May 30, 2021 – Retail sales excluding autos fell 0.8 percent month-over-month (MoM) in April after consumers exhausted stimulus payments from the prior month. Year-over-year (YoY) growth in retail sales ex-autos is now up 40.6 percent, given the low base during the lockdowns in April 2020. Restaurant spending rose 3 percent MoM as the country eased restrictions on indoor dining. Consumers favor spending on goods versus services and that divergence actually widened in March despite most states progressing with reopenings and vaccinations.

Nominal disposable income grew 32.3 percent YoY in March. Government stimulus checks and other pandemic-related assistance roughly doubled from the previous month, boosting income by 21.1 percent MoM. The savings rate spiked up to 27.6 percent and is almost triple the long-run average.

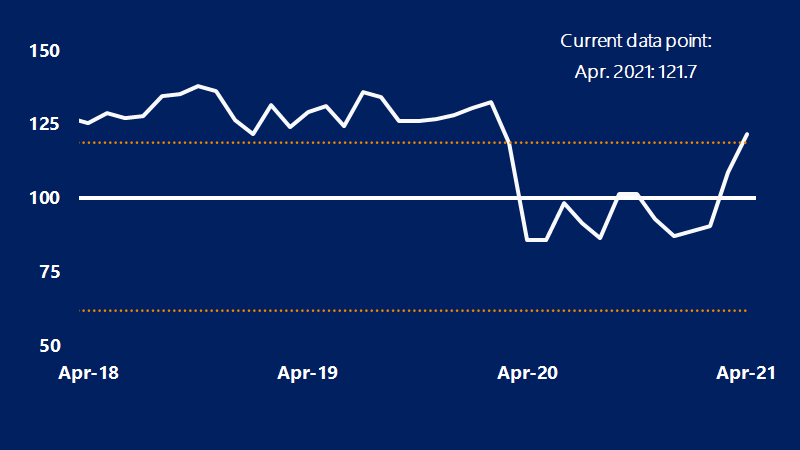

“Now that we are lapping the sharp contraction in spending this time last year, many year-over-year readings are difficult to interpret,” said Michael Brown, Principal U.S. Economist. “That said, the impressive rebound, fueled in part by the stimulus payments, has kickstarted consumer spending into high gear to begin Q2.”

Consumer prices rose 0.8 percent MoM in April, pushing prices up 4.2 percent YoY. Core prices, which exclude food and energy, rose 0.9 percent MoM or 3.0 percent YoY. Roughly half of the monthly increase in Consumer Price Index (CPI) was from areas that cannot get workers (e.g. restaurants, hotels) or areas that have supply constraints (e.g. auto-related sectors). Lower labor force participation rates and heavy supply constraints put upward pressure on prices.

“The Conference Board survey shows that consumers feel jobs are plentiful, which is in line with recent employment reports”, said Jeffrey Roach, Sr. U.S. Economist. “Consumer confidence in New England, Mid Atlantic and Pacific regions is very close to fully recovering.”