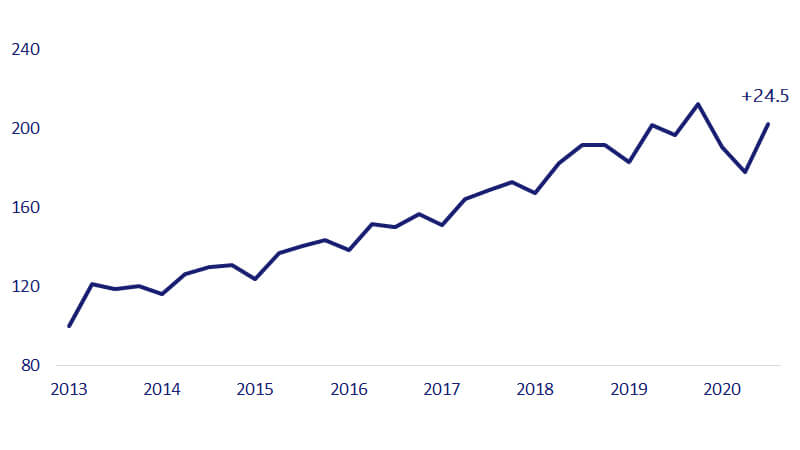

December 7, 2020 – After two straight quarters of small business spending falling sharply, spending on small business cards had a significant rebound in the third quarter (+24.5), according to the Visa Small Business Spending Index. The ability for many small businesses to reopen hinged on investing in materials to prevent COVID spread, such as plexiglass dividers in restaurants. Despite revenues remaining low, many small businesses ramped up spending to be able to open their businesses safely.

Outstanding balances on Visa small business credit cards slid for the third consecutive quarter(-1.9). Although small businesses are spending, they are also wary of taking on any new revolving debt while revenues remain far below pre-pandemic levels.

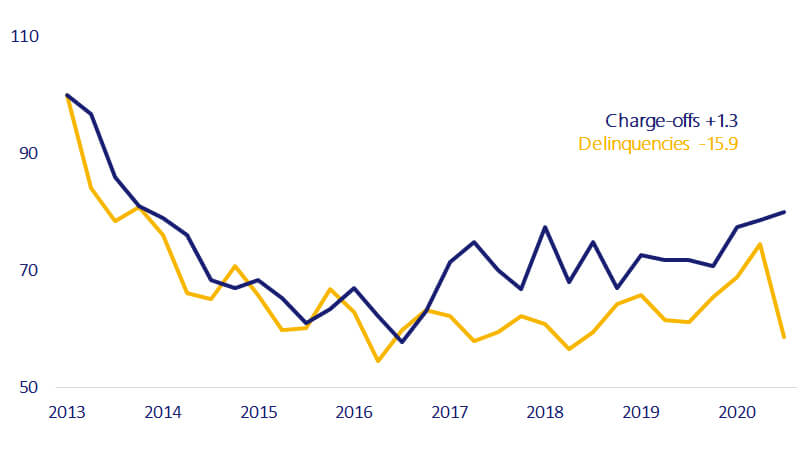

While charge-offs increased modestly in the third quarter (+1.3), delinquencies plummeted (-15.9). As small businesses navigate this turbulent time, their hesitation to take on revolving debt has increased the share of credit card debt that remains current. Bank loans and federal assistance continued to be the preferred borrowing path for small businesses.

"Despite the ongoing challenges of the pandemic, small business spending has rebounded significantly. Small businesses are far less likely to be delinquent on their credit cards, but this is primarily due to remaining uncertainty around the pandemic that has kept small businesses from borrowing more on their credit cards."

Wayne Best

Chief Economist, Visa Inc.