September 15, 2020 — The Conference Board Consumer Confidence Index fell to its lowest level since 2014 in August, likely a combination of increased COVID-19 cases in various parts of the U.S. and the end of some government stimulus programs. Consumers are also beginning to see some rent moratoriums and deferrals on debt payments expire, with uncertainty surrounding extension or expansion of these programs at a local or national level.

The Present Situation Index—based on consumers' assessment of current business and labor market conditions—had been on a two month run of increases, but led the August decline, dropping by nearly 12 points to 84.2 from 95.9. The Expectations Index—based on consumers' short-term outlook for income, business, and labor market conditions—decreased to 85.2 from 88.9 in July. Until this portion of the index shows solid and steady improvement, it is likely that spending growth will be equally muted.

The percentage of consumers who believe business conditions will improve in the coming six months dipped slightly after a steep decline last month and volatility in consumers’ assessment of business conditions remains historically high.

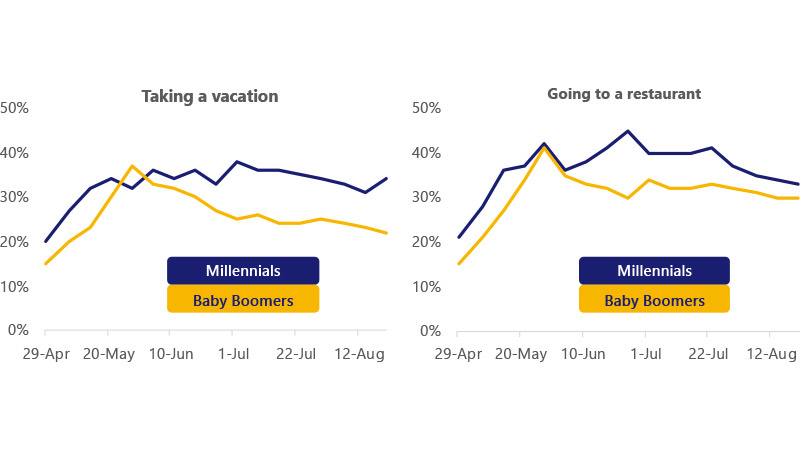

After increasing for several weeks in late spring, the percentage of consumers who were comfortable engaging in what was considered everyday activities before the pandemic has been on the decline. Until recently, adults in the United States were steadily growing more confident that they would be able to safely return to public spaces in the near future, according to high-velocity consumer data gathered by Morning Consult. The latest trends vary by age group and activity, however. Millennials had the highest comfort level with most activities, but converged close to levels of other age groups and the population for certain activities in recent weeks.

Highlights:

- August consumer confidence fell, led by a plunge in the Present Situation Index

- Business expectations also worsened slightly

- Millennials becoming less comfortable going out to eat, but have a higher comfort level than other consumers with taking a vacation