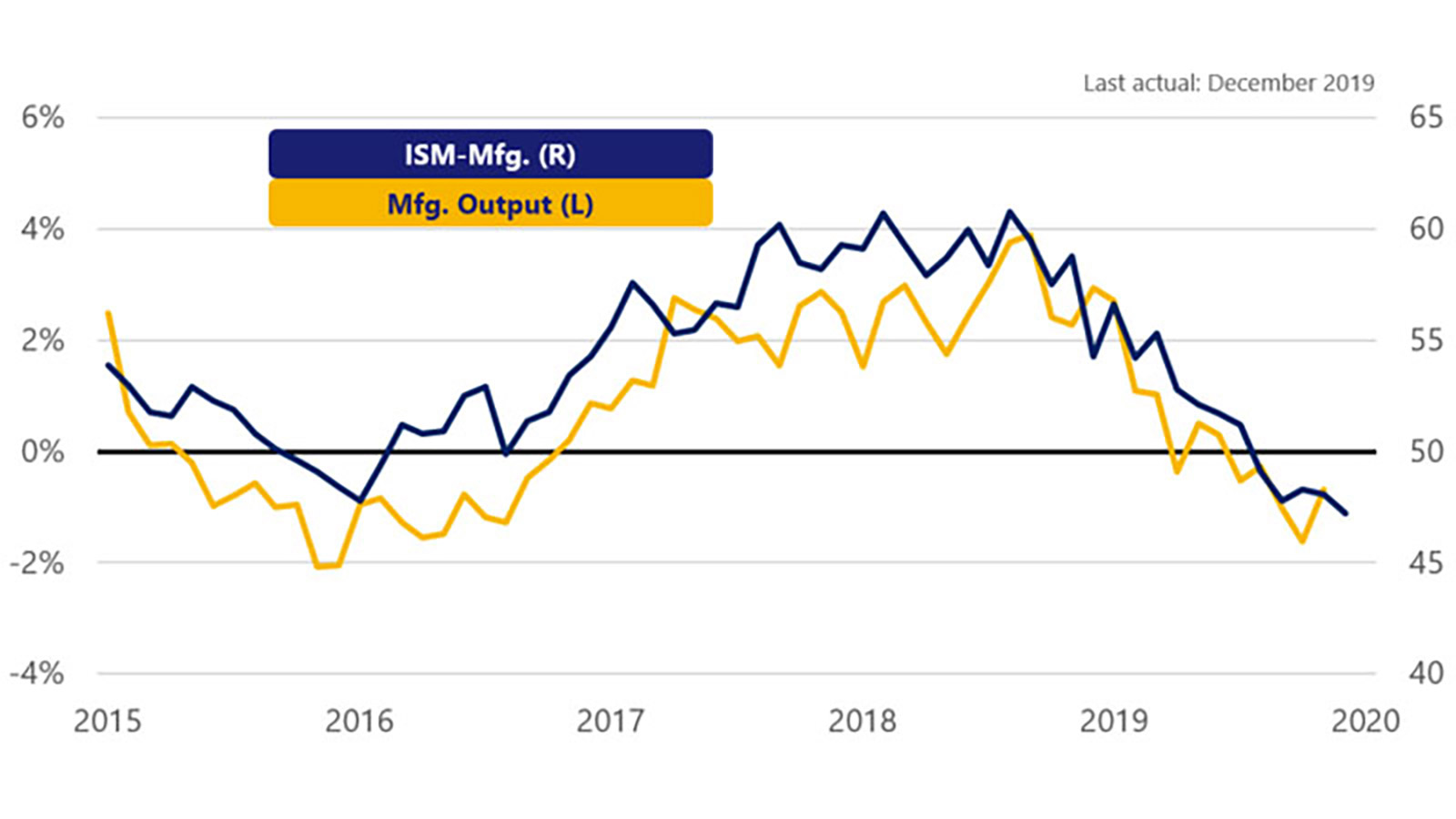

January 22, 2020 – Equity markets continue to hit all time highs, inflation remains tame, consumer confidence remains at elevated levels, and job gains remain solid. For most of the U.S. economy, times are good. However, the manufacturing sector continues to struggle. The ISM Manufacturing Index slid to 47.2 in December—the fifth straight month of contraction and the lowest reading since June 2009 (bottom right graph). The ISM Index provides a very good sense of how real output in the sector performed in the month and suggests, even with a trade truce with China, that lingering issues remain for the sector. For certain manufacturing pockets around the nation, it might feel more like the worst of times.

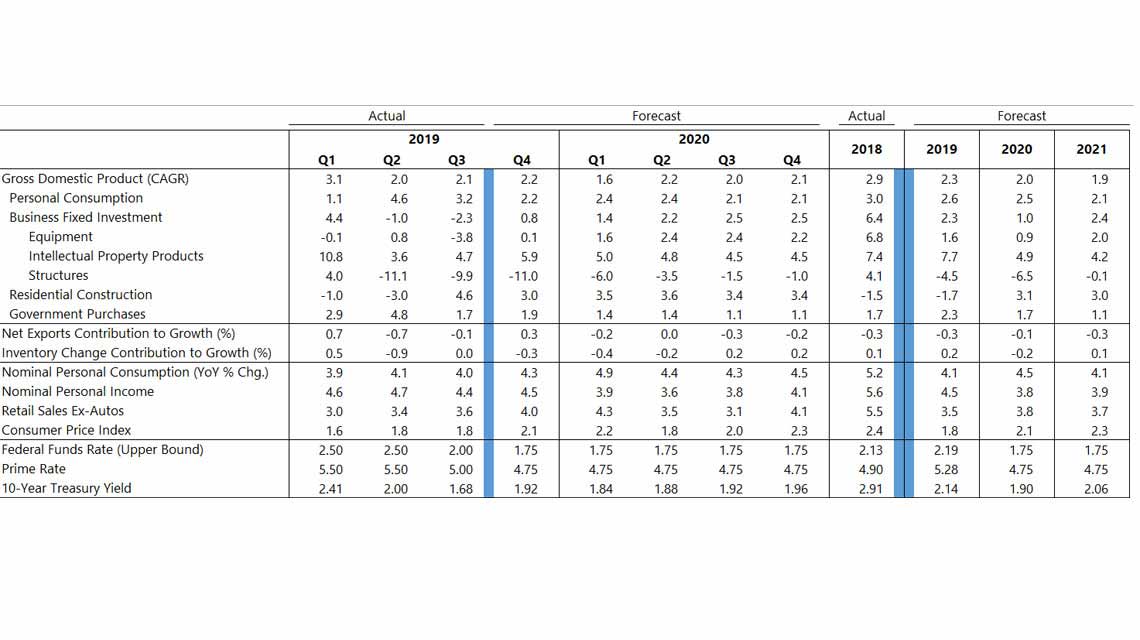

This month we have upwardly revised our outlook for Q4 GDP growth to 2.2 percent as net exports are now expected to add to growth for the quarter, while the pace of inventory building is expected to be less of a drag than we thought last month. First quarter GDP growth is now likely to be softer than expected as ongoing issues with Boeing’s 737 Max weigh on the pace of inventory building. At the same time, net exports once again are expected to begin pulling down GDP growth, with imports growing faster than exports.

Highlights:

- Manufacturing sector struggling

- Core GDP growth expected to hold up in 2020

- Interest rates not likely to change much this year

- Trade issues could re-emerge again this year