June 24, 2020 – “Small businesses are facing unprecedented challenges due to the COVID-19 pandemic,” said Wayne Best, chief economist at Visa. “While Congress has enacted large SBA-led lending programs, the loss of demand due to widespread stay-at-home orders has left most small businesses in a very precarious position.”

Small business spending declined sharply in Q1 as the uncertainty of the health crisis unfolded and sales plummeted due to stay-at-home orders; however, states are beginning to open up, with restrictions gradually being lifted in most places.

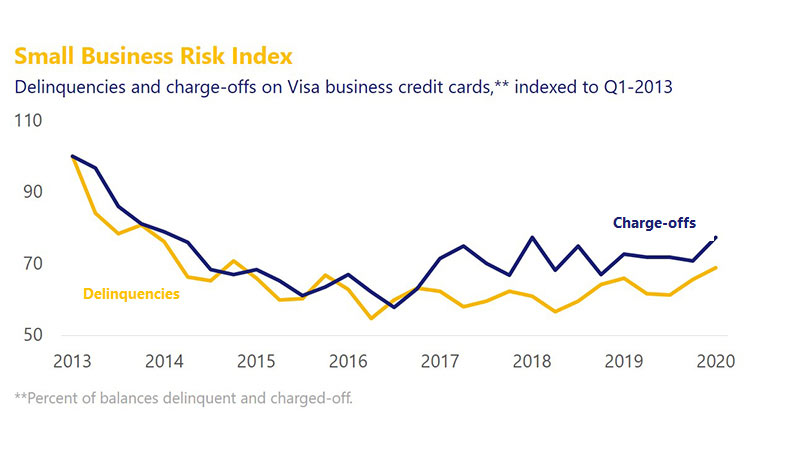

Outstanding balances on Visa business credit cards dropped 2.6 points, but may increase as lost revenues kick in and borrowing becomes more necessary. Risk, on the other hand, ticked up with increases in both delinquencies (+3.3) and charge-offs (+6.6). Whether federal assistance programs and forbearance regulations can help stem the tide remains to be seen.

Half of small businesses were either at risk of closing (45 percent) or anticipated they would need to close (5 percent) because of the COVID-19 pandemic, according to a Q1 survey conducted by Kelton Global on behalf of Visa. Most small businesses are looking for assistance to stay afloat, either through flexible payment options (81 percent), relief from debt payments (78 percent), or access to loans (73 percent).