-

Tap to Phone

Expanding payment acceptance by turning smartphones into contactless point-of-sale devices.

Expanding payment access, one tap at a time

With Tap to Phone (TTP), merchants anywhere can securely accept contactless payments on the near-field enabled Android and Apple smartphones they already own. Simply by downloading an app. Now even the smallest merchants can easily accept digital payments. And larger merchants can create new payment experiences customers love.

Evolving the payment experience

Tap to Phone leverages existing mobile technology and consumer buying preferences to create fast, frictionless payment experiences.

Getting started

Whatever part you play in the payment ecosystem, there’s a Visa partner to help you benefit from Tap to Phone’s vast potential.

New places, new possibilities

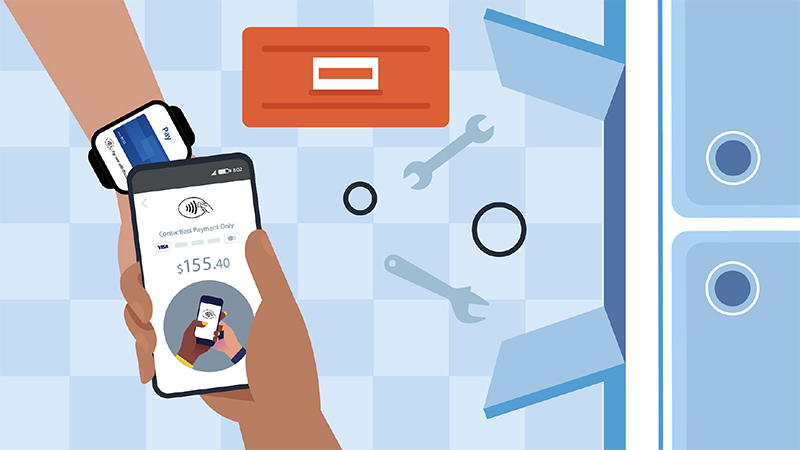

Tap to Phone opens up a new world of payment experiences—both face-to-face and unattended.

Go-to-market tools

Tools and materials to help acquirers and payment service providers educate and excite merchants and consumers about Tap to Phone.

Tap to Phone for Sellers

Accept digital payments anytime, anywhere with no additional hardware required. All it takes is your current generation smartphone and the Tap to Phone app.

Tap to Phone Payment Acceptance

Tap to Phone makes accepting contactless payments from your customer’s card, phone or watch simple and easy.

Tap to Phone with Customer PIN

With Tap to Phone customers can make convenient digital payments using their PIN, all on the trusted global Visa network.

Tap to Phone Signage

Customers are more likely to enter a store displaying Visa signage, let customers know you now accept contactless payments.

Tap to Phone for Consumers

Whether you pay with your card, phone or watch, Tap to Phone is as convenient and safe as traditional payment terminals.

Resources

Discover all the ways—and all the places—that Tap to Phone is expanding contactless acceptance.

Pine Labs brings Tap to Phone to India

Pine Labs enables small merchants, home entrepreneurs, street vendors, hawkers, cab drivers, and others who are not ready to invest in a traditional point-of-sale (PoS) terminal to accept digital payments.

IBA Group launches Tap to Phone in Eastern Europe and Asia

IBA Group launches Tap to Phone technology that enables current-generation Android devices to accept payments anywhere without additional hardware.

Tap to Phone accelerates financial inclusion

TTP can be a powerful lever for increasing financial inclusivity by providing under- or unbanked sellers and customers greater access to digital payments.

- Visa Contactless Drivers and Barriers Study

- Visa Back to Business Study: 2021

- Visa internal metrics and data as of August 2022