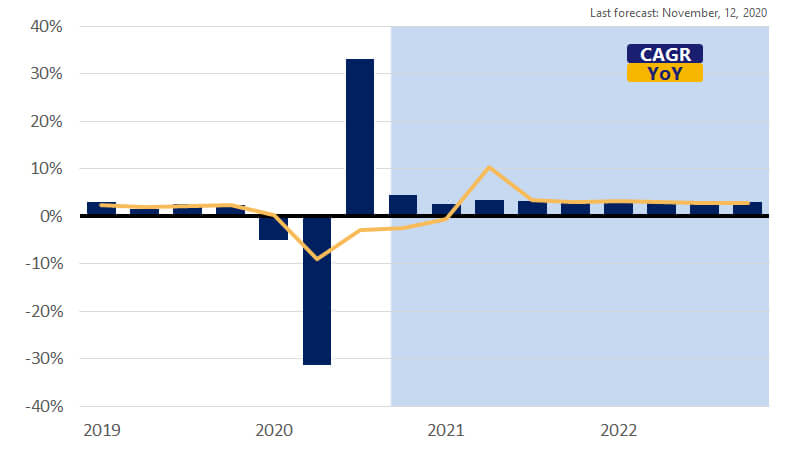

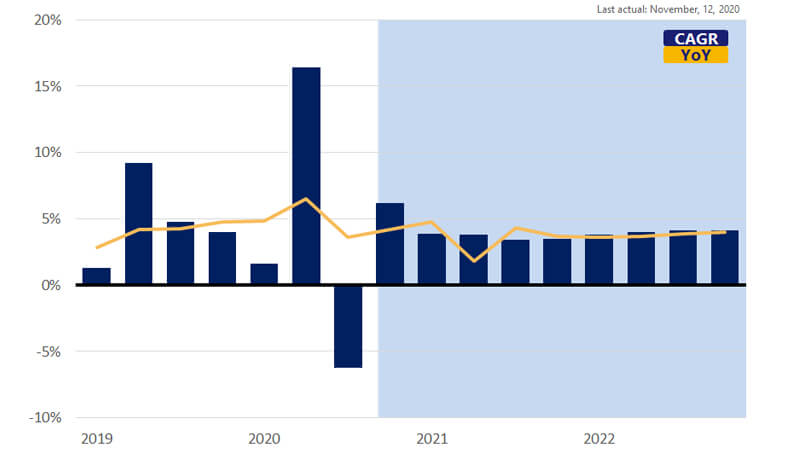

November 20, 2020 – With the presidential election in the rear view mirror after several days of counting votes, attention now turns to the near-term fiscal policy concerns. This month, our revised forecast reflects our belief that some form of stimulus will be passed during the lame duck session of Congress this year. Furthermore, we anticipate that Congress and the administration will avoid a government shutdown in early December when federal funding is set to run dry. Aside from the fiscal policy challenges, the third major wave of COVID-19 cases continues to spread throughout the U.S. While the epidemiological trend this fall was expected, the magnitude appears to be quite severe. In light of these two competing forces, higher GDP growth from a stimulus package and lower GDP growth from slower spending due to virus concerns, we have revised our outlook a bit higher for Q4 but lowered our expectations for growth entering 2021.

We now estimate fourth quarter GDP growth to be 4.5 percent (annualized) before downshifting to 2.6 percent in Q1 of next year. Full-year GDP growth for 2021 is expected to rise 3.9 percent before moderating to 2.9 percent in 2022. Control of the U.S. Senate remains a toss-up, but for now we are assuming President-elect Biden will be facing a divided Congress next year. We do not foresee any major fiscal policy changes in 2021 that would lead to upward revisions to our current baseline forecast. As has been the case for months now, we remain very concerned about the adverse impact of the coronavirus case surge eroding consumer confidence, and by extension consumer spending.