April 18, 2017 - Following the United Kingdom’s surprise vote to leave the European Union in June 2016, the value of the British currency has plummeted to its lowest level in three decades against the U.S. dollar. Exchange rate movements of such magnitude can have a significant impact on the cross-border flow of commerce as well as the broader economy.

Issuers in source markets might need to adjust their reward programs and authorization strategies accordingly. Travel merchants, likewise, might benefit from prioritizing business lines that depend on the cross-Atlantic travel. Regardless of the eventual outcome, the U.K.’s travel and tourism industry stands well-positioned to benefit from the devaluation of the British currency and can play a significant role in softening any economic disruption from the U.K.’s breakup with the E.U.

Depreciation of the pound

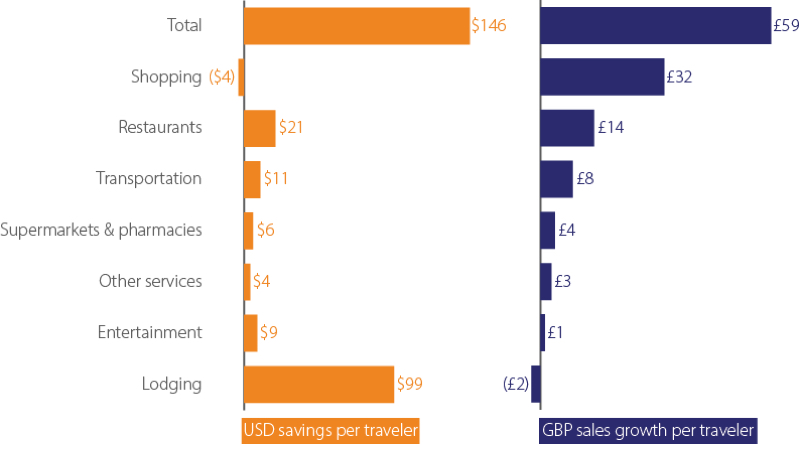

Tracking the effects of the pound’s depreciation on the U.K.’s bellwether travel and tourism industry—accounting for 6 percent of total exports and 13 percent of services exports in 2015—is one way to gauge the impact of the currency’s decline on the British economy. For many international consumers, the weaker British pound made the U.K. a more affordable and desirable travel destination in the months following Brexit. In fact, North American travelers saved an average $146 U.S. dollars per trip on U.K. travel in late 2016, spending1 percent less than a year earlier.

Currency impact

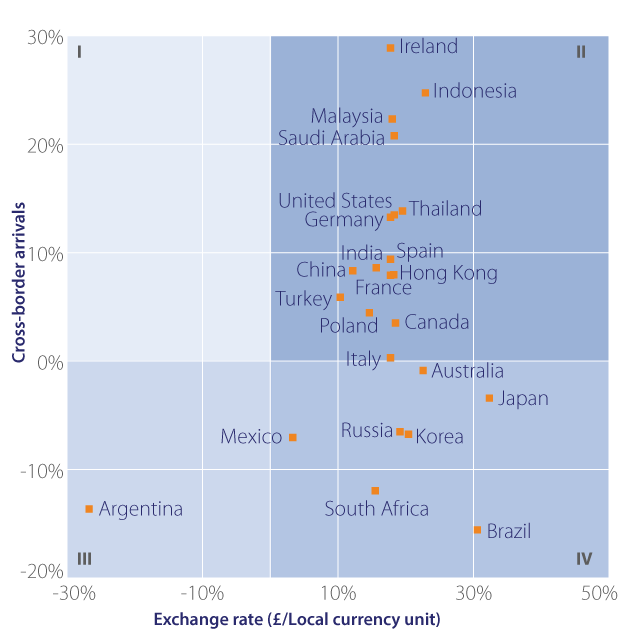

Inbound travel to a country gets a 3 to 4 percent boost for every 10 percentage points of real depreciation in the destination currency, assuming other relevant economic drivers remain the same, according to a recent IMF study. This effect has been closely substantiated with VisaNet data, but no travel corridor truly fits into the “average.” Applying real-time VisaNet data analysis reveals more of the nuances of the impact when viewed on a country-by-country basis.

The U.K.’s real effective2 exchange rate was down 16 percent in the second half of 2016 relative to its value a year earlier. Britain’s improved cost advantage as a destination has correspondingly helped boost inbound travel to the country from a number of origin markets, according to the Visa International Travel (VISIT) database, which shows 6 percent year-over-year growth in total arrivals from more than 80 origin and destination markets globally VISIT tracks on a monthly basis.

Currencies in the vast majority of countries (chart, quadrant II)—including the U.S., Canada, China, Germany, India, and many others—gained against the British pound in the second half of 2016. Consequently, their outbound travel to the U.K. also increased over the same period, according to VISIT. For example, cross-border arrivals in the U.K. from North America increased nearly 12 percent year-over-year (YoY) as the dollar grew stronger at the end of last year.