September 2, 2020 — Small business spending fell sharply for the second straight quarter due to a significant drop in revenues caused by pandemic lockdowns. Additionally, many small businesses shifted their spending to debit cards. Spikes in COVID-19, that began toward the end of June, paused reopenings and created more uncertainty for the future.

Outstanding balances on Visa small business credit cards dropped 7.8 points in Q2 as businesses decreased spending overall and preferred borrowing funds through SBA-led (Small Business Assocation) programs or traditional bank loans to borrowing on their credit card. This follows a general trend across the economy of large declines in revolving debt.

Risk again ticked up with increases in both delinquencies (+5.6) and charge-offs (+1.3) in Q2. Federal assistance programs and forbearance regulations helped keep many small businesses current on their credit card during the second quarter. However, with COVID-related restrictions continuing longer than expected, many more small businesses are at risk of missing credit card payments through the rest of this year.

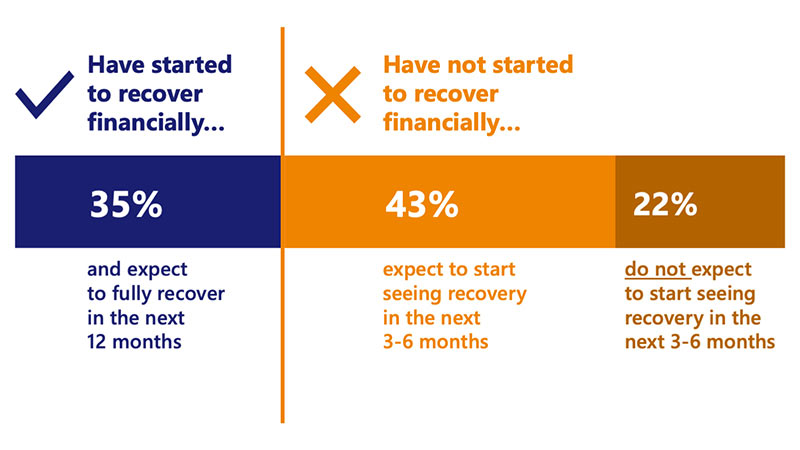

Small businesses continue to face unprecedented challenges due to the COVID-19 pandemic. Despite small businesses cutting spending and taking advantage of SBA loan programs, a large amount of uncertainty remains.

— Wayne Best, Chief Economist, Visa Inc.