December 17, 2019 – Economic data this month continues to reflect a bifurcated economy, with the business side of the economy still showing signs of softness while economic data related to the consumer side of the economy continues to point towards solid growth. As we noted in our Holiday Sales Outlook, the U.S. economy faces some key risks this month. In addition to a possible federal government shutdown, yet-to-be-resolved trade issues have the potential to cause shocks in both the equity markets and business and consumer confidence. Sound familiar? Last year, this exact combination of a government shutdown and trade tension-induced equity market sell-off led to a disappointing end to the 2018 holiday shopping season.

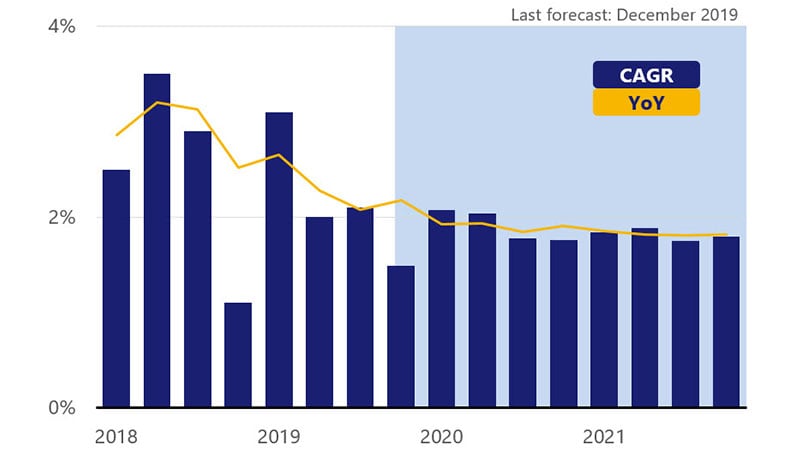

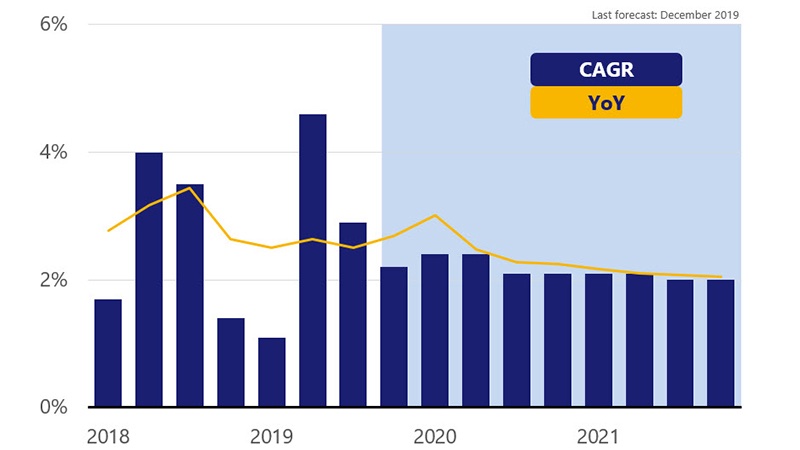

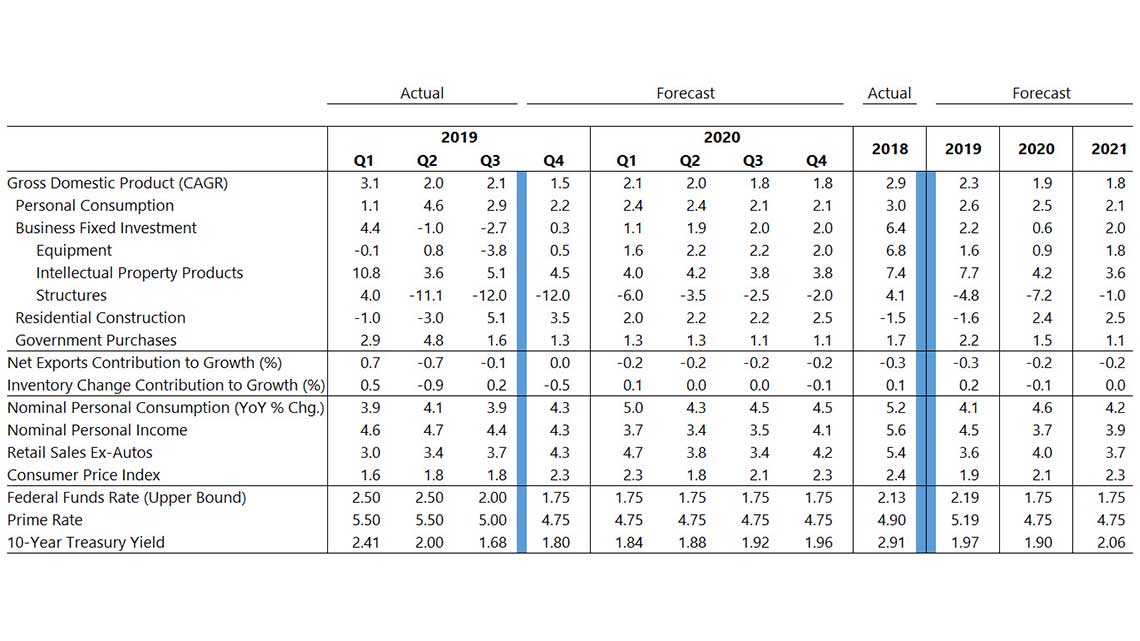

Our forecast (P.2) assumes a government shutdown is avoided but does not assume a complete resolution to ongoing trade issues between the U.S. and China. As such, our fourth quarter gross domestic product (GDP) growth estimate reflects growth of 1.5 percent. Real consumer spending should rise 2.2 percent on an annualized basis in Q4 before accelerating in the first half of 2020. Business investment will remain soft, rising just 0.3 percent for the quarter.

Highlights:

- Slower Q4 GDP growth

- Consumer fundamentals remain solid

- The Fed is likely on hold for a while

- Expect trade issues to weigh on the outlook