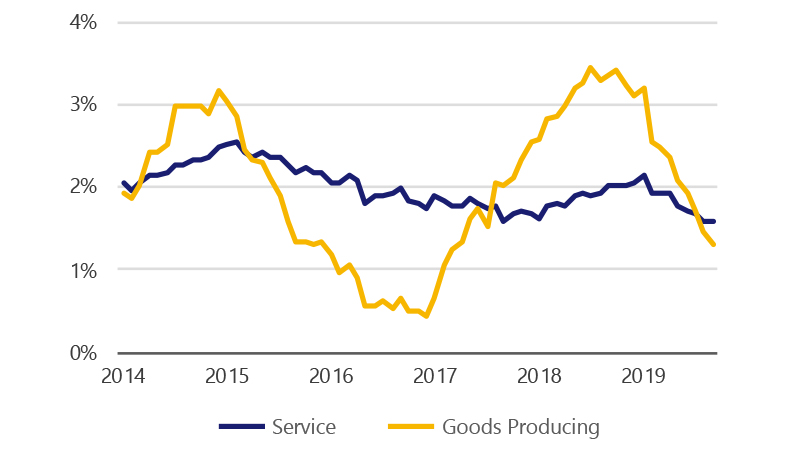

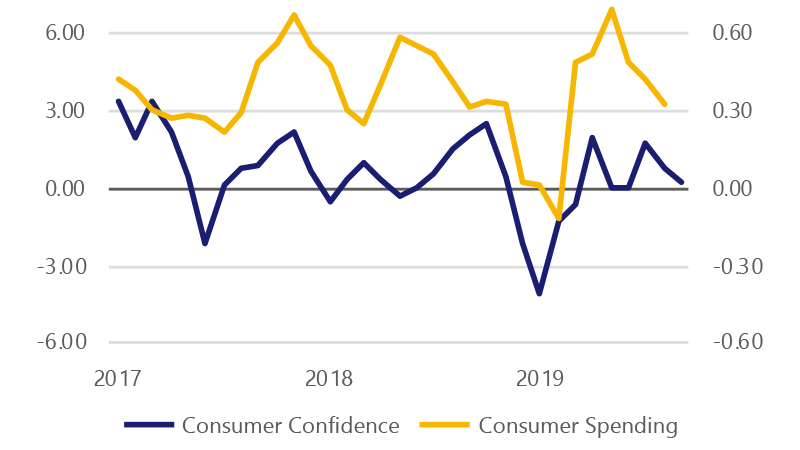

The holidays are quickly approaching and shoppers are expected to be a bit more cheerful this holiday season. While the pace of job growth has slowed recently, overall consumer economic conditions remain relatively solid. Thanks in part to more modest inflation, real average hourly earnings are up 1.9 percent on a year-over-year (YoY) basis as of September compared to 0.7 percent the same time last year. Consumers’ current assessment of the economy is also on par with last year’s readings.

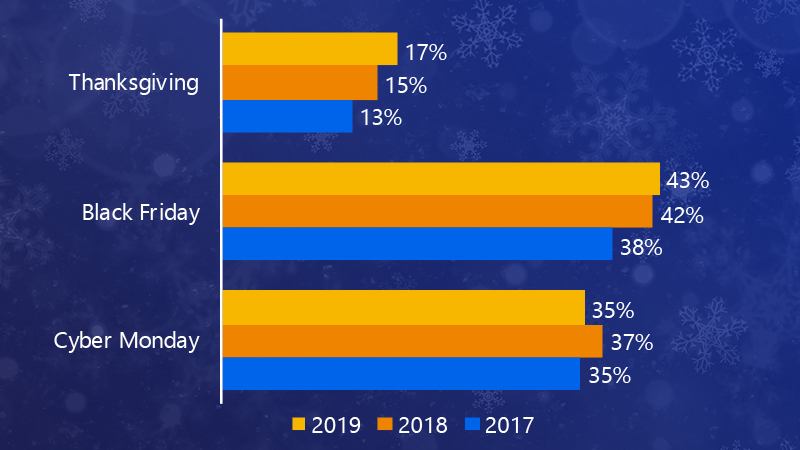

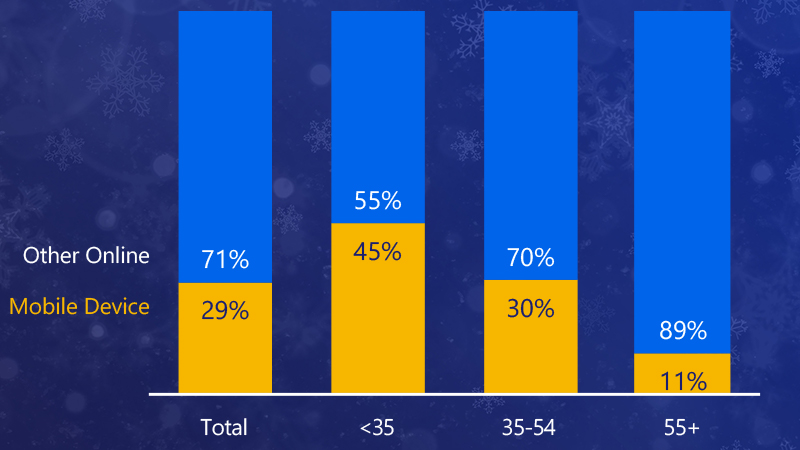

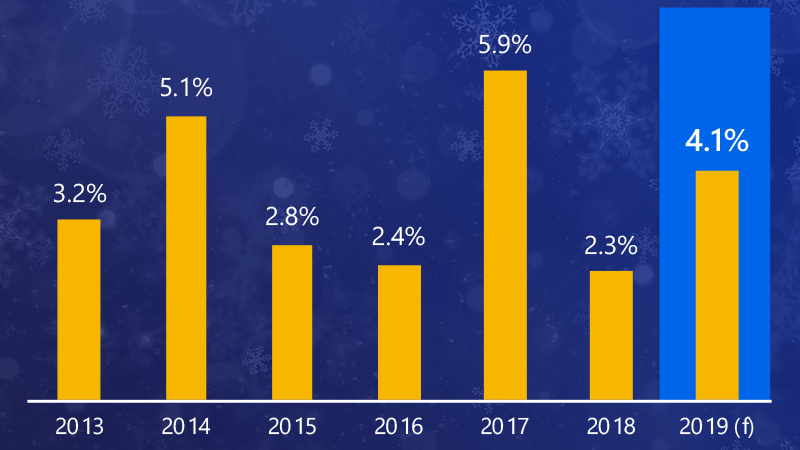

U.S. holiday spending* is likely to grow 4.1 percent (YoY) on all forms of payment, according to Visa Business and Economic Insights. This forecast represents an acceleration from the 2.3 percent gain in 2018. On average, consumers expect to spend $618 on gifts this holiday season, up from $608 last year, according to survey data from Visa and Prosper Analytics. While this holiday shopping season is expected to be better than last year’s, there are also risks to be aware of. Namely, the potential for another federal government shutdown during the holiday shopping season. Trade tensions could also weigh on equity markets and thus consumer confidence. Absent these negative factors, it looks like the U.S. consumer should have a holly jolly end to 2019.