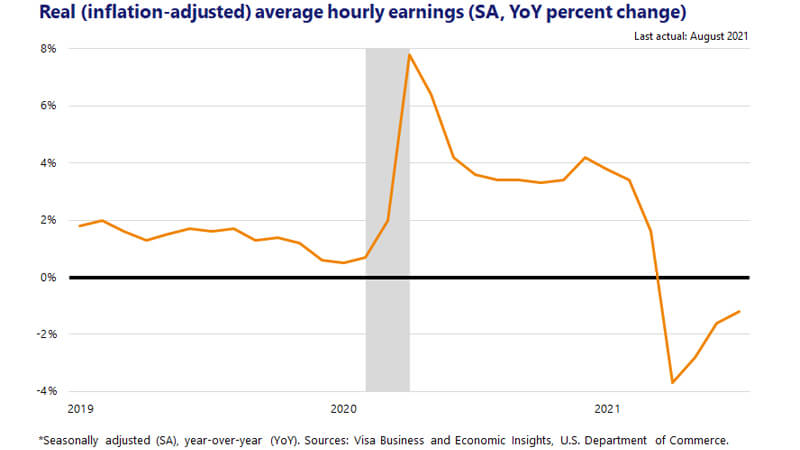

October 14, 2021 – Last month, we downgraded our outlook for Q3 gross domestic product (GDP) growth as incoming economic data, combined with our timely indicator of consumer spending (the Spending Momentum Index), was pointing toward softness. Given the changes made a month ago, our outlook has only been modestly downgraded this month as incoming data has supported our case for 0.4 percent (annualized) growth for Q3. We attribute the downshift in consumer spending and, by extension, GDP growth to two key factors–a surge in the Delta variant and higher consumer prices eroding the purchasing power of consumers.

While it is still early, we see things improving a bit in Q4. For starters, new COVID case counts and hospitalizations have been falling since mid-September, which should help lift consumer spending on services. Inflation pressures, however, are likely to persist through the end of the year and will continue to keep a lid on overall consumer spending growth. Even with the more modest pace of growth through the end of this year, we still expect the Federal Reserve to begin tapering its purchases of assets next month. Beyond the Fed, we continue to be focused on developments on Capital Hill and the possibility of more gridlock around funding the government and lifting the nation’s debt limit beyond the current deadline of December 3rd.

With our revisions to the outlook this month, we now see GDP growth expanding 5.3 percent this year, 3.2 percent next year and moderating closer to its long-run average at 2.6 percent in 2023.