Fashion resale apps enable circular economy’s broadening appeal

October 2023 – The circular economy is gaining a foothold in the global economy, with multiple trends converging to create new opportunities for businesses and governments worldwide as consumers shift towards buying more sustainable and recycled goods. One driver of the circular economy is a groundswell of concern about the state of the planet, coupled with increased efforts to set policy around resource efficiency and waste management. As more consumers prioritize buying responsibly-manufactured and sourced goods, businesses are exploring new circular business models to address the demand: everything from shoes made out of recycled plastic bottles to second hand and online fashion resale platforms. The circular economy represents a small but growing portion of the global economy—it could generate $4.5 trillion in additional economic output by 2030 and $25 trillion by 2050.¹ Using Visa data, coupled with external data sources, we can shed light on some of the new ways that consumers have started to navigate in the circular economy.

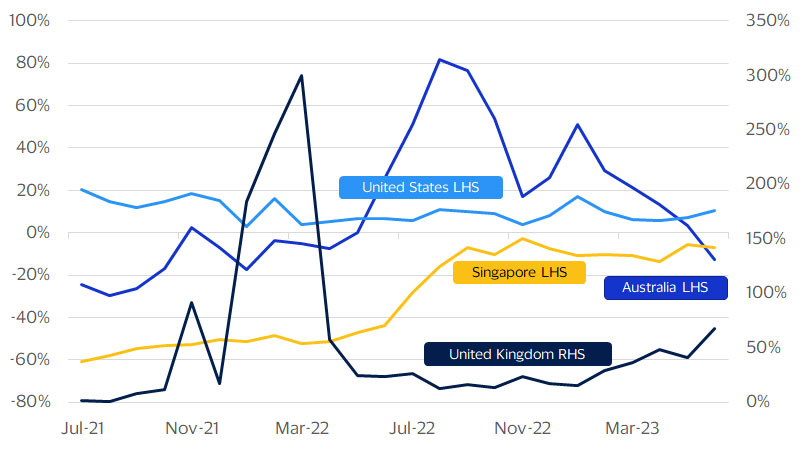

Consumers’ changing fashion preferences signal an important development in the circular economy. Setting aside the vast overproduction challenges in fashion—a truckload of textiles is landfilled or incinerated every second globally²—there’s an increased cost to consumers in some cases that is changing how they buy their clothes. High inflation has been a catalyst. During the pandemic, inflation spiked in many countries due to supply chain shortages. The United Kingdom recorded its highest rate of inflation for clothing in more than 30 years, reaching 10.2 percent in March 2022. In Australia, it surged 9.2 percent in September 2022. Budget-conscious consumers inevitably started substituting new goods with secondhand goods at a time when incomes were also not keeping up with inflation. According to Visa data using Visa-branded credentials, both Australia and the U.K. experienced stronger growth in the number of card transactions in used merchandise stores during periods of higher clothing inflation in 2022 (see figure below).

Change in transaction counts at used merchandise stores across regions

(Year-over-year)

Card transactions in the United Kingdom for used merchandise stores grew by 300 percent in March 2022, when clothing inflation surged. Further, growth in both transaction counts and amounts in used merchandise stores outpaced that of general clothing stores in Australia, the United Kingdom and the United States in periods of high clothing inflation.

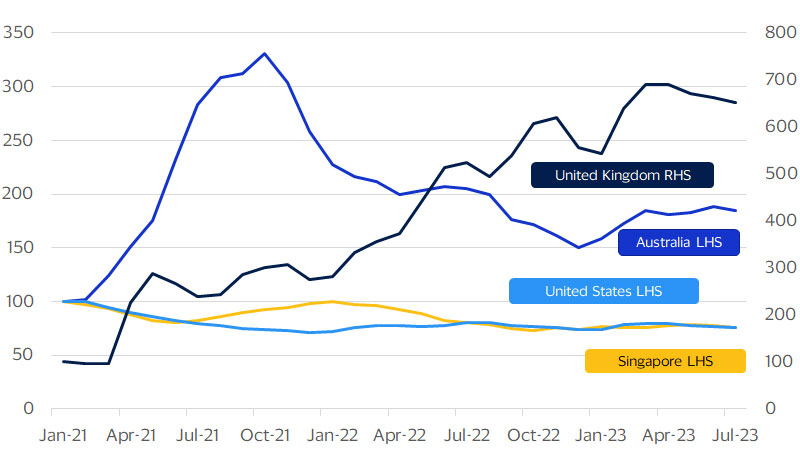

Technology has also played a pivotal role in changing consumption patterns towards the circular economy. Thrifting has existed for decades, but technology has accelerated its uptake, especially in recent years by reaching a wider and younger audience through digital apps. The pandemic played a role in this, as people had to use digital apps to communicate and transact remotely. This entrenched people’s behavior towards the use of digital apps post-pandemic. In 2022, for example, as inflation remained elevated in the United Kingdom, growth in daily use of the top resale shopping apps in the United Kingdom surged more than 200 percent (see figure below). Interestingly, the resale shopping app activity in Asia Pacific, including Singapore and Australia, saw a slowdown from the second half of 2022. This could be due to the re-opening of borders in Asia Pacific and people more focused on travel-related apps rather than resale shopping apps.

