of cryptoeconomics.

Written by Mustafa Bedawala and Aaron Salot. Acknowledgement to Catherine Gu, Dominic Silk and Mert Özbay.

05/04/2023

Cryptoeconomics is a relatively new study of incentive mechanisms that has gained significant traction in recent years in the context of blockchain networks. A primary goal of cryptoeconomics is to promote the creation of secure, decentralized and distributed systems that can function without the need for a centralized entity. At its core, cryptoeconomics revolves around the concept of incentives. Incentives are financial rewards that encourage people to take certain actions. In the context of blockchain networks, incentive mechanisms are used to encourage participants to behave in a certain way, such as validating transactions or publishing blocks. By providing financial incentives, network participants are encouraged to act in ways that help promote the network’s security and stability.

Cryptoeconomics is an important field of study that plays a crucial role in helping to create secure network protocols. Given that blockchains are distributed and often decentralized, it is essential to have the right incentive mechanisms in place to help prevent bad behavior. Incentives in the form of rewards and penalties distributed to network participants using native tokens of a protocol are aimed to self-regulate against bad behavior and promote good behavior in a decentralized environment.

In both Proof of Work (PoW) and Proof of Stake (PoS) blockchains, incentive mechanism design plays a critical role. In PoW blockchains, miners are incentivized to expend computational resources to create new blocks and validate transactions. In PoS blockchains, validators are incentivized to stake their tokens (in that sense, their stake serves as “skin in the game”) and act with integrity when creating new blocks and validating transactions. In both cases, cryptoeconomics helps ensure that the network remains decentralized and secure, helping to make it difficult and costly for any single entity to gain control of the network. For a more in-depth understanding of PoW and PoS, see our recent publication "What are Consensus Mechanisms?" ¹ As an example, Ethereum's transition from PoW to PoS consensus mechanism through “The Merge” is a perfect example of how organizations are applying cryptoeconomics in practice. Developers view this transition to PoS as a significant milestone because it is a prerequisite for several subsequent development priorities. You can find our reporting on The Merge in "What was the Ethereum Merge?" where we cover the implications of the event in detail.²

This in-depth examination demonstrates the significance of cryptoeconomics in relation to security in permissionless blockchains. Permissionless refers to a system or network where participants can interact without requiring approval from a central authority or any other participant. As settlement networks are integrated with blockchains to establish a robust blockchain-based payment network, understanding how the blockchain assures itself of greater, uninterrupted security guarantees is equally important. In this blog we will look at the changes to Ethereum's monetary policy, how validators in the network are incentivized for optimal behavior and punished for malicious behavior, and explore Ethereum’s staking model.

Introducing a new fee model for Ethereum

Ethereum is a decentralized and distributed blockchain network that operates on its native token, Ether (ETH). ETH is widely used as a means of payment for a variety of transactions on the Ethereum network, including paying for transaction fees, executing smart contracts, and purchasing for other crypto assets. Over the years, Ethereum has adapted its monetary policy multiple times to help ensure its stability and security. Initially, miners who secured the network were rewarded with 5 ETH per block, but this reward has gradually decreased to 3 ETH per block and eventually to 2 ETH per block as of 2019.

