October 2022 – Psychoanalyst Theodor Reik once remarked, “[I]t has been said that history repeats itself. This is perhaps not quite correct; it merely rhymes.” In the final months of 2022, our analysis has led us to pick up on indicators that certainly seem to rhyme with what happened to the U.S. economy in 2001. Business valuations (especially in the tech sector) grew rapidly after the initial pandemic-induced downturn in 2020, thanks in large part to accommodative monetary policy boosting the stock market. Since then, the stock market has sustained immense losses, with the S&P 500 down by more than 20 percent and the Nasdaq down over 30 percent year-to-date. Additionally, many of these firms have not been profitable and have subsisted on cheap loans enabled by very low interest rates. With inflation sustaining 40-year highs, the Federal Reserve’s commitment to tamping down inflation by raising interest rates is likely to heavily impact these and other businesses.

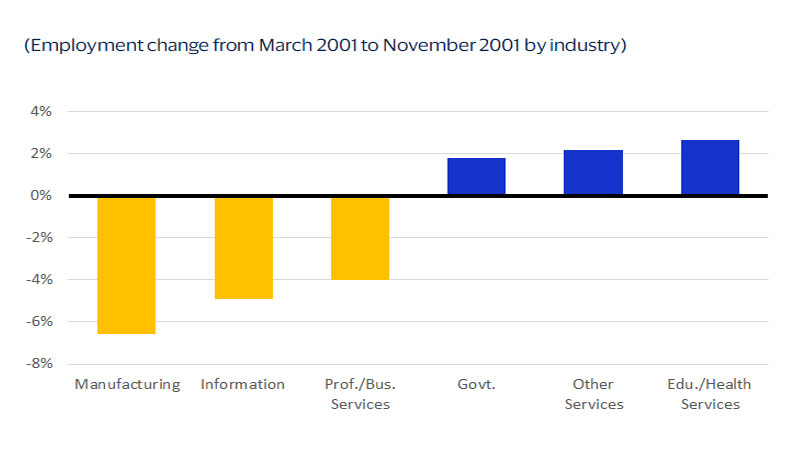

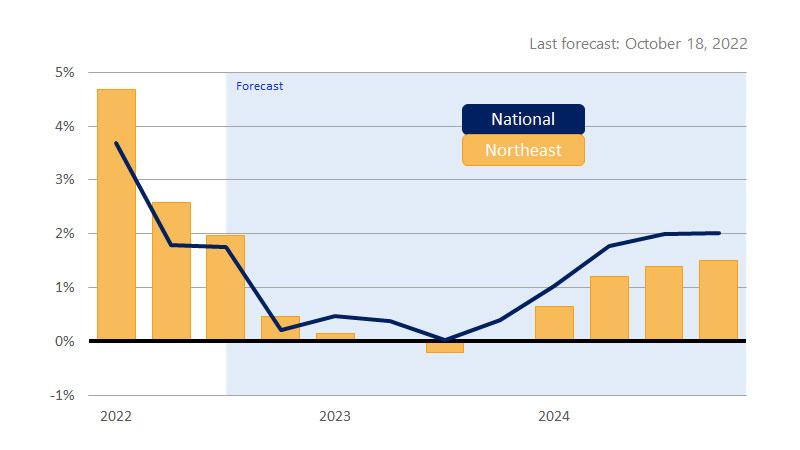

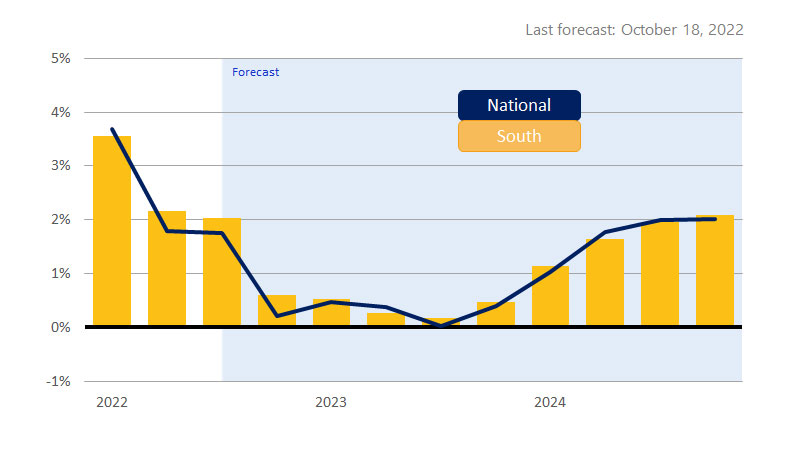