Average daily active users of resale shopping apps have varied across regions

(Indexed to Jan-21 levels)

For the United States, the number of daily active users of resale shopping apps has been strong since 2019, although growth in the past 10 months has been tepid given the market’s already high user base. While growth in daily active users may be weak, growth in sales in online fashion resale platforms is expected to perform well given the large market. According to Insider Intelligence,³ sales via online fashion resale platforms are projected to grow by 16 percent from $12 million in 2022 to 14 billion in 2023. This will be in part driven by Gen Z and younger millennials‘ interest in thrifting and sustainability, as well as high cost-of-living pressures. Inflation could have also caused U.S. consumers to scrimp on physical products such as clothing to spend on experiences instead .⁴

The circular economy within the fashion industry is expected to account for 23 percent of the global fashion market by 2030.⁵ The second-hand market is estimated to become twice the size of fast fashion by 2029. The circular economy may reduce demand for durable goods in the short term. But, more intensive use of these goods will require more frequent repairs and replacements, giving rise to an entirely new ecosystem of commerce platforms and associated payments infrastructure.

AI and blockchain could usher in the next wave of the circular economy

Circular economy transformations such as those underway in the fashion industry are just the beginning of fundamental changes that could take hold over the coming decades. The vision for a circular economy encompasses existing business models such as thrifting, recycling and the sharing economy, and expands to include fundamental design changes that will allow the world to delink economic prosperity and growth from the consumption of natural resources. In a circular economy, businesses and consumers will prolong the use of existing materials and resources in the economy as long as possible, thereby reducing waste. New forms of economic organization could see customers shift from ownership of materials or goods to using, renting, sharing and borrowing. In these models, manufacturers retain ownership so as to better control and direct the full life cycle of a product.

Emerging technologies such as artificial intelligence (AI) and blockchain technology could catalyze the transition to a circular economy. AI can strengthen circular economy business models, such as product-as-a-service, by using real time and historical data of products and users. Throughout the product lifecycle, AI can assist with pricing, demand prediction, predictive maintenance and smart inventory management. For example, companies are using AI to enhance the consistent classification of used products that will be re-sold at existing secondhand markets. By giving consumers a voucher or a giftcard that can be used at the original retail brand, it boosts customer loyalty.⁹ The blockchain technology has the potential to create traceability and transparency in supply chains.¹⁰ The smart contracts used in blockchain allows a supplier to buy back products when buyers no longer have a need for it . By using interactive machine-learning methods for prototyping and testing, AI can enhance as well as accelerate the development of products and materials. For instance, AI has been used to research and create new metal alloys that perform in more efficient ways, be used longer and manufactured with minimal waste in comparison to existing metal alloys.¹¹

As high inflation continues to encourage more consumers to adopt circular consumption behaviors, AI and blockchain technologies will help power these opportunities in the sustainable space. And, the payment ecosystem will provide the infrastructure necessary for the circular economy to grow.

Footnotes

- Lacy, P. & Rutqvist, J.. (2016). Waste to wealth: The circular economy advantage. https://newsroom.accenture.com/news/the-circular-economy-could-unlock-4-5-trillion-of-economic-growth-finds-new-book-by-accenture.htm

- European Commission, March 30, 2022, https://ec.europa.eu/commission/presscorner/detail/en/QANDA_22_2015

- Insider Intelligence, April 2023, “U.S. Online Fashion Resale 2023”

- Visa Business and Economic Insights, American Mood Trend, May 2023, “Consumers paint an increasingly pessimistic view of the future”

- Ellen MacArthur Foundation, Circular business models: redefining growth for a thriving fashion industry (2021)

- Ellen Macarthur Foundation, Financing the circular economy - Capturing the opportunity, 2020

- The World Bank. 2022. “Squaring the Circle: Policies from Europe’s Circular Economy Transition”

- International Labor Organization, May 2018, World Employment and Social Outlook 2018: 24 million jobs to open up in the green economy (ilo.org)

- Ellen MacArthur Foundation, 2019, Artificial intelligence and the circular economy - AI as a tool to accelerate the transition

- Deloitte, 2023, “Using blockchain to drive supply chain transparency”

- Ellen MacArthur Foundation, 2019, Artificial intelligence and the circular economy - AI as a tool to accelerate the transition

Forward Looking Statements

This report may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook”, “forecast”, “projected”, “could”, “expects”, “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.