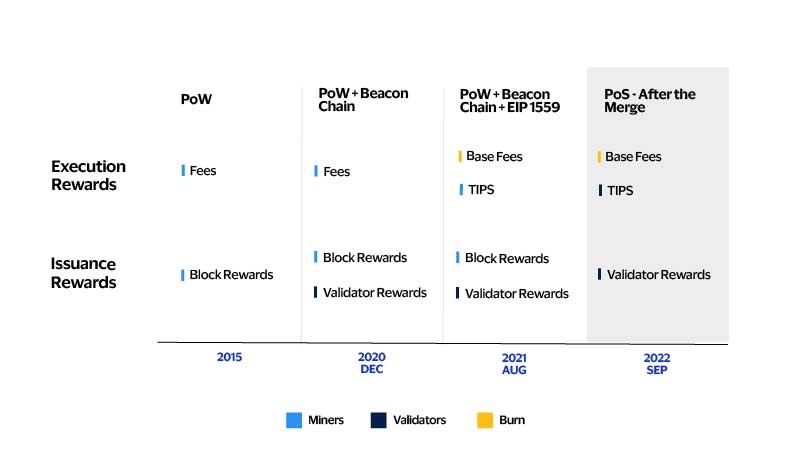

In December 2020, Ethereum introduced a new consensus layer for Ethereum's PoS chain, known as the beacon chain. This event raised the issuance rewards for securing the blockchain state because miners who secured the main chain (the execution chain) and validators who secured the new beacon chain each received their own issuance rewards, thereby increasing the total issuance from the network. The blockchain network pays miners or validators for activities related to consensus through issuance rewards. The new beacon chain also introduced a validator deposit contract, which allows ETH holders to become validators. By staking 32 ETH as a security deposit, ETH holders can become validators on the new beacon chain. For every 32 ETH staked, one validator is activated and rewarded for securing the beacon chain state.

The Ethereum network has undergone significant changes in recent years, including the introduction of the EIP (Ethereum Improvement Proposal) 1559 via the London Hard Fork in August 2021. This proposal has drastically altered the Ethereum network's fee model and how it rewards network participants. The EIP 1559 fee model incentivizes network validators and regulates network traffic to help ensure that the Ethereum network functions efficiently. This event, the London Hard Fork, resulted in the network charging two types of fees: the base fee, which would be burned and be used to regulate the circulating supply of ETH, and the tip, which would incentivize network validators.

Figure 1: Ethereum reward types

The process of executing transactions on the Ethereum network requires a gas fee. Gas is a measurement unit that quantifies the total computational effort an operation will require. For example, a money transfer is a simple operation that will generally require less gas than a DeFi-lending transaction that involves more complicated code execution. The transaction fee depends on the amount of gas needed for the computation and the unit cost of gas, which is a dynamic value in gwei (1 billion gwei = 1 ETH).

The unit cost is based on two variables: the base fee and the tip. The base fee is dynamically determined by the size of the last processed block to regulate the network traffic. This means if the previous block is larger than the target block size (15M gas), the network is busy, causing the base fee to increase. If the previous block is smaller than average, the opposite will happen. In other words, at times of network congestion, the base fee will be high and continue to rise until the congestion is relieved. The tip, on the other hand, is set by the user initiating the transaction and serves as a priority fee. Transactions with higher tips are processed before those with lower tips, giving users the ability to prioritize their transactions. The formula below explains the EIP 1559 fee model in simple terms.

EIP 1559 fee model: [Gas fee (in gwei) = Gas units × (Base fee + Priority fee)]

Overall, the EIP 1559 fee model provides a new mechanism for incentivizing network participants and regulating network traffic. The reduction of network rewards following The Merge (15th September 2022), combined with the introduction of this new fee model, results in a dynamic reward system.

Before The Merge, miners and validators were incentivized to earn around 13,000 ETH and 1,700 ETH per day, respectively. Post the Merge, block rewards and transaction tips are now directed to the validators; miners no longer need to be paid with new ETH. This reduces the rate of new ETH minted by almost 87 percent. When network activity increases, the ETH burn rate surpasses the issuance rewards that validators are paid. In such cases, the network data suggests that ETH issuance becomes negative, resulting in a deflation of ETH-circulating supply. These types of scenarios are common after The Merge because a threshold base fee of 16 to 18 gwei is sufficient for ETH to become deflationary, given the current number of validators.

Breaking down Ethereum rewards and penalties

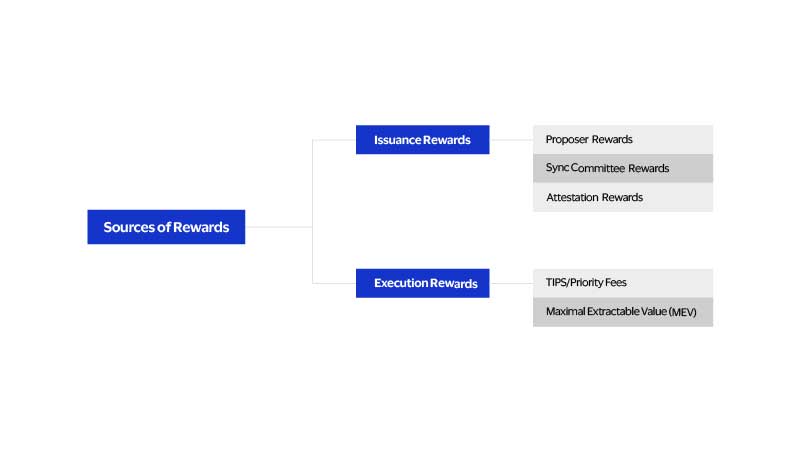

Ethereum incentivizes validators with rewards. To participate in Ethereum validation, node operators must first deposit ETH into a smart contract. They are then rewarded for running client software that verifies the validity of newly created blocks through the peer-to-peer (P2P) network. At a high level, validators are motivated by two types of rewards:³

