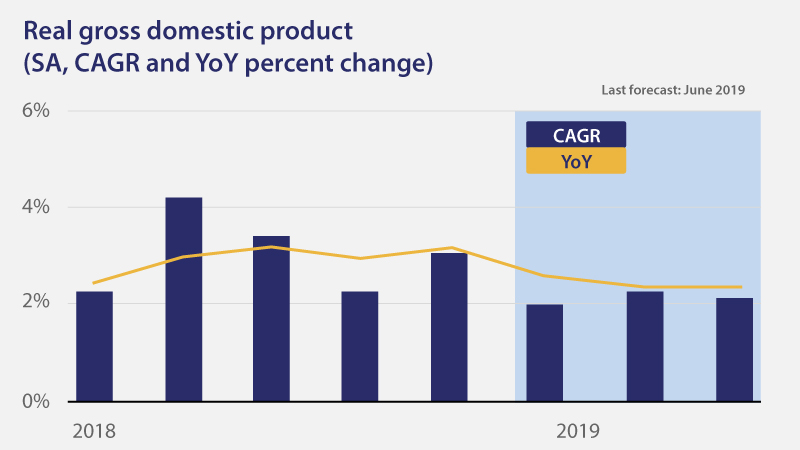

Consumer spending to support 2019 growth

While a number of risks remain, one bright spot to the outlook is the consumer sector. Real consumer spending is expected to rise 2.7 percent in the second quarter before moderating in the third and fourth quarters of 2019. On a nominal basis, consumer spending is expected to rise 4.2 percent this year. With a downshift in auto sales expected as the year progresses, the primary drivers of consumer spending growth should be services and retail goods. If continued equity market sell-offs persist, consumers may begin to pull back on spending. Additionally, higher prices passed on to consumers from additional tariffs may begin to erode the purchasing power of consumers going into the critical fall holiday season.

Implications of the inverted yield curve

In response to recent equity market sell-offs, global investors have been piling into safe U.S. assets such as 10-year U.S. Treasury Notes. This is resulting in an inverted yield curve—short term interest rates are higher than long-term rates. When such behavior persists, banks become less willing to lend, drying up credit. We remain cautious in our outlook for both business and consumer spending given that the inverted yield curve environment is likely to stick around for a bit longer. It does not signal the end of growth but does add yet another headwind to the economy.

Key risks to the outlook

For the second month in a row we highlight trade tensions as the number one downside risk to our growth outlook. While tariffs on Mexico have been avoided, there remains a risk of further tariffs on imports from China. This would create a challenge for the Fed in trying to balance job growth and keep inflation in check. We suspect the Fed will look past the near-term effects of the tariffs and keep rates unchanged. Manufacturing would likely continue to bear the brunt of any new tariffs and slow the growth of consumer spending on such goods. In the near-term, we would expect higher inflation readings likely beginning in the third quarter of this year. On balance we now see more downside risks to growth than upside over the next two years.

Forward-Looking Statements

This report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook,” “forecast,” “projected,” “could,” “expects,” “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.