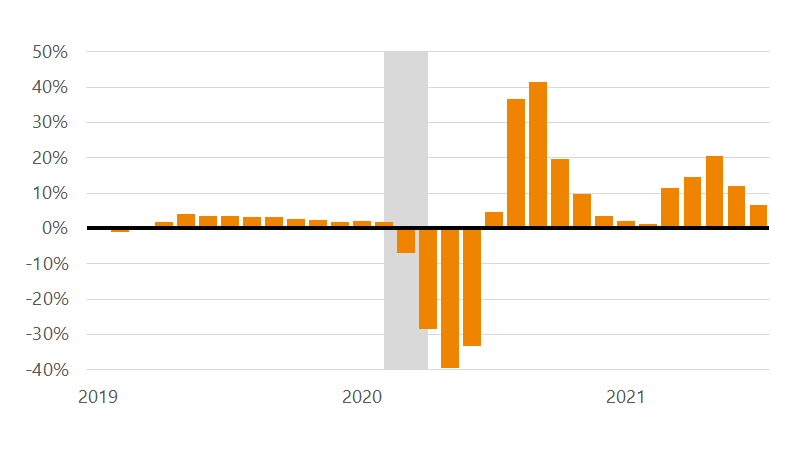

September 21, 2021 – As the COVID-19 case counts continue to rise in the U.S., the economic impact of the latest virus wave is coming into focus. The first sign of concern was a slide in consumer confidence in August, which tumbled 11.3 points to 113.8, erasing all of the gains in the confidence index since March.¹ August’s nonfarm payroll report showed 235,000 jobs were added for the month, the slowest pace since January.² Our forecast assumptions last month had a solid month-over-month (MoM) rise in real consumer spending (normally roughly 70 percent of GDP (Gross Domestic Product) growth) for July but the actual data showed a slight contraction.³ In light of the recent economic data, we now expect the economy to grow at a much more modest 2.0 percent (annualized) in Q3 before accelerating to 4.6 percent in Q4. The more modest pace of economic activity should be short lived, in our view, assuming virus case counts begin to fall. Even with the downshift in economic activity, the Fed is still on course to begin tapering their monthly asset purchases beginning in December of this year.

In addition to the above changes in our outlook, we have also rolled out our forecast for 2023 this month. After expanding 5.4 percent year-over-year (YoY) this year and 3.2 percent in 2022, we expect GDP growth to rise 2.4 percent in 2023. The growth rates we have penciled in for 2022 and 2023 reflect our view that economic activity will gradually return to its pre-pandemic average of 2.3 percent (YoY) in the latter two years of our forecast horizon. GDP growth in 2022 is likely to remain elevated above its long-run average due, in part, to inventory rebuilding efforts that have been hampered this year by the virus.