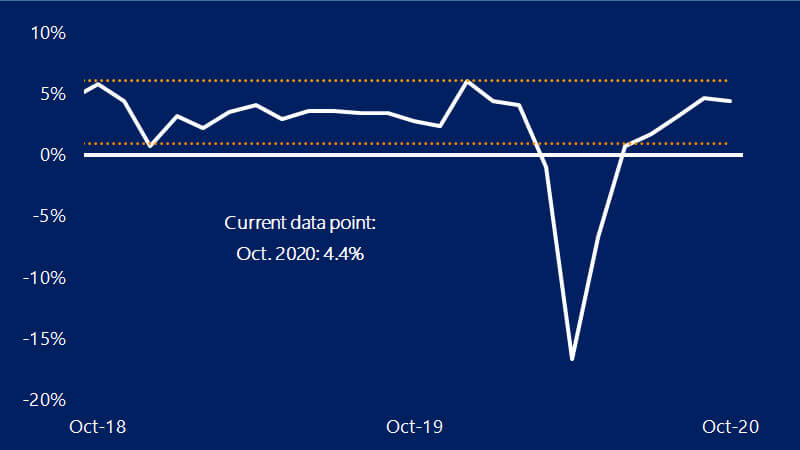

December 4, 2020 – October retail sales (excluding auto sales) rose 0.3 percentage points from September’s level to a 4.4 percent year-over-year (YoY) growth rate. Non-store (e-commerce) sales remained robust in October and are up 26.3 percent YoY. Gasoline sales and clothing sales were down 13.7 and 11.3 percent, respectively, reflecting the ongoing pandemic effects on these sectors of more people working from home. Control group sales* pointed towards a much slower pace of consumer spending to start Q4.

Stimulus effects continued to support nominal disposable income growth, which rose 6.9 percent above last year’s level. The all-important wage and salary component returned to positive territory for the first time since the trough of the recession in April, rising 0.5 percent YoY. The saving rate remained elevated, at 14.3 percent.

Nominal consumer spending accelerated again in September, rising 1.4 percent from the prior month. Nominal spending continued to slowly inch towards recovery, with total spending down 0.6 percent on a YoY basis. The recovery in consumer spending remained unequal across spending categories—goods purchases were up 8.2 percent YoY verses services spending, which remained down (4.6 percent) relative to last year’s levels.

“October retail sales data pointed towards a downshift in the pace of consumer spending,” said Michael Brown, Principal U.S. Economist. “While income growth remains robust, due in part to continued stimulus effects, nominal consumer spending remains well below pre-pandemic growth rates.”

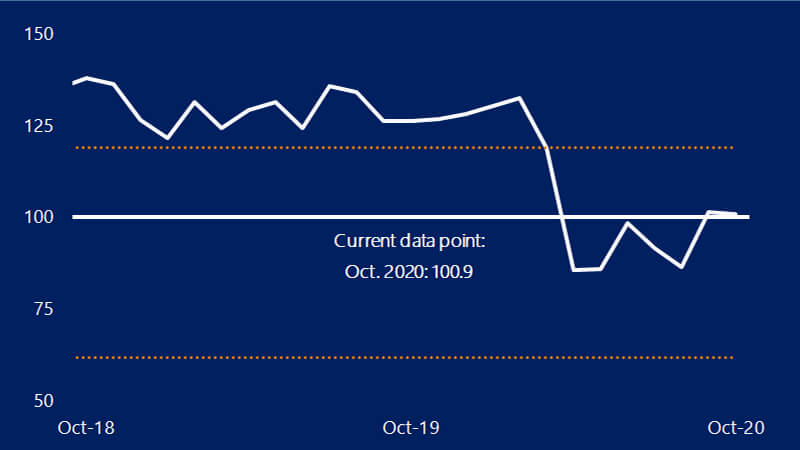

“After a strong September, consumer price growth, consumer confidence, and job growth all took a slight step backward in October,” said Travis Clark, Associate U.S. Economist. “New spikes in COVID cases and the lack of a new stimulus package have impeded the rebound in confidence.”