July 6, 2020 – Small businesses reporting a decrease in operating revenue since last month fell 18.3 percentage points from May to June, according to the Small Business Pulse Survey. As most states enter more advanced stages of reopening, gains in revenue should continue to grow.

Small businesses that reported cash on hand that will cover three or more months of expenses increased nearly 8 percentage points from May to June. However, they are also less optimistic than last month that they will be able to return to business as usual in six months or less. The pace of reopening for many states has been slow, which is causing more firms to anticipate a return to normal coming next year instead.

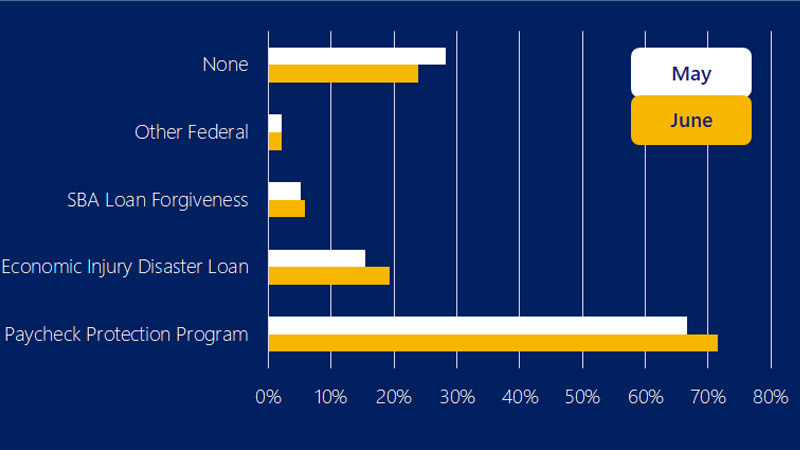

With businesses reporting more cash on hand, they are also increasingly more likely to report staying current on payments. SBA loans and support from financial institutions appear to be helping small businesses to avoid falling behind on payments and maintain business operations.

— Michael Brown, Principal U.S. Economist

SBA-led federal aid programs and the lifting of stay-at-home restrictions are beginning to alleviate much of the burden small businesses have carried since March. However, small businesses are less optimistic about a return to normal this year due in part to fears that recent infection spikes could slow reopening.

— Travis Clark, Assoc. U.S. Economist