December 1, 2020 – November and December are the two most important shopping months of the year for over 120 countries1 and half of the world’s population. One-fifth of all retail sales (less autos, gas and restaurants2) occur during these months. Given the pandemic-related losses earlier in 2020, both small and large businesses face greater financial pressure for a strong ending to the year. For businesses within the more economically developed and mature economies, holiday sales are likely to meet if not surpass last year’s levels. Three factors are cause for the optimistic view: a shift in consumers’ spending mix in favor of retail sales, a bounce-back in spending in previously closed sectors, and the move (for many) to working from home.

2020 holiday sales start strong globally

Retail sales are back on track for some countries

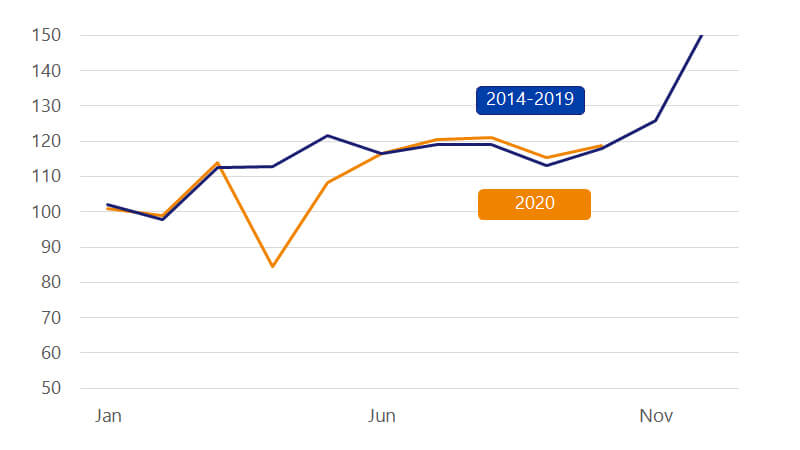

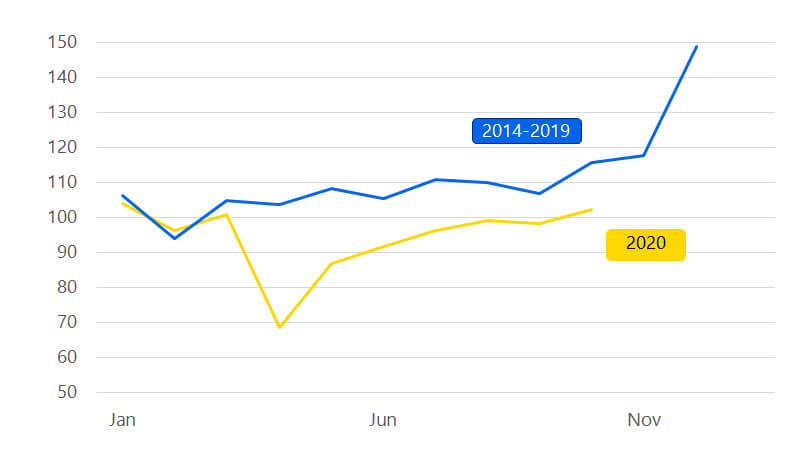

As the holidays approach, retail sales growth globally has taken on a K-shape, with more developed, advanced economies3 recovering faster as their offline spending approximates their typical seasonal trend. Retail sales in emerging markets, in contrast, remain depressed. In some cases, sales are actually losing strength. The recent divergence between the two groups of countries comes after a fairly synchronous downturn. Retail sales over the first nine months of 2020 fell 5 percent compared to the same period in the previous year in each group of countries.

Why have advanced economies recovered faster? Four factors contributed. First, governments in advanced economies had much greater capacity to provide income support to their households and businesses, collectively adding deficit spending equal to 7 percent of total output, which is twice as much in relative terms compared to emerging markets. Second, emerging economies are more dependent on cross-border trade and commodity prices, both of which declined sharply, and therefore had a disproportionately more negative impact on household incomes. Advanced economies were better able to preserve their small businesses. As of October, only two out of every three small and medium-sized businesses in emerging markets had card activity. In comparison, three out of every four small businesses were active during the same month in advanced economies. Lastly, the first wave of the pandemic lingered longer, with more devastating impact on emerging markets, especially in Latin America, than it did elsewhere in the world.

Beyond these macro-issues, the way in which consumers have adjusted to the challenges faced by the pandemic also provides a boost to holiday sales this season in advanced economies. Taking a closer look at two of the world’s largest advanced economy markets—the United States and the European Economic Area (EEA)4—reveals that consumers adapted in three distinct ways that could explain why holiday sales may be stronger than general economic conditions suggest.

