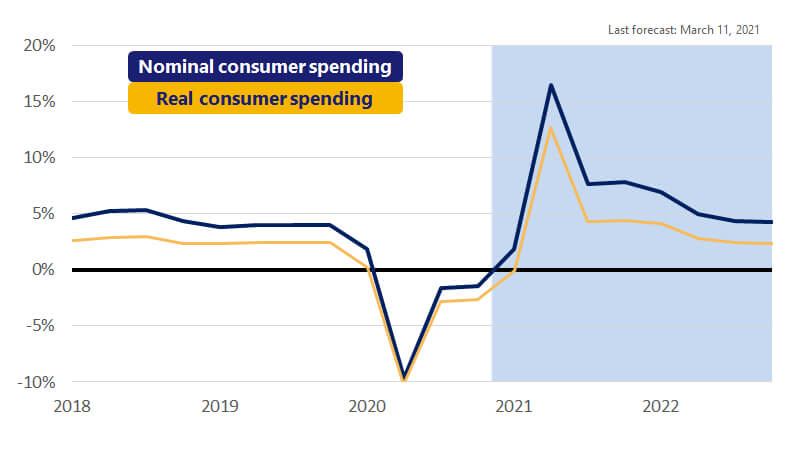

March 12, 2021 – Incoming economic data over the last month has been mixed. U.S. job growth in February was robust, with 379,000 jobs added, and the unemployment rate edged lower to 6.2 percent, according to the U.S. Department of Labor. Income growth and consumer spending were solid in January, the vaccine rollout gained momentum and Congress was on the cusp of enacting another round of fiscal stimulus. There are, however, a few headwinds to growth that emerged as well. Severe winter weather across the South and New England regions appears to have weighed on consumer spending in February, while supply chain issues have slowed the pace of inventory rebuilding. Strong domestic demand is boosting import growth but slower vaccine rollouts globally are weighing on export growth. Combined, these factors resulted in a downward revision to our Q1 real gross domestic product (GDP) growth estimate to 2.2 percent. While we downgraded a number of sectors, we now expect net exports and inventories to subtract as much as 2.2 percentage points from GDP growth this quarter.

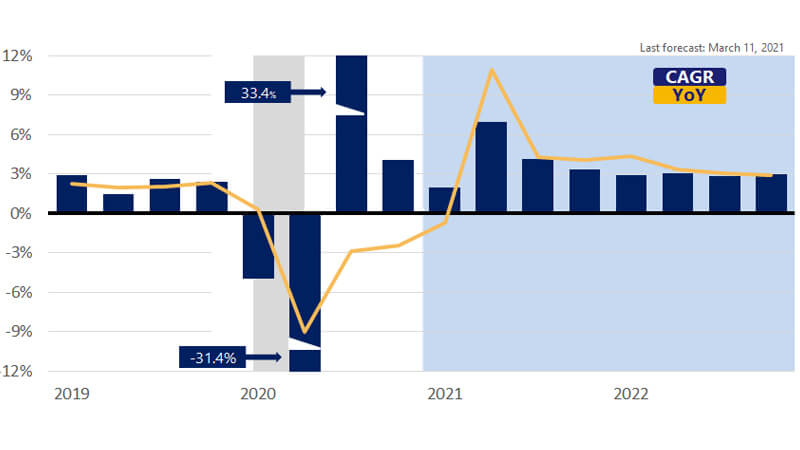

Looking ahead to the rest of this year, Q2 will likely shape up to be the strongest quarter of the year (Real GDP chart) fueled by the passage of the $1.9 trillion stimulus package. The short-term boost from stimulus should begin to fade in the second half of the year as inflation pressures build. The likely result is that real, inflation-adjusted, economic activity will begin to decelerate as the purchasing power of consumers and businesses is eroded. The anticipation of higher inflation pressures later this year is driving interest rates higher and thus will likely reduce housing affordability later this year and into 2022.