Oct 15, 2019 – Newtonian physics teaches us that objects in motion will stay in motion unless acted upon by an outside force. In the case of the U.S. economy, a broad-based softening in economic data is signaling that the global economic slowdown— induced, in part, by ongoing trade tensions—has acted upon the momentum behind U.S. economic growth. Both the manufacturing and service purchasing managers indices for September were softer than expected, with manufacturing activity contracting for the second month in a row.

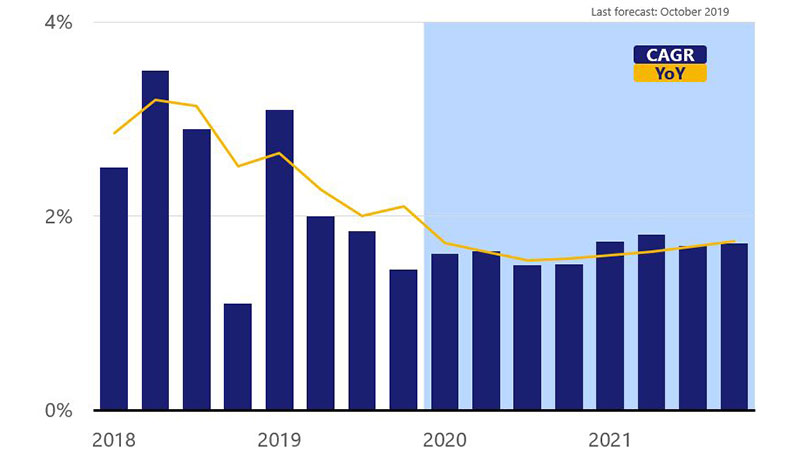

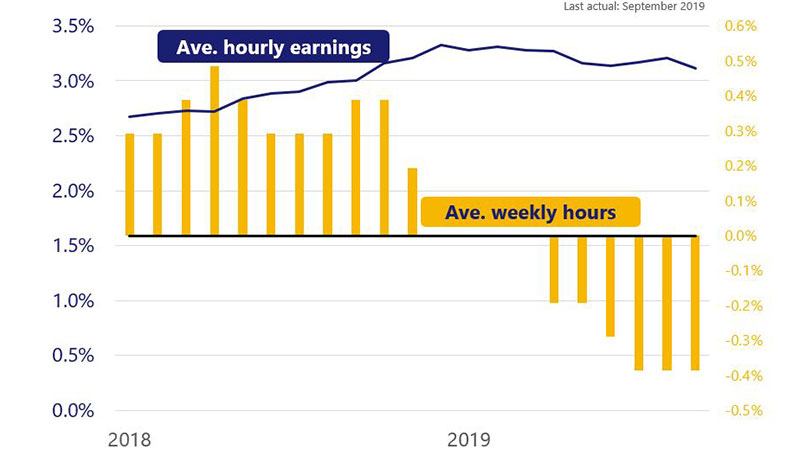

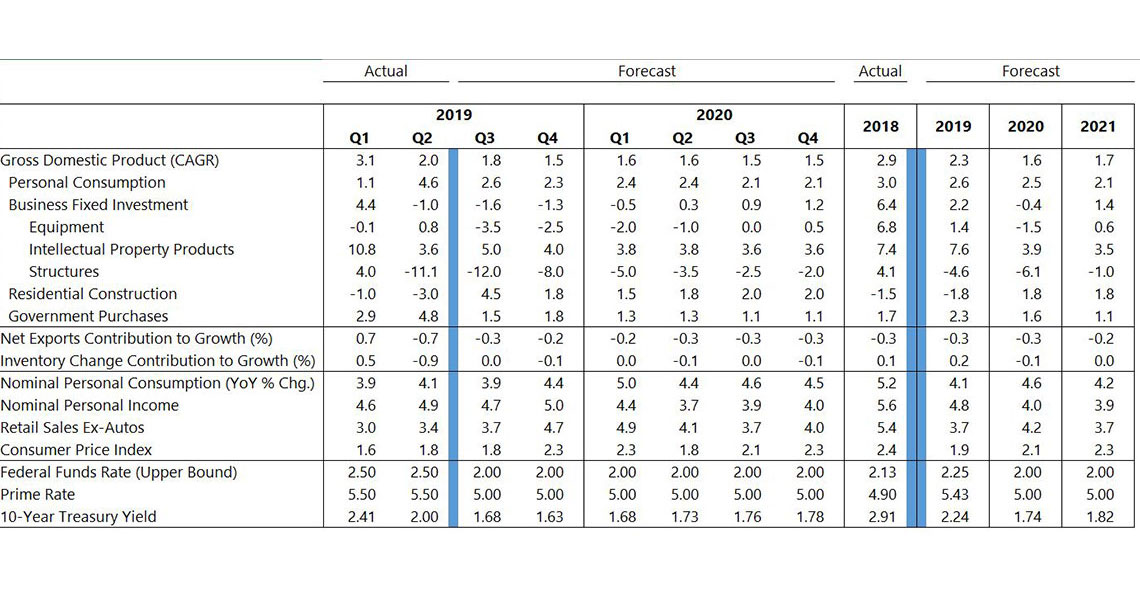

We have been discussing the broad-based slowdown in manufacturing activity for a while, but it is now beginning to permeate the services sector in a more pronounced way. The September employment report was soft in two of the three key measures we track more closely at the late stage of a business cycle: average weekly hours and average hourly earnings. While we do not weigh a single month of soft economic data, the marked downshift has elevated our concern. Our expectation is that fourth quarter Gross Domestic Product (GDP) growth will end up at 1.5 percent, down from an estimated 1.8 percent in Q3, with most of the support for growth coming from consumer spending. The risk that U.S. economic growth can be undermined by outside forces is omnipresent.