- Issuance rewards that come from the consensus layer for performing tasks such as proposing the next block and attestations

- Execution rewards, which come from the execution layer for processing and adding the blocks of transactions

Figure 2: Sources of issuance and execution rewards

Issuance rewards

Issuance rewards in the Ethereum network are a crucial part of the staking mechanism and incentivize validators to participate and maintain network security. These rewards are predictable, however, as the level of staked ETH increases, the rewards will decrease accordingly. The rewards are distributed to validators every 6.4 minutes, which is known as an epoch. The rewards that validators receive are multiplied by the "base reward," which acts as the foundation for all other rewards calculations. The "base reward" is determined by the validator’s "effective balance" and represents the average reward that a validator can expect to receive under optimal conditions per epoch. The "effective balance" is a calculated value based on the current balance and is used to determine the size of the rewards or penalties a validator may receive. The "effective balance" can never exceed 32 ETH.

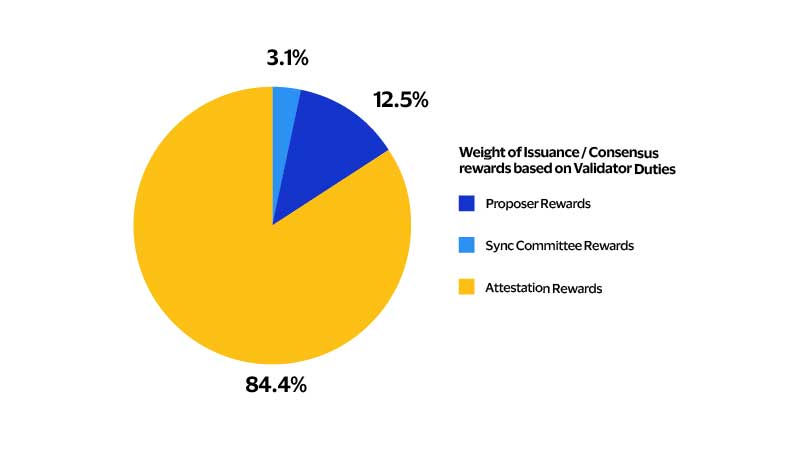

- Proposal rewards

Proposers are randomly chosen validators who are compensated for proposing the Ethereum network’s next block. Once chosen, the validator must produce a block for that slot (a slot lasts 12 seconds; there are 32 slots in an epoch). The other validators' beacon chain attestations are accumulated in the block, and the block producer is compensated with a portion of the inclusion rewards from the block’s attestations. The block producer is awarded one-eighth of the inclusion reward, while validators whose attestations are included in the block are awarded seven-eighths.

Sync committee rewards

The sync committee is a group of validators on the Ethereum network who are responsible for ensuring the beacon chain's integrity and security. These validators are in charge of signing the header of each beacon chain slot, which is an essential facet of the consensus process. The sync committee is made up of 512 validators and rotates infrequently — every 256 epochs, or roughly every 27 hours — to ensure that light clients can identify sync committee members without having to keep the entire beacon chain state. A random selection of validators determine the membership of the sync committee, like that of the block proposals, for each period of 256 epochs. By participating in the sync committee, these validators are able to earn rewards for their work in securing the network.

Attestation rewards

Most validator rewards come from making attestations. Validators who vote (attest) on the current head of the chain and on checkpoints earn rewards. Attestations play a crucial role in establishing the finality of the blockchain, meaning that once the validators have attested to a checkpoint in an epoch, the prior transactions cannot be removed or altered. In the attestation process, every active validator is selected to make exactly one attestation per epoch. This means that the attestation rewards are the most frequent type of reward and contribute significantly to the overall yield of validators.