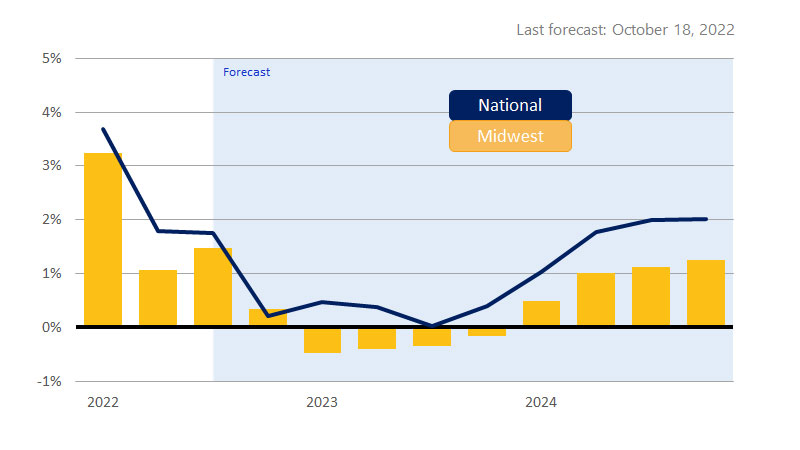

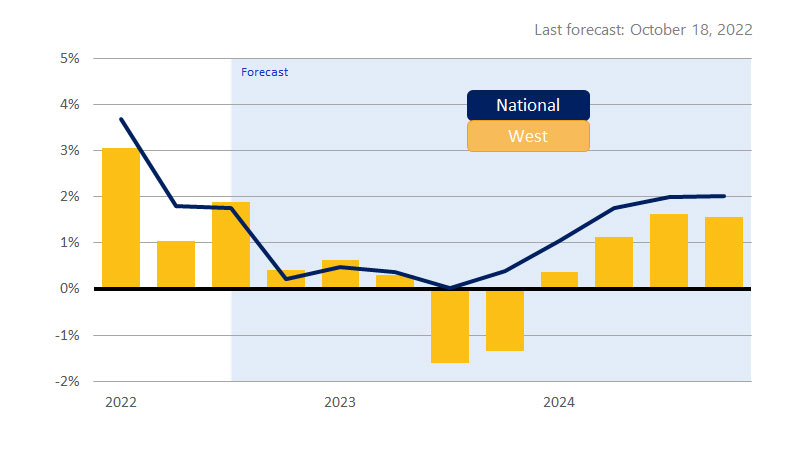

Like the 2001 recession (figure below), it is likely that manufacturing and information (tech) will be the most heavily impacted should a recession materialize in 2023. However, unlike the 2001 recession, we do not expect the negative impact on professional and business services to be as large. The Midwest and West will likely be hardest hit by a downturn in the economy due to their heavy concentrations in manufacturing and tech. Unlike 2001, we expect a long and deep downturn in housing, which will likely disproportionately impact the West and parts of the South. On the other hand, the fact that government, education and health services, and other services could be the least impacted bodes well for the Northeast and South. Also, unlike 2001, oil prices will be a boost to the energy sectors in the South and Midwest. While gross domestic product (GDP), nominal personal consumption expenditure (NPCE), and employment growth should remain strong for the remainder of 2022, the outlook for 2023 is considerably weaker.