Cracks beginning to form

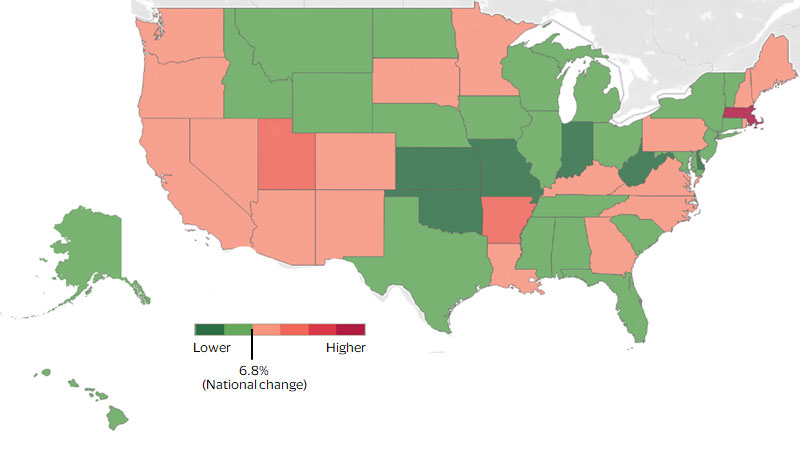

May 2023 – Across the U.S., cracks are forming in the foundation of the economy. Weakness in the labor market appeared in the first quarter, as unemployment insurance claims grew 6.8 percent nationwide compared to the 2022 average. Regionally, this was most evident in the West. Initial employment claims in most Western states grew faster than in the nation overall (see map below). High borrowing costs have been an important catalyst in the recent softness in the housing market, as well as the construction, tech and banking sectors. The West is highly exposed to tech and construction, which we expect will translate into relatively larger declines in employment, economic growth and consumer spending in the region. While high interest rates have not yet led to large-scale job losses in the manufacturing sector, average weekly hours for manufacturing employees declined both year-over-year (YoY) and quarter-over-quarter in Q1-2023. We expect the pivot from goods to services, along with reduced investment by firms, to weigh on the manufacturing sector. Because the Midwest is heavily dependent on manufacturing activity, the Midwest should also underperform during the downturn later this year.

Unlike the West and Midwest, the Northeast and South are less exposed to rising loan costs, which will limit the magnitude of their respective economic slowdowns. Both regions have a high concentration of employment and gross domestic product (GDP) in education services, health services and government, all sectors that are less reliant on business loans. The Northeast’s high degree of exposure to the banking industry—which is now facing downward pressure on profits due to short-term rates moving above long-term rates—poses a significant challenge for that region’s economy. The South, on the other hand, has far less exposure to interest-rate sensitive sectors and has profited greatly from decades of high in-migration. We expect that these structural factors and long-run trends will benefit the South, causing the region to lead all others through 2023.

Highlights:

- Northeast: A sturdier foundation

- South: A source of strength in tough times

- Midwest: On the precipice of a slow decline

- West: It’s not just tech

Western labor markets are under pressure

Q1-2023 average initial unemployment insurance claims (change from 2022 average, by state)

Northeast: A sturdier foundation

In the fourth quarter, the most recent data available, the Northeast once again posted a YoY GDP growth rate that was only outpaced by the South. The Mid-Atlantic (New York, New Jersey, Pennsylvania) was a source of strength in the region due to substantial job creation in education and health services. While economic growth in New England (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont) remained relatively subdued in the fourth quarter, Massachusetts and Maine recovered their pre-pandemic levels of employment thanks to strong job gains in the leisure and hospitality and transportation and warehousing sectors.

Strong employment gains in leisure and hospitality, education, and healthcare have continued into 2023. As a result, we expect the entire Northeast to finally recover its pre-pandemic level of employment. This continued employment growth likely contributed to strong consumer spending and GDP growth in the first quarter of 2023. While a recession is likely to hit the nation later this year, it should have a relatively mild impact on the Northeast. While we expect slower lending activity and high short-term interest rates to squeeze banking industry profits, we do not expect this to have a significant impact on employment or economic growth outside of New York and Connecticut. Similarly, weakness in the Northeast tech industry should be largely confined to Massachusetts and New York, as neighboring states have comparatively lower levels of tech exposure. Furthermore, the education and healthcare sectors are expected to fare much better than most other sectors. Since these two sectors dominate employment in the Northeast, we expect that the negative impact on consumer spending and GDP growth brought on by the coming recession to be relatively mild in the region. Our forecasts indicate that both spending and economic growth in the Northeast will trail only the South in 2023.

South: A source of strength in tough times

The final quarter of 2022 concluded with the South leading all other regions in GDP and employment growth. Its main source of strength, the West South Central Division (Texas, Louisiana, Oklahoma, Arkansas), was heavily bolstered by YoY GDP growth in Texas and Arkansas that ranked first and fourth highest in the nation, respectively. High mining employment growth in Texas and strong wholesale trade employment growth in Arkansas drove increased incomes and thus boosted GDP growth. Over the course of 2022, consumer spending and GDP growth in the South were shored up by states with high in-migration over the past two decades, such as Texas, Florida, Georgia, North Carolina and Tennessee.