Figure 3: Weight of rewards per validator duty

Execution rewards

Execution rewards are given to validators for executing transactions and performing related tasks in the Ethereum network’s execution layer. These rewards differ from issuance rewards as they are highly variable and depend on the level of activity on the blockchain and the demand for blockspace. Unlike issuance rewards, which are largely dependent on the blockchain’s staking level, execution rewards are purely dynamic and subject to external factors and opportunities.

Tips - Priority fees

As discussed, the implementation of EIP 1559 has helped lead to the full burn of base fees and the introduction of tips as a source of income for validators. A tip is an additional fee paid by users to fast-track their transaction and have it confirmed before others. This fee serves as an economic incentive for validators to prioritize the given transaction and include it in the next block. By paying a tip, users can ensure that their transaction is processed in a timely manner, which can be especially important in cases where speed is a priority.MEV

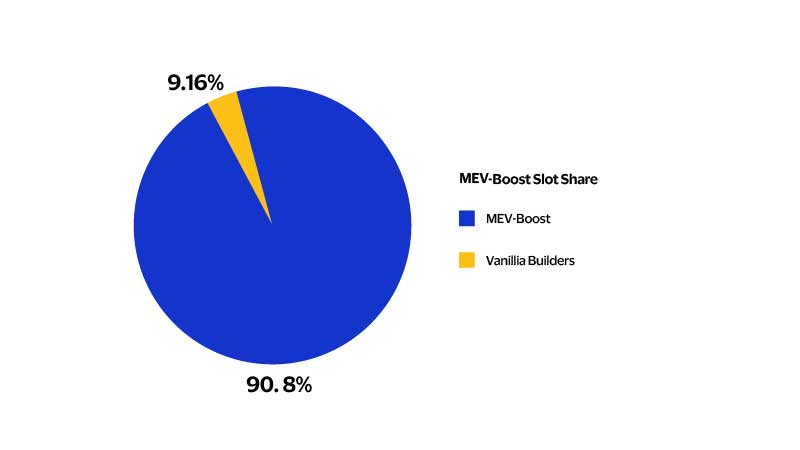

MEV refers to the maximum amount of value that validators can extract from producing blocks through specific techniques such as front-running, back-running, decentralized exchange arbitrage, liquidations, sandwich attacks and NFT (Non-Fungible Token) MEV. This value is created by manipulating the order of transactions and fees, beyond the standard block rewards and gas fees. Independent network participants known as "searchers" are responsible for extracting a significant portion of MEV. Validators can also receive a share of MEV as searchers offer high gas fees in exchange for a higher likelihood that their profitable transactions will be included in a block.

Only validators who are running what is known as “MEV boost” client software can access MEV rewards. MEV boost is an optional service for Ethereum PoS validators that allows them to increase their APR (annual percentage return) by outsourcing their block production duties to the highest bidder. When setting up MEV boost, validators can choose from which relays to accept blocks. Currently, there are 10 major MEV boost relays, including Flashbots, Ultrasound, BlockNative, Manifold and Eden.

Figure 4: MEV-Boost slot share

Penalties

It is also crucial to understand the repercussions of acting maliciously or deviating from protocol regulations in the Ethereum network, which can compromise the security of the blockchain and its finalization. To uphold network safety and stability, Ethereum has implemented various disciplinary measures, including slashing, inactivity leaks and penalties, to reprimand validators who partake in such harmful or non-conformant behavior. Incentivizing validators on the Ethereum is similar to a double-edged sword. On one hand, validators are offered a prize for safeguarding the network, but on the other, they face consequences for falling short of their responsibilities. This carrot-and-stick approach encourages validators to strive for responsible and secure participation in the network.

- Slashing involves removing a portion of a validator's staked ETH as punishment for violating protocol regulations, such as submitting conflicting attestations for the same checkpoint or proposing two conflicting blocks at the same height. This can result in substantial losses and expulsion from the protocol.

- Inactivity leaks, on the other hand, are a mechanism that gradually decreases the staked ETH of inactive validators, encouraging them to remain active and participate in the network. This is designed to restore finality in the event that a large number of validators permanently fail.

- Penalties also apply to validators who fail to meet their obligations, such as their attestation duties. These penalties result in small amounts of stake being lost and are implemented to align the incentives of all participants toward maintaining the network's security and integrity.