More highlights:

- Advanced economies have recovered faster from the economic downturn

- Three distinct ways in which consumers have adapted in those markets help explain why

- COVID-19 Economic Impact Index

- Regional recovery updates

- Small and medium-sized businesses show greater resilience to a global surge in cases

Advanced economies have largely closed the gap in offline retail sales (January-February = 100, 2015 $US)

Offline retail sales continue to lag in emerging markets (January-February = 100, 2015 $US)

Adaptation #1: Spending shifts from closed to open sectors

Health restrictions and social distancing have disproportionately impacted restaurants and hotels throughout much of this year. In April, only 20 percent of restaurants and hotels in the EEA, and 56 percent in the U.S., remained open. Today, more restaurants and hotels are open, but activity in the sector remains subdued relative to food retailing. As a result, consumer spending on eating out is now increasingly spent on food at home. In both the EEA and U.S., the share of consumer spending on restaurants and lodging is down 3 percentage points, while grocery spending is up 5 percentage points in the EEA and 3 percentage points in the U.S. To accurately capture these shifts in spending, this analysis relies on price and exchange rate-adjusted comparisons across countries and categories.

For the purposes of tracking holiday spending, these shifts matter because restaurant spending is not counted towards holiday sales, whereas food purchased at stores is. So, while the current wave of infections is leading to greater restrictions on restaurants and suppressed restaurant spending, it also reinforces a stronger holiday sales reading due to the grocery component. Moreover, in the U.S., higher than average inflation in food prices should also help to boost holiday sales on a nominal basis. Supply chain disruptions, inclement weather last year, and strong consumer demand have caused households to spend more on groceries than before.

Adaptation #2: Working from home creates new demand

Since telework has become the new normal, consumers have scrambled to make their living spaces more comfortable for spending more time at home. In the European Union, only 15 percent of workers had ever worked from home prior to the pandemic; now it’s close to 40 percent.5 A similar shift has occurred in the U.S. While the trend appears to have peaked in the EEA and plateaued in the U.S., growth in spending on housing, utilities and household goods remains elevated relative to pre-pandemic levels. In both markets, consumers are now allocating an additional percentage point of their total spending to purchasing goods and services for their homes. While this increased level of spending most likely will continue through the rest of the year, over the medium-term it remains to be seen whether households will continue to spend as much at home once offices re-open and travel and tourism resumes.

Adaptation #3: Spending bounces back when lockdowns are lifted

Spending in some categories tends to bounce back once the danger passes. During the pandemic, clothing and footwear purchases that were deferred during the peak of the lockdowns came back once shops re-opened. While both the EEA and U.S. were hit at the same time, of note is how they have diverged during and after the peak. EEA consumers’ greater reliance on in-store clothes shopping—accounting for 69 percent of all pre-pandemic apparel sales—likely drove the EEA’s sharper fall during peak lockdowns. In the U.S.— where only 59 percent of apparel sales were in-store, consumers were more accustomed to online shopping, and retailers had established online sales channels—the pandemic-induced dip was shallower. Since the lockdowns were lifted, in-store clothing purchases in the EEA and U.S. have fallen to 57 percent and 47 percent of all sales, respectively. In the EEA, at least 13 percent of online sales is done through e-commerce marketplaces and platforms, versus 30 percent in the U.S. These trends indicate that more consumers in both markets are now shopping online than before.

Momentum should carry retail sales through the holidays

The shifts in spending and consumer savings resulting from the lockdowns should help to support spending through the holiday season. However, spending trends into mid-2021 are less certain. Growth and spending could slip backwards due to the coronavirus resurgence and expiring fiscal support to households and businesses. The evolution of spending in emerging markets provides a cautionary example of how fragile spending gains can be. Additionally, when we decompose the trends in growth, what stands out is how much current spending growth relies on households of more limited means. Since the pandemic started, spending by the affluent has remained depressed. Until that changes, consumer spending will depend on a more narrow set of households and could be more prone to setbacks.

Forward-Looking Statements

This report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook,” “forecast,” “projected,” “could,” “expects,” “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the U.S. Securities and Exchange Commission (SEC). Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

Studies, survey results, research, recommendations, opportunity assessments, claims, etc. (the ‘Statements’) should be considered directional only. The Statements should not be relied upon for marketing, legal, regulatory or other advice. The Statements should be independently evaluated in light of your specific business needs and any applicable laws and regulations. Visa is not responsible for your use of the Statements, including errors of any kind, or any assumptions or conclusions you might draw from their use.