We expect the South’s strong growth in 2022 to carry into the first quarter of 2023. Our forecasts indicate that Oklahoma, Mississippi and Delaware will finally recover their pre-pandemic levels of employment, leaving just D.C., Maryland, Louisiana and West Virginia as the only states to not reach that level. While the South will still be hit by the recession in mid 2023, given its lower share of GDP and employment exposure to interest-rate sensitive sectors, we expect it to outpace all other regions. Even the expected manufacturing downturn will be less negative in the South thanks to auto demand remaining relatively healthy, which should limit job losses in the East South Central (Alabama, Kentucky, Mississippi, Tennessee). High employment in government and sectors that are highly dependent on government in Virginia, D.C., and Maryland will also be a source of strength for the South Atlantic (Delaware, D.C., Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia and West Virginia). We expect that GDP and employment growth in West South Central will be far less impacted, due mostly to Texas’s economy, which will likely avoid a significant slowdown. As a result, we expect the South to lead all other regions in GDP, consumer spending and employment growth in 2023.

Midwest: On the precipice of a slow decline

The Midwest finished 2022 lagging the national average in consumer spending, GDP and employment growth. While the Midwest outperformed the West in GDP growth in the final two quarters of 2022, the region continued to underperform the West in consumer spending and employment growth. Lower inflation levels contributed to slower consumer spending growth, but the slowdown was also likely the result of a slow employment recovery. As of Q4-2022, only Indiana, Missouri, Nebraska and South Dakota had recovered their pre-pandemic levels of employment. Population decline in much of the Midwest has limited companies’ ability to hire, leading to a tight labor market that continues to limit potential consumer spending growth.

The good news is that the mining sector in the West North Central division (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota) and the leisure and hospitality sector in the East North Central division (Indiana, Illinois, Michigan, Ohio, Wisconsin) have each experienced recent strong employment growth that will likely boost consumer spending and economic growth in Q1-2023. Additionally, we expect that this employment growth resulted in the Midwest reaching its pre-pandemic level of employment in the first quarter of 2023. However, the bad news is that the U.S. economic slowdown will likely lead to sharp losses in manufacturing employment and output. There are already signs that the manufacturing sector is feeling the burden of high prices and borrowing costs: All of the Institute for Supply Management’s manufacturing purchasing manager indices indicate future contraction. While pent-up demand for cars could help cushion the blow, we expect job losses in the manufacturing sector to disproportionately impact the Midwest. These job losses will likely weigh heavily on the region’s economy, leading the Midwest to underperform all regions except the West in 2023.

West: It’s not just tech

The West was the only region where GDP contracted on a YoY basis in the fourth quarter of 2022, as the region was heavily dragged down by the Pacific division’s (Alaska, California, Hawaii, Oregon, Washington) weak performance. California and Oregon’s decline in YoY real (inflation-adjusted) income largely contributed to the Pacific’s downturn. Income in these states was heavily influenced by a struggling tech industry that suffered major stock market losses, with the Nasdaq index falling 33 percent from the end of 2021 to the end of 2022. High borrowing costs, more stringent lending standards and lower returns culminated in large-scale layoffs at many tech firms in the fourth quarter. On the other hand, GDP growth in the less tech-dependent Mountain division (Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah, Wyoming) remained strong.

We estimate that a January spike in consumer spending led to rapid YoY GDP growth in Q1-2023. The spending bump is on track to fade in the second quarter, but YoY GDP growth should remain positive as it laps slow growth from the previous year, masking considerable real-time weakness. Recent unemployment claims data provides evidence of impending job losses across the West. The Pacific division will likely continue to suffer from volatility in the tech sector, while the Mountain division could suffer from a disruption in housing and construction. Home sales, building permits and new home starts have declined considerably, removing a significant driver of economic growth over the past three years. Additionally, asset valuations for office property are under strong downward pressure, which we expect will exacerbate the construction pullback and dampen transaction activity in commercial real estate. These dynamics are likely to lead to relatively heavier job losses in the West, especially in the Pacific division, and ultimately to weaker consumer spending growth and a larger GDP contraction in the second half of 2023.

Forward Looking Statements

This report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are generally identified by words such as “outlook,” “forecast,” “projected,” “could,” “expects,” “will” and other similar expressions. Examples of such forward-looking statements include, but are not limited to, statements we make about Visa’s business, economic outlooks, population expansion and analyses. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. We describe risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, any of these forward-looking statements in our filings with the SEC. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise.

Disclaimer

The views, opinions, and/or estimates, as the case may be (“views”), expressed herein are those of the Visa Business and Economic Insights team and do not necessarily reflect those of Visa executive management or other Visa employees and affiliates. This presentation and content, including estimated economic forecasts, statistics, and indexes are intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice and do not in any way reflect actual or forecasted Visa operational or financial performance. Visa neither makes any warranty or representation as to the completeness or accuracy of the views contained herein, nor assumes any liability or responsibility that may result from reliance on such views. These views are often based on current market conditions and are subject to change without notice.

Visa’s team of economists provide business and economic insights with up-to-date analysis on the latest trends in consumer spending and payments. Sign up today to receive their regular updates automatically via email.