Relationship between staking level and network activity

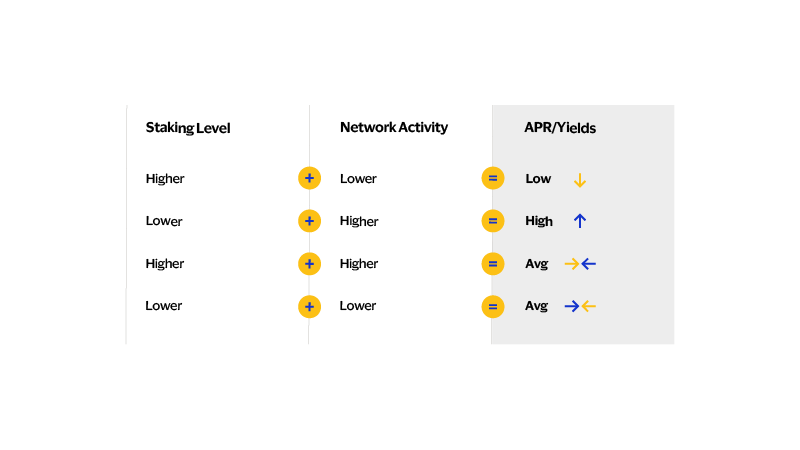

Figure 5: Relationship between variables and yields

For validators, the primary source of rewards to assess the economics comes from issuance rewards. The reward curve illustrates the relationship between ETH issuance and staked ETH. As more ETH is staked, more ETH is issued, but at a diminishing rate. In simple terms, for Validators, the reward curve represents how the rewards decrease as the amount of staked ETH increases, and vice versa. This means that validators receive lower compensation for their stake when more ETH is deposited, and higher compensation when less ETH is deposited.

Another factor affecting rewards for validators is tips and MEV, as discussed in earlier sections. These rewards are entirely dependent on the network activity level, such as the demand for block space, which is inherently dynamic. Figure 5 presents a table that summarizes the yield each validator can expect based on the staking level and network activity of the blockchain. Yield refers to the variable annual percentage yield (APY) a validator can expect to earn in ETH terms. For example, if the staking level is high and network activity is low, per-validator yields will be lower, as neither factor is favorable for providing higher yields.

Liquid staking derivatives and staking model for Ethereum

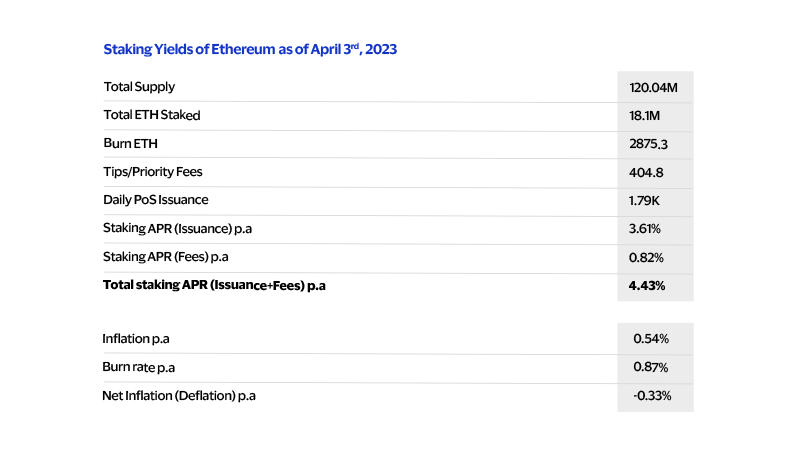

Figure 6: Staking yields of Ethereum as of April 2023

Looking forward

On the 12th April 2023, the Ethereum ecosystem went through significant changes with the anticipated Shapella Upgrade.¹⁰ Shapella is a combination of Shanghai and Capella, referring to two network upgrades that occurred simultaneously. This update addressed the issue of withdrawing staked ETH by enabling users to stop running their validators, exit the network and unlock their 32 ETH along with any accrued rewards. The increased flexibility provided by this withdrawal functionality will allow more market participants, who previously had reservations, to join the network. It will be important for participants to monitor whether this event will affect the total number of validators in the blockchain in the short to medium term. Additionally, the upgrade could impact DeFi applications, including but not limited to liquid staking derivatives.

