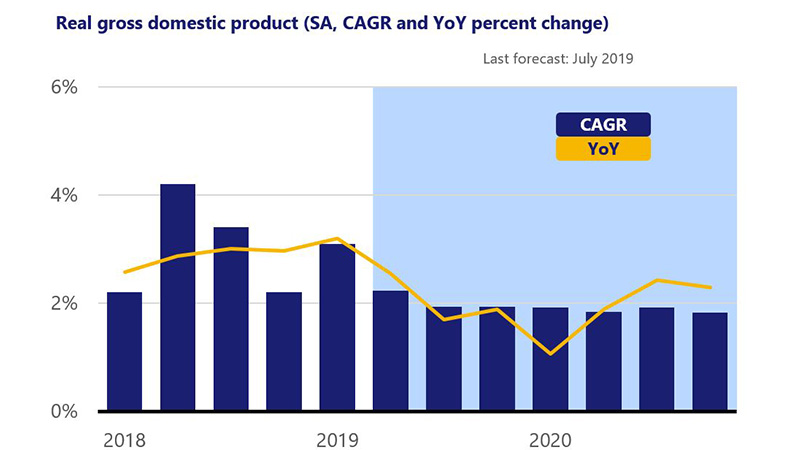

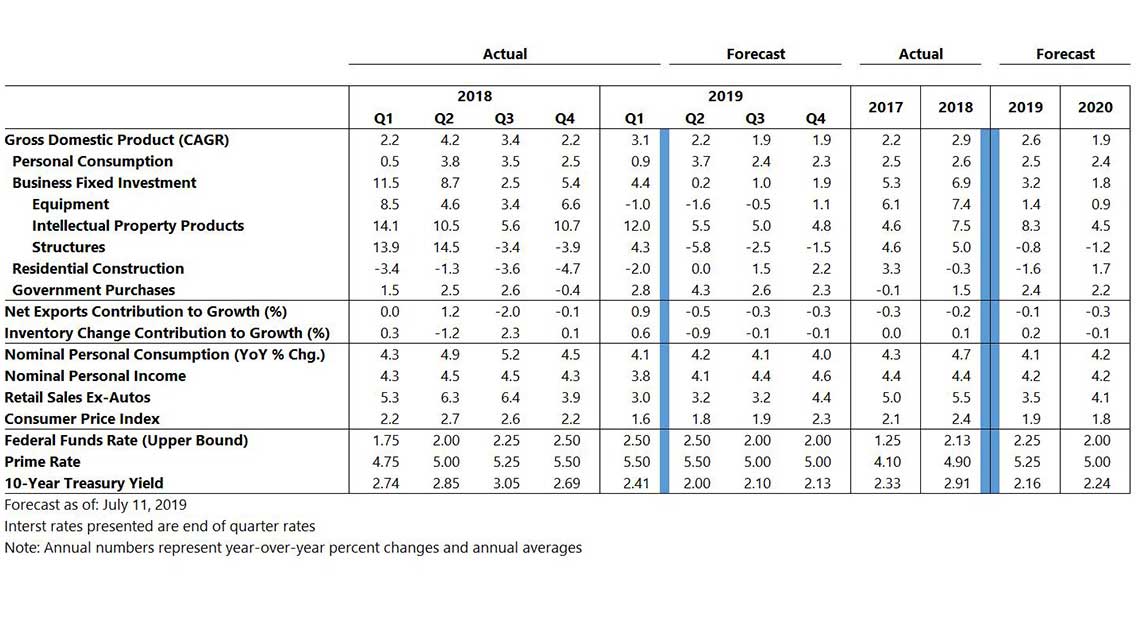

July 10, 2019 – To cut or not to cut (rates)? That is the question members of the Federal Open Market Committee (FOMC) will be debating later this month. Economic data is mixed, with coincident economic data such as employment growth showing continued strength while more forward-looking data such as business sentiment indices showing signs of softness. Furthermore, inflation readings have been below the Fed’s expectations, something it hopes a rate cut could help correct. The FOMC will likely cut rates twice this year, trying to nudge inflation closer to its 2 percent target and offset the slowdown in U.S. manufacturing. With ongoing trade tensions feeding global economic softness, it’s doubtful that Fed policy will be successful in boosting inflation and business demand.

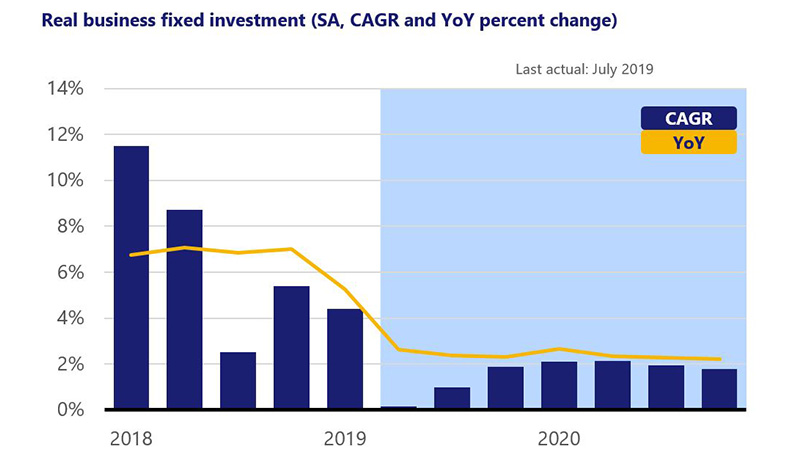

One of the big modifications to the forecast this month is a downward revision to business investment over the entire forecast horizon. Ongoing uncertainty related to trade policy along with more modest global economic growth will likely keep business investment restrained for the near future. Businesses are expected to remain cautious at this late stage of the business cycle. Consumer spending, however, should remain relatively stronger following a soft first quarter as job gains and wage growth help to support further spending activity.