Easy setup

Installments is an option that’s already integrated into the Visa card you have. No credit check or waiting period needed.

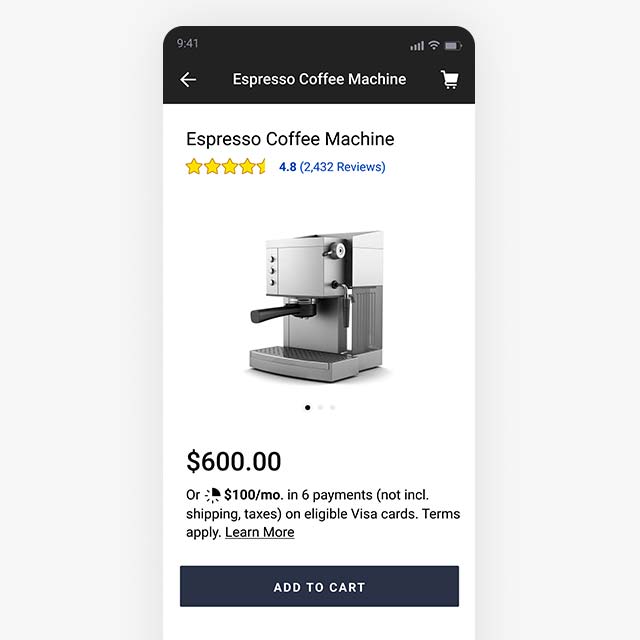

Choose Installments Enabled by Visa at checkout for qualifying purchases from participating retailers.

Installments is an option that’s already integrated into the Visa card you have. No credit check or waiting period needed.

Pick out what you want and choose to pay over time through easy, equal, monthly payments.

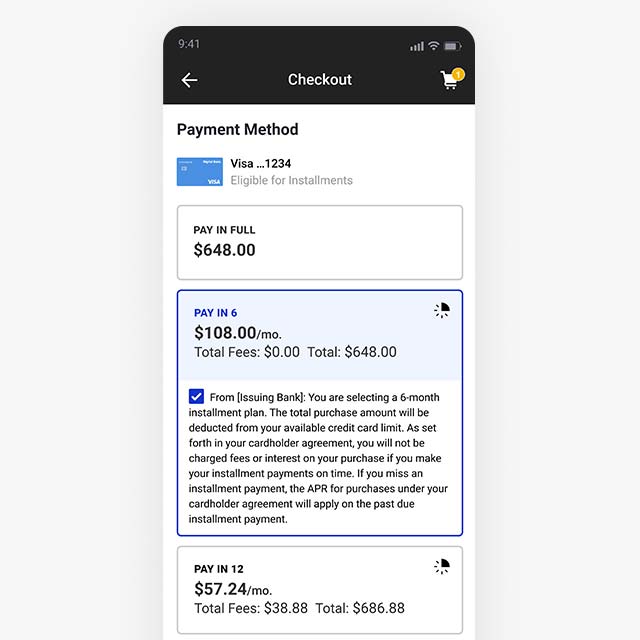

Select the installments plan option at checkout, and then agree to the terms of the issuer or bank so you can avoid any potential payment surprises.

Get the items and experiences you want in as little as three steps.

Now is your chance to get what you want by using your Visa for a qualifying purchase at many participating retailers.

Look for the “Installments Enabled by Visa” option during checkout and choose the installments plan that works best for you.

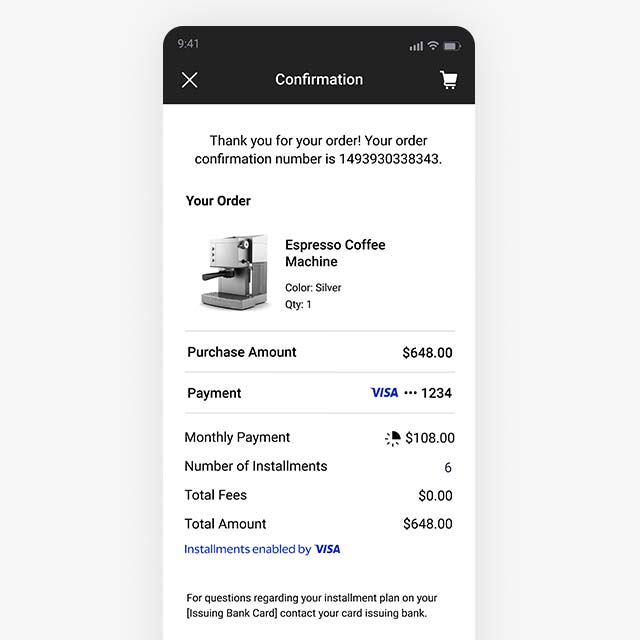

Pay for the rest in equal, monthly installments on your card, through your existing Visa—so you don’t have to manage multiple accounts.

Whether you’re in-store or online, you can pay with Installments Enabled by Visa at your favorite stores, shops, and retailers.

¹ Limited availability

See below for participating financial institutions and banks. For more details, please contact your bank.

It’s a simple way to pay for a purchase in equal monthly installments using your eligible Visa card for qualifying purchases at participating retailers. And, with Visa Installments, there’s no need for another line of credit, credit check or a new account. Offered by participating banks and enabled by Visa.

Eligibility for an installment plan is determined by your card issuing bank. Please contact them regarding eligibility and available installment plans

You can shop online or in store at participating retailers. At checkout, simply enter your Visa card. If your Visa card is eligible, and if your purchase is a qualifying purchase, you’ll see the available installment plans at checkout. After that, simply choose a plan by accepting the terms and complete your order. It’s that easy.

No. Any installment plans offered are provided by your card issuing bank as a benefit of your existing eligible Visa card.

Yes. Your total purchase amount will be deducted from your available credit limit on your existing credit card account. For further details about this, please check with your card issuing bank and review your cardholder agreement.

No. An installment plan does not increase your credit limit nor is it an additional line of credit.

Please contact your card issuing bank for specifics on how refund amounts for purchases made using an installment plan will be applied to your credit card account.

For questions regarding your installment plan, refer to your cardholder agreement or contact your card issuing bank.

Please contact your card issuing bank for specifics about how refunds will impact your installment plan.

Payment and servicing of your installment plan is through your card issuing bank. The installment amount due and due date will be part of your billing or account statement for your card and may be included in your minimum payment due. Please contact your card issuing bank or review your cardholder agreement for more information.

For questions regarding your installment plan, please contact your card issuing bank.