As Ethereum embraces a modular approach, network security is expected to become increasingly important. The added complexity and security of this approach may necessitate a robust staking mechanism, with network demand for ETH staking only increasing. This raises concerns about the protocol's maximum staking level, the potential increase in the gas limit per block, MEV-related problems and the long-term impact of these decisions on Ethereum's success.

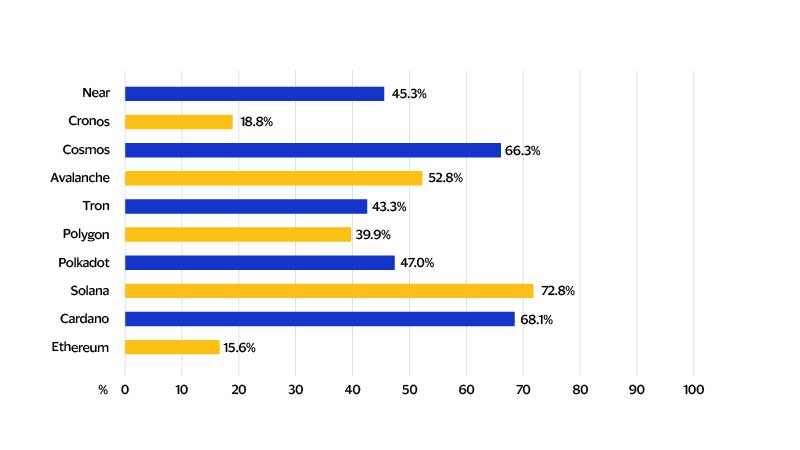

Figure 7: PoS blockchain stake rate

Benefitting the whole ecosystem

The significance of cryptoeconomics in the blockchain’s success cannot be overstated. Understanding the rewards and punishment mechanisms in a distributed system, as discussed in the article, is vital for industry players to ensure network security and incentivize participants to act in a way that benefits the entire system. Ethereum’s model to network security serves as a prime example of the importance of cryptoeconomics, with its high nominal and real yields ranking among the top of major smart contract Layer 1s.

This blog explains the potential rewards available through staking and emphasizes the need for secure networks. With Ethereum moving toward a modular-focused roadmap and growing transactions being executed on Layer 2s, the demand for participants to engage in network activities will continue to grow. It is essential to carefully consider the long-term impact of these decisions on Ethereum’s success.

Reach out to Visa Crypto at GDLVisaCryptoResearch@visa.com to learn more about Visa’s involvement in the crypto ecosystem and our products we are currently building to help expand capabilities within blockchain payments.

This article is part of a series of articles on blockchain ecosystem developments. Head over to Visa Crypto Thought Leadership for more consumer insights, best practices, and innovative approaches to the blockchain through our research.

Footnotes

- “What are Consensus Mechanisms?” Accessed 17 Apr. 2023.

- ”What was the Ethereum Merge?” Accessed 17 Apr. 2023.

- “Upgrading Ethereum.” Upgrading Ethereum, 11 Jan. 2023, eth2book.info/bellatrix. Accessed 17 Apr. 2023.

- “Open Source Ethereum Blockchain Explorer - beaconcha.in – 2023. Accessed 4 Apr. 2023.

- Ether Supply Growth Chart | Etherscan. etherscan.io/chart/ethersupplygrowth. Accessed 3 Apr. 2023.

- “ETH Deposited.”dune.com/queries/1933035/3188467. Accessed 3 Apr. 2023.

- “ETH Burned Over 1 Day (April 2nd-3rd).” https://dune.com/queries/2324141. Accessed 3 Apr. 2023.

- “Sum of Tips 1 Day (April 2nd-3rd).” https://dune.com/queries/2324161. Accessed 3 Apr. 2023.

- "Flashbots/Eth2-research.” GitHub, github.com/flashbots/eth2-research. Accessed 17 Apr. 2023.

- “Mainnet Shapella Announcement.” https://blog.ethereum.org/2023/03/28/shapella-mainnet-announcement. Accessed 17 Apr. 2023

- “Staking Rewards.” https://www.stakingrewards.com/. Accessed 17 Apr. 2023.

- Open source public blockchain explorers. Accessed 17 Apr